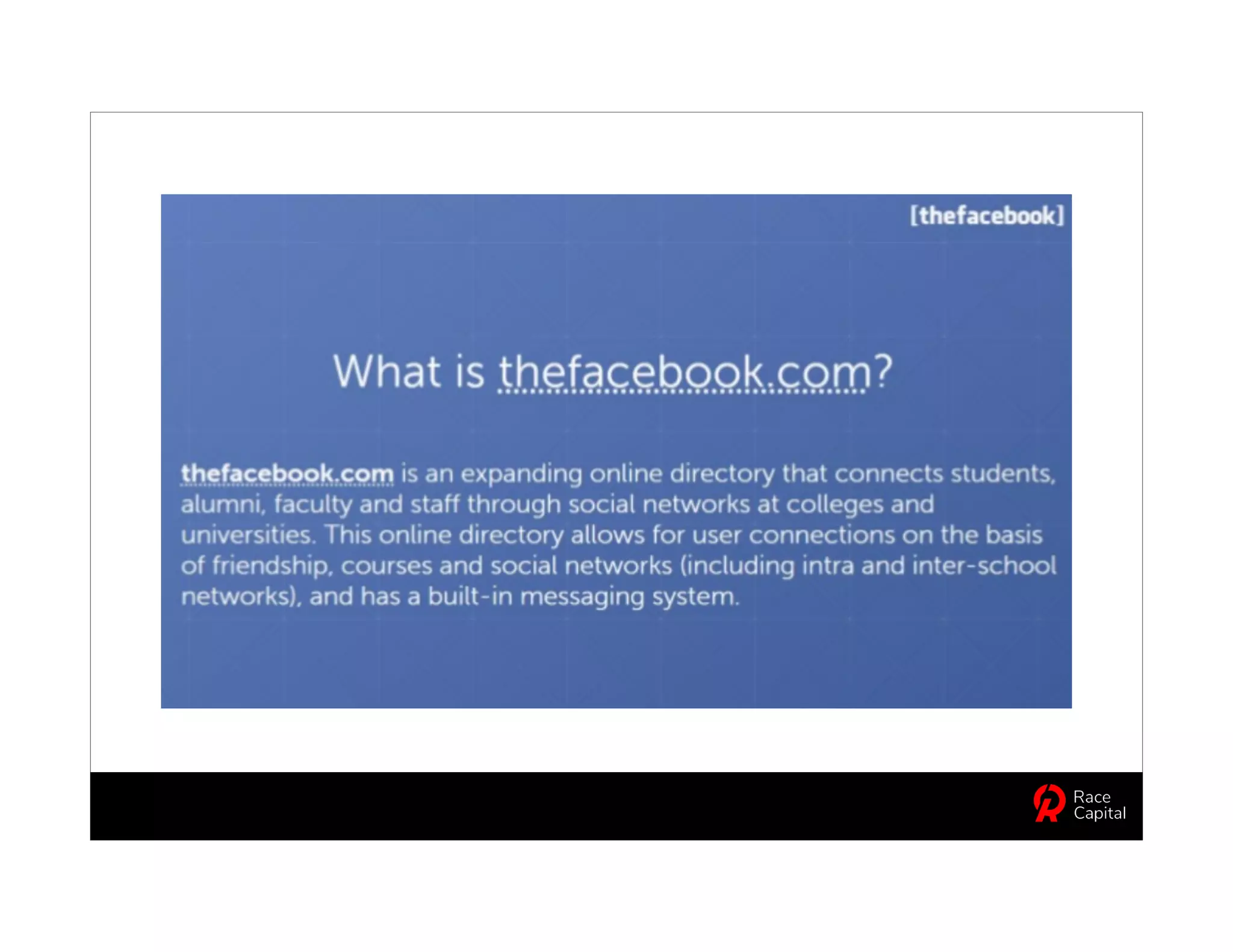

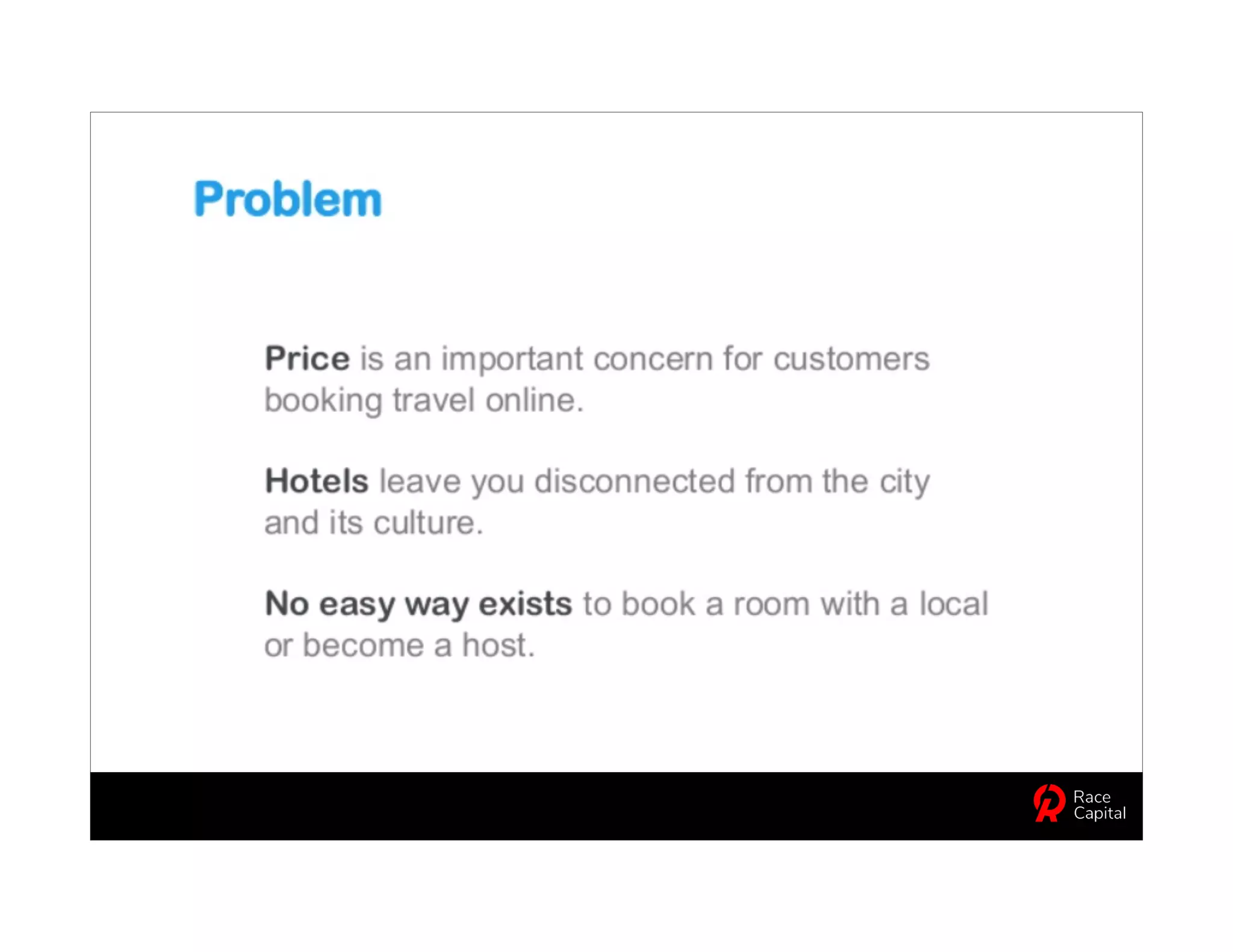

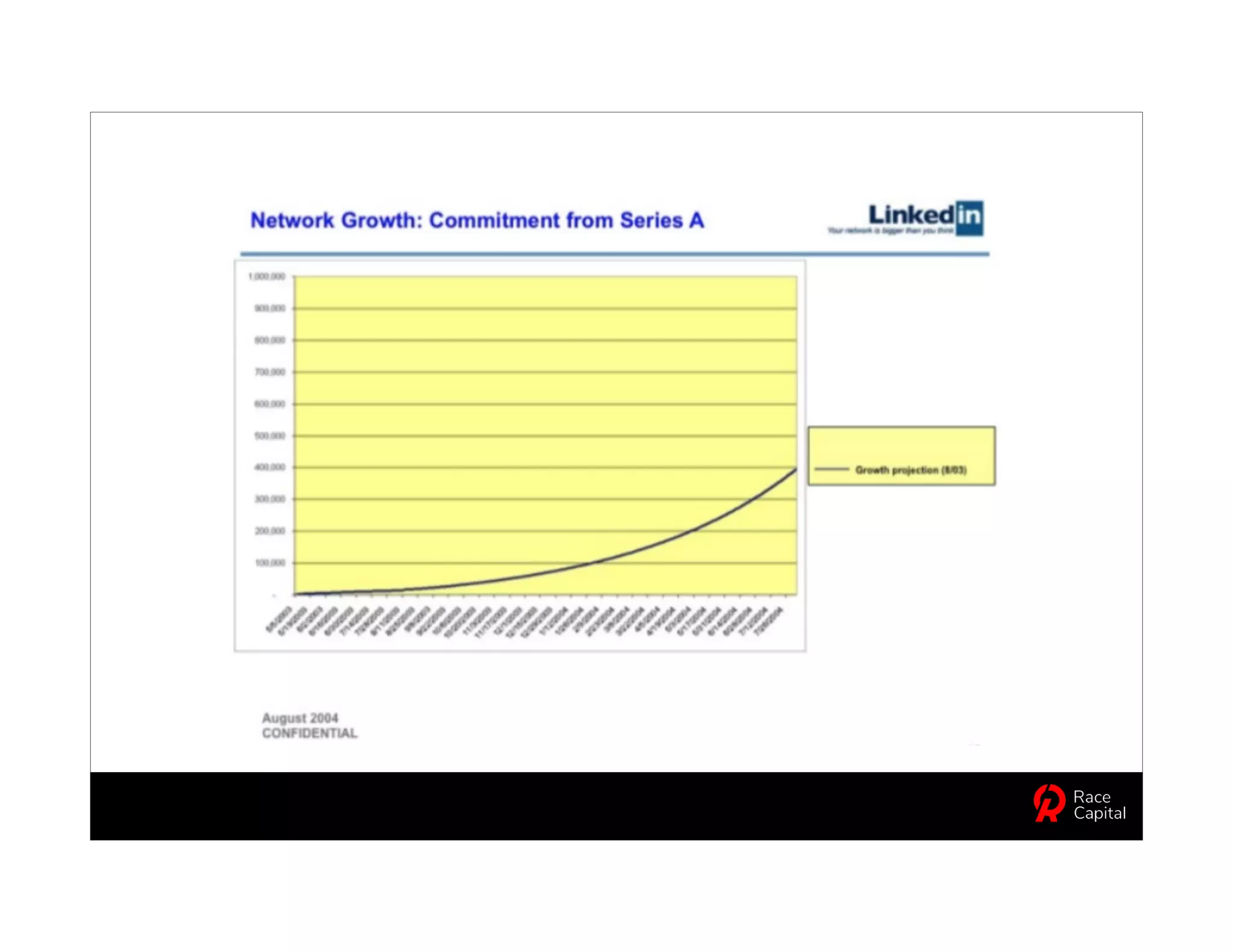

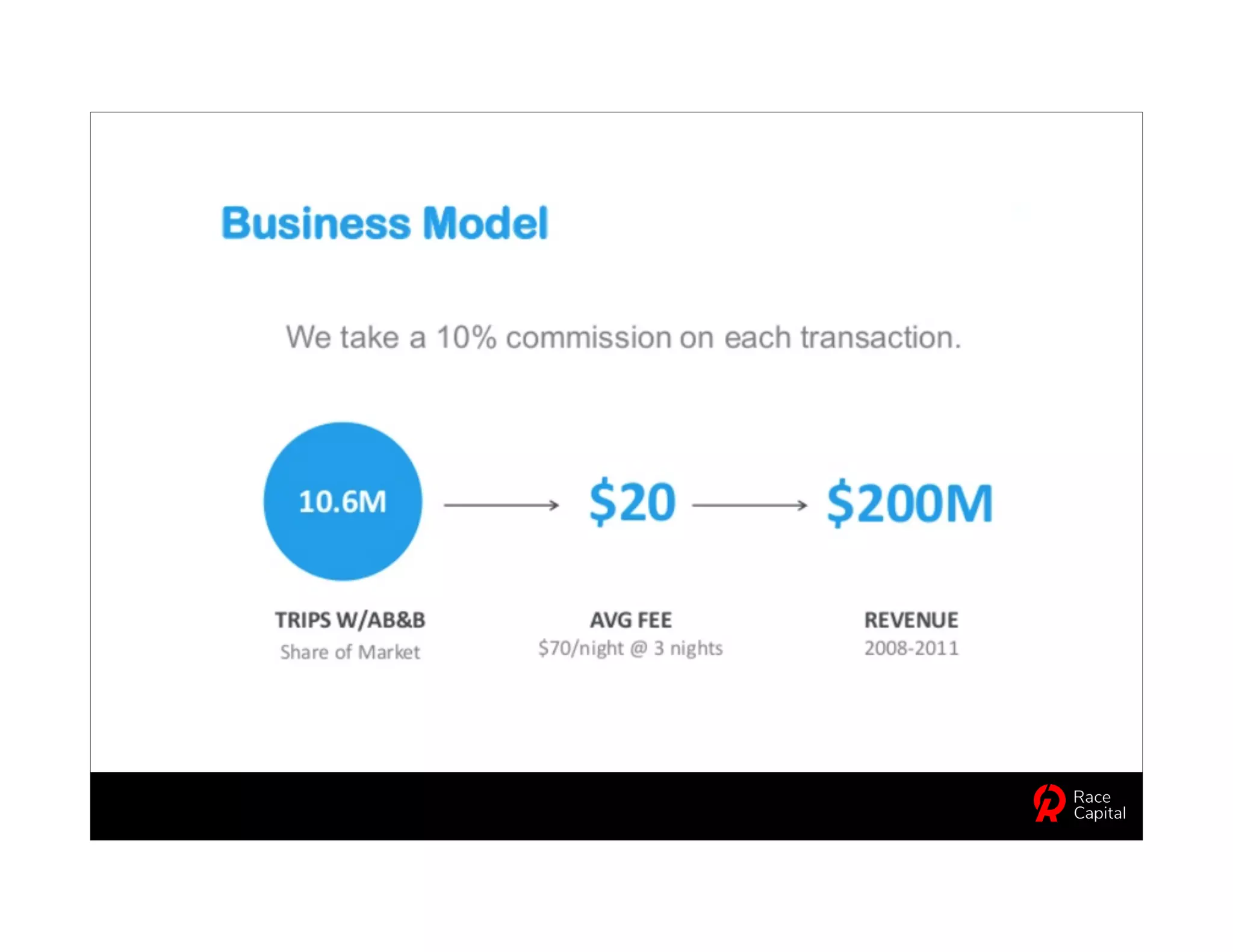

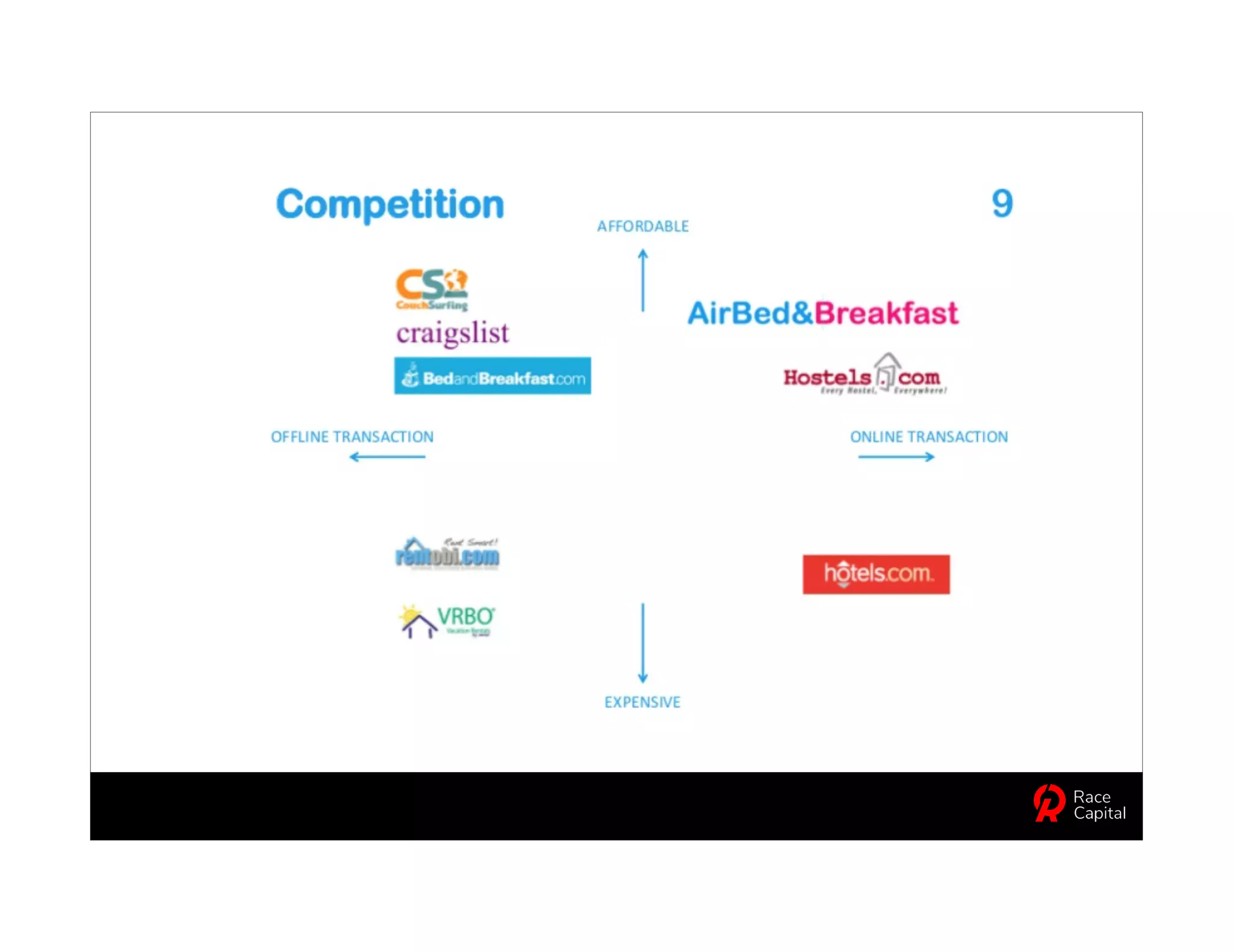

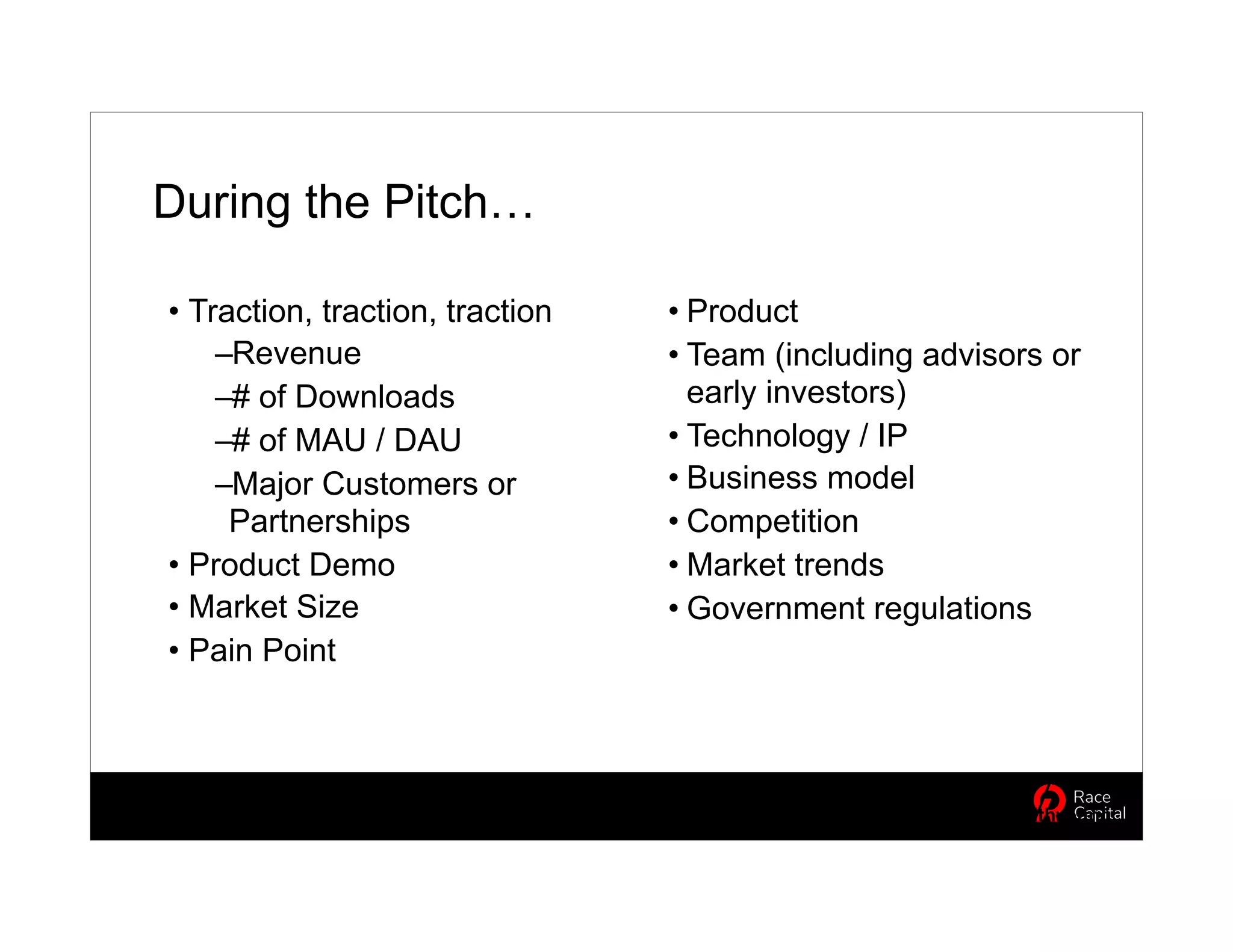

Edith Yeung, a general partner at Race Capital, outlines strategies for effectively pitching a startup, emphasizing the importance of traction and clear communication. Founders should focus on key elements such as their product, market size, team, and competition during their pitch. Post-pitch, it's crucial to follow up promptly with investors, sharing relevant information and expressing gratitude.