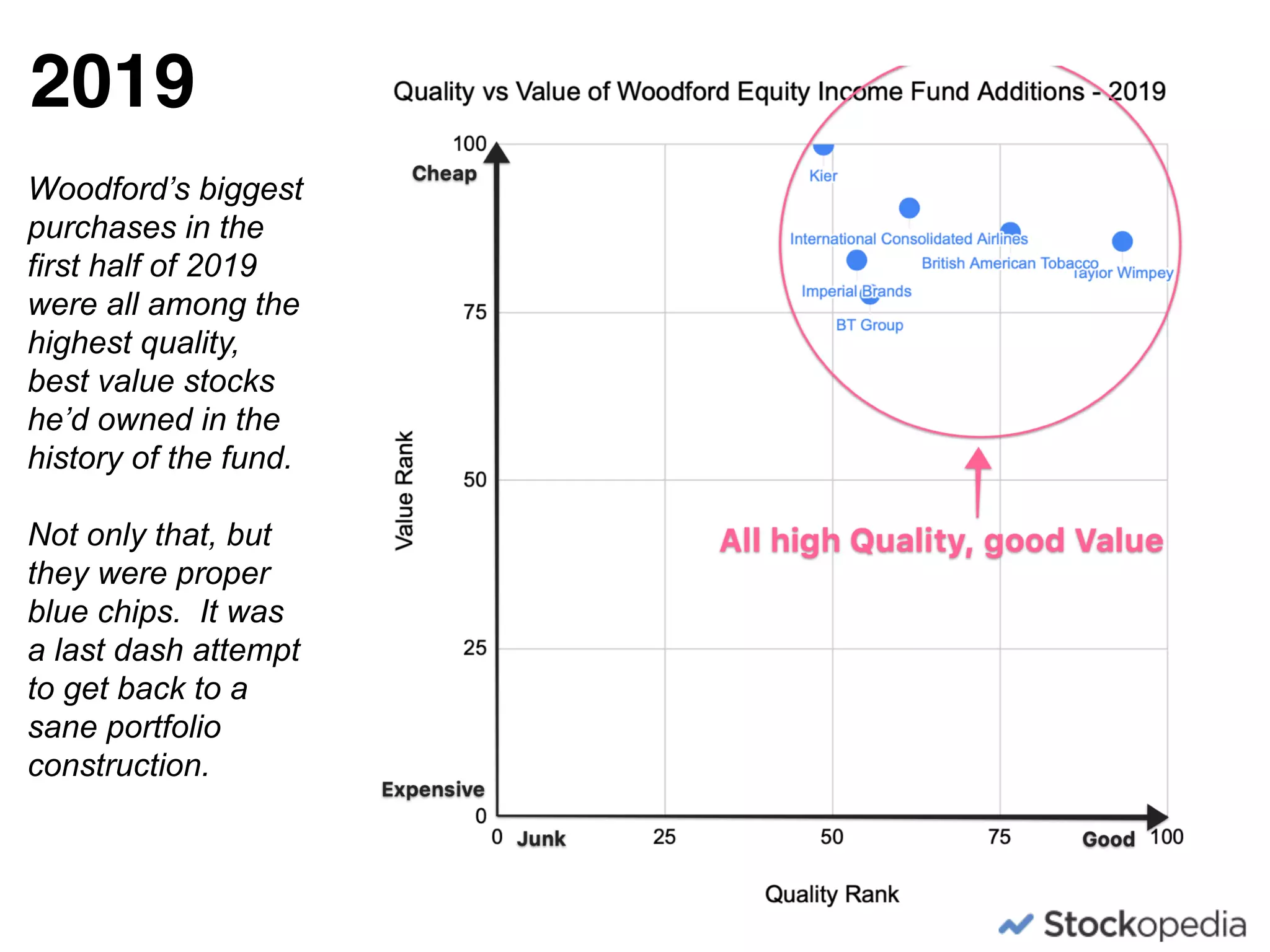

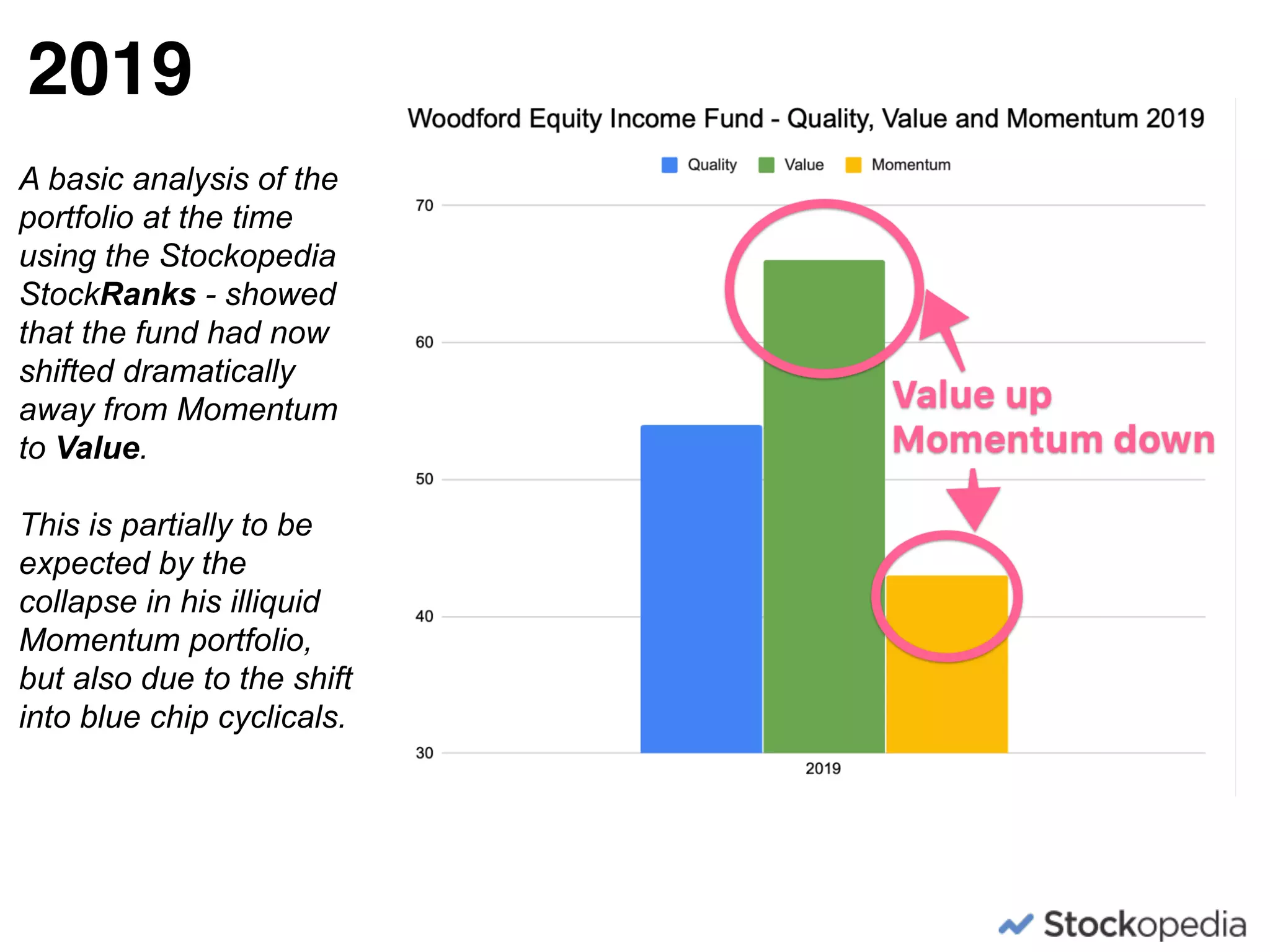

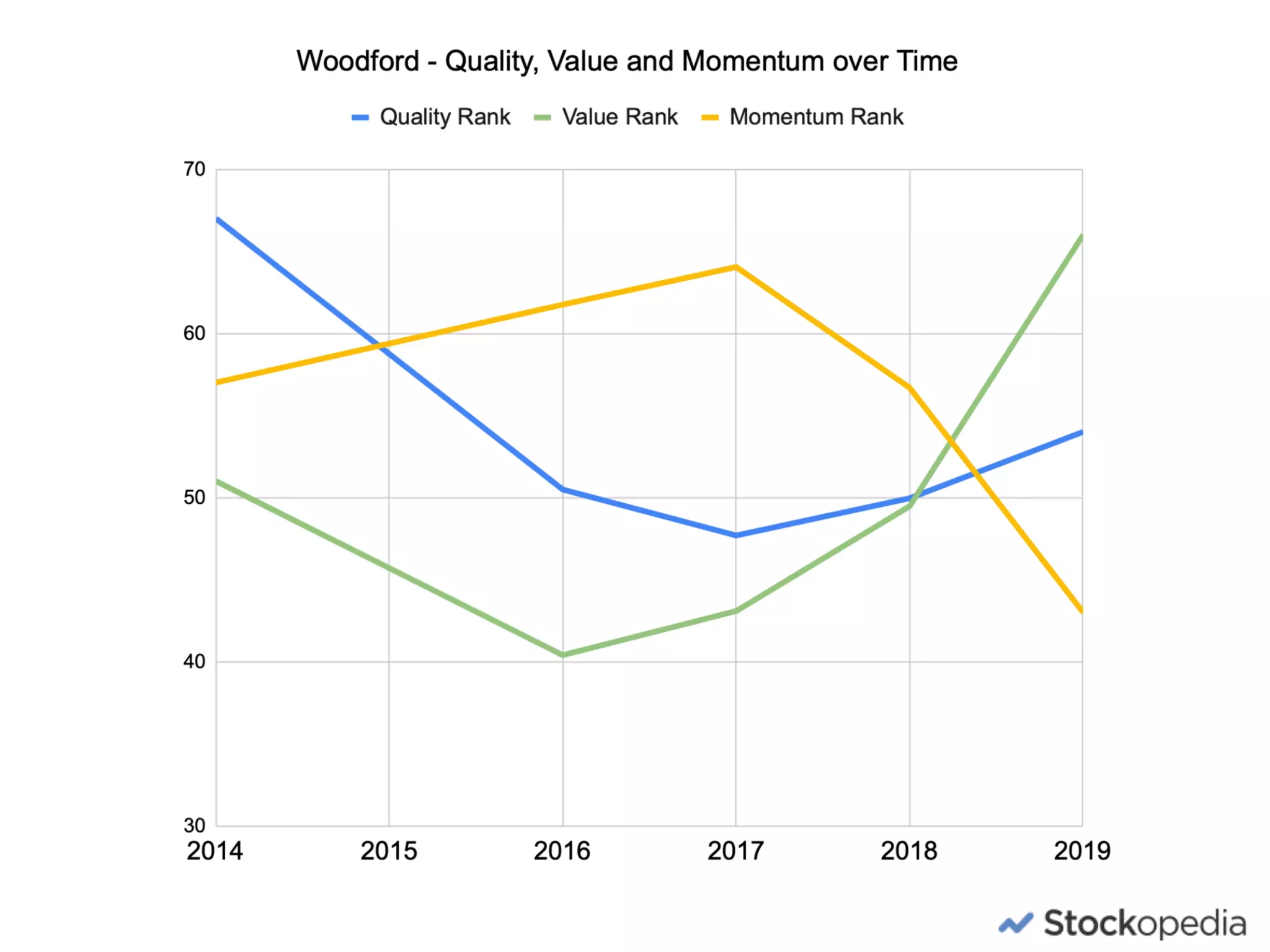

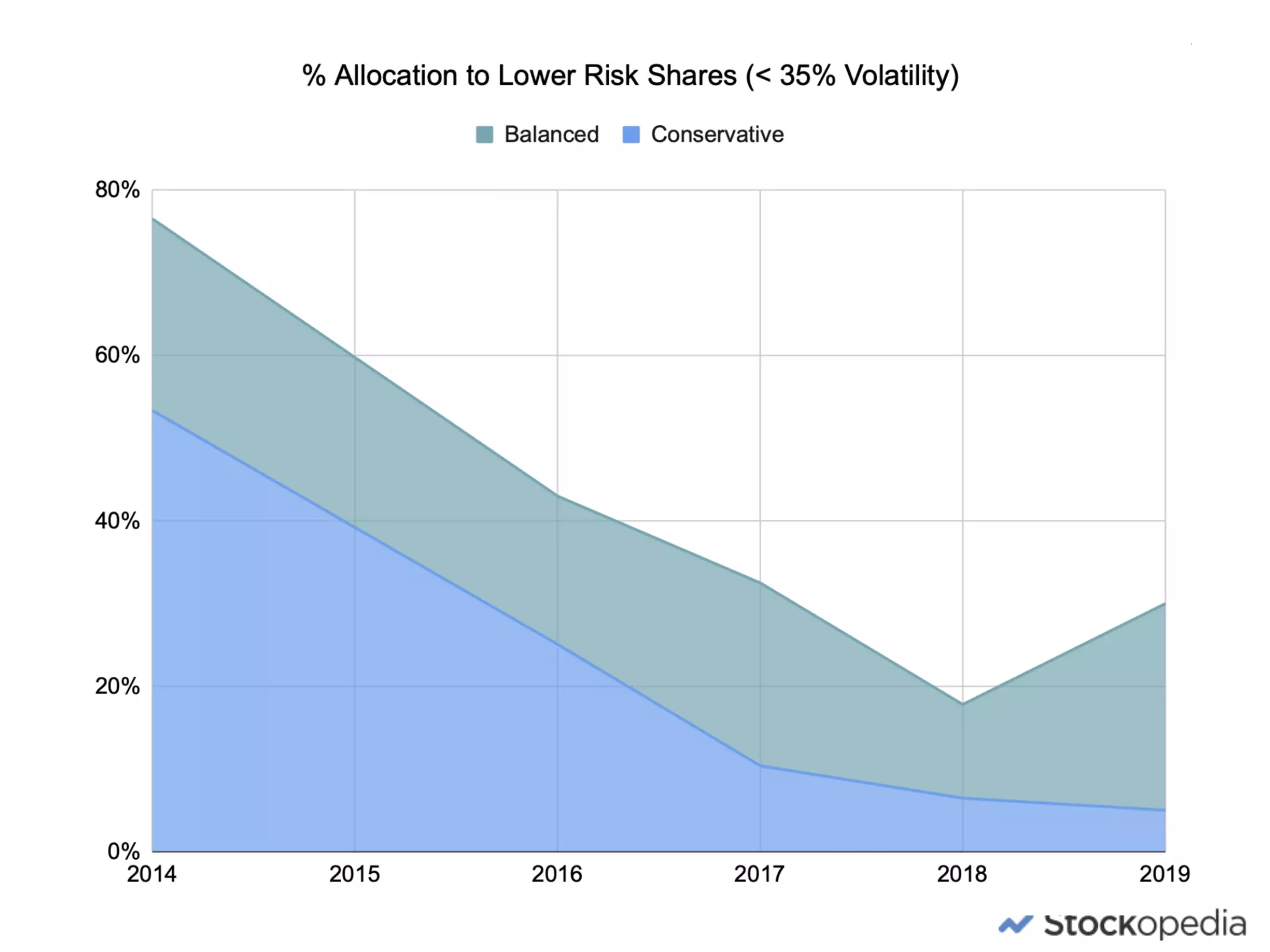

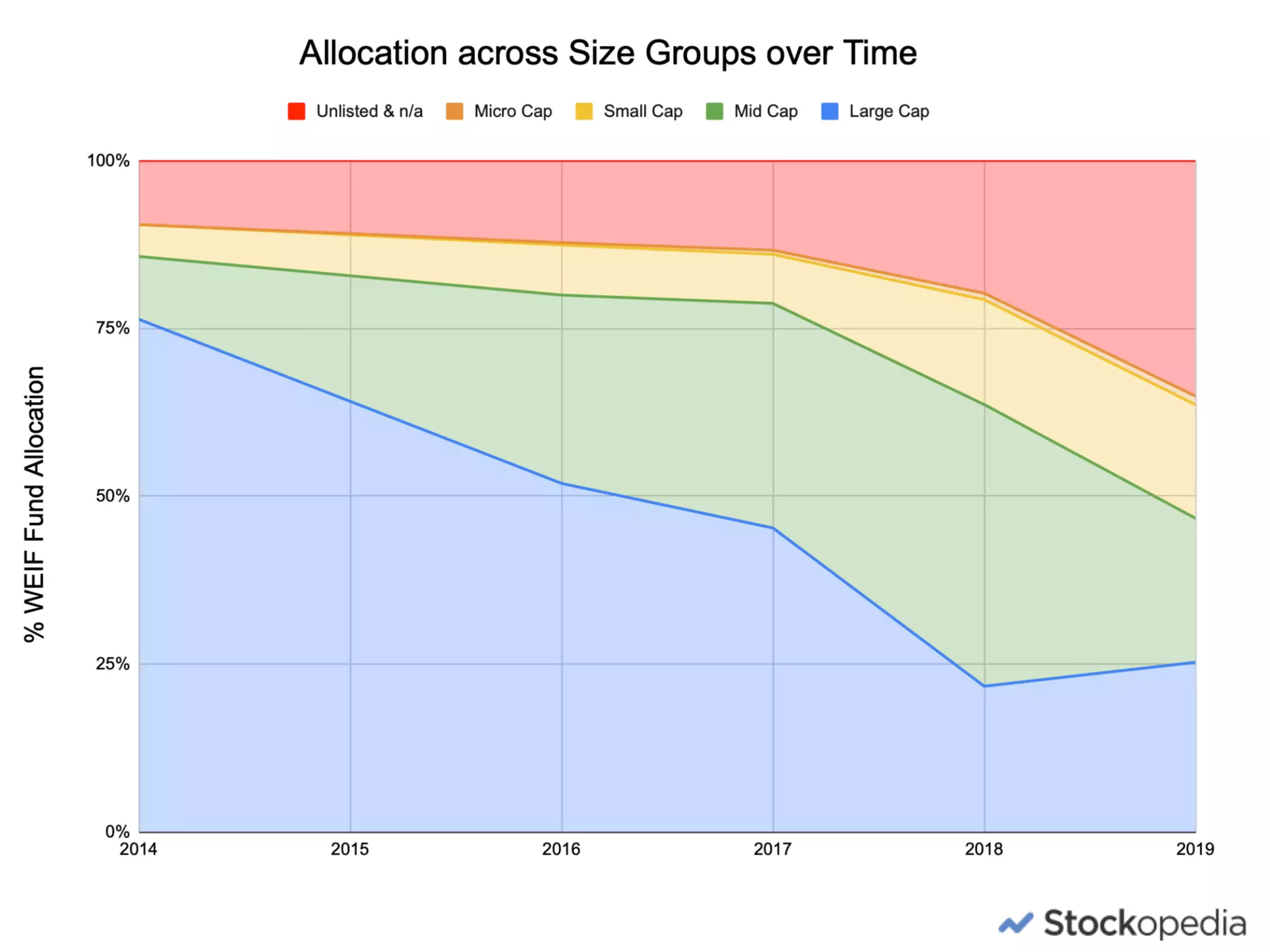

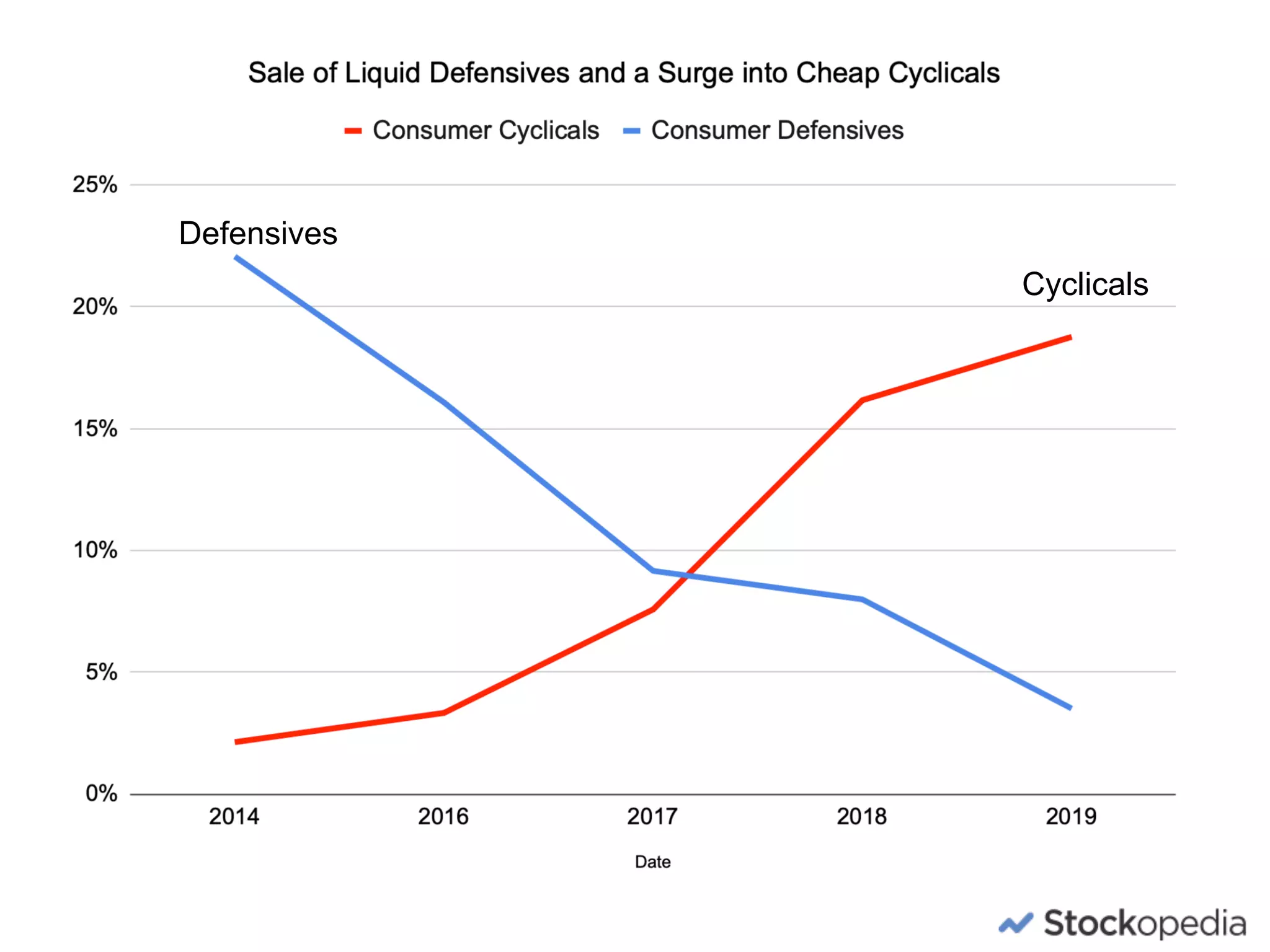

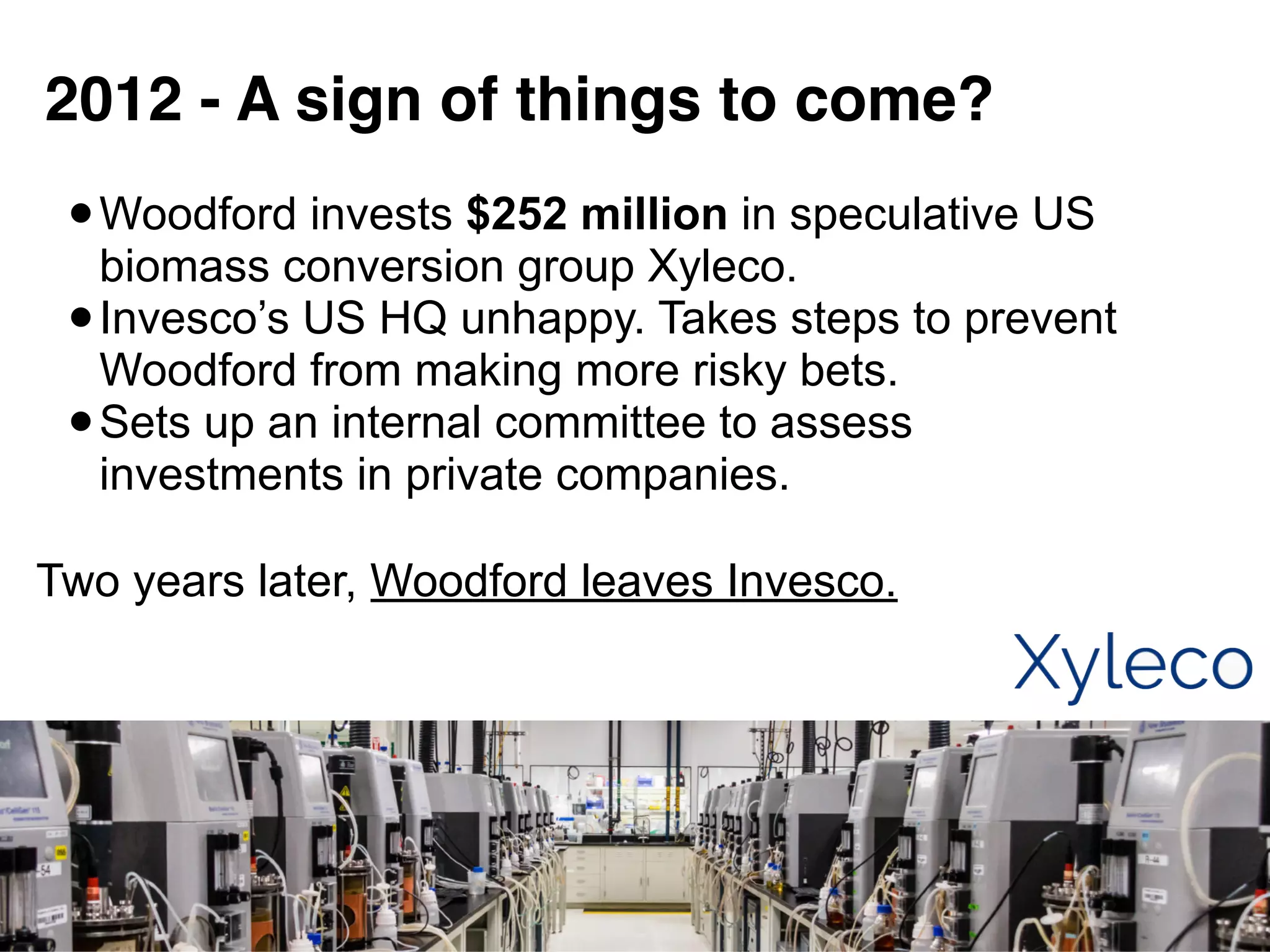

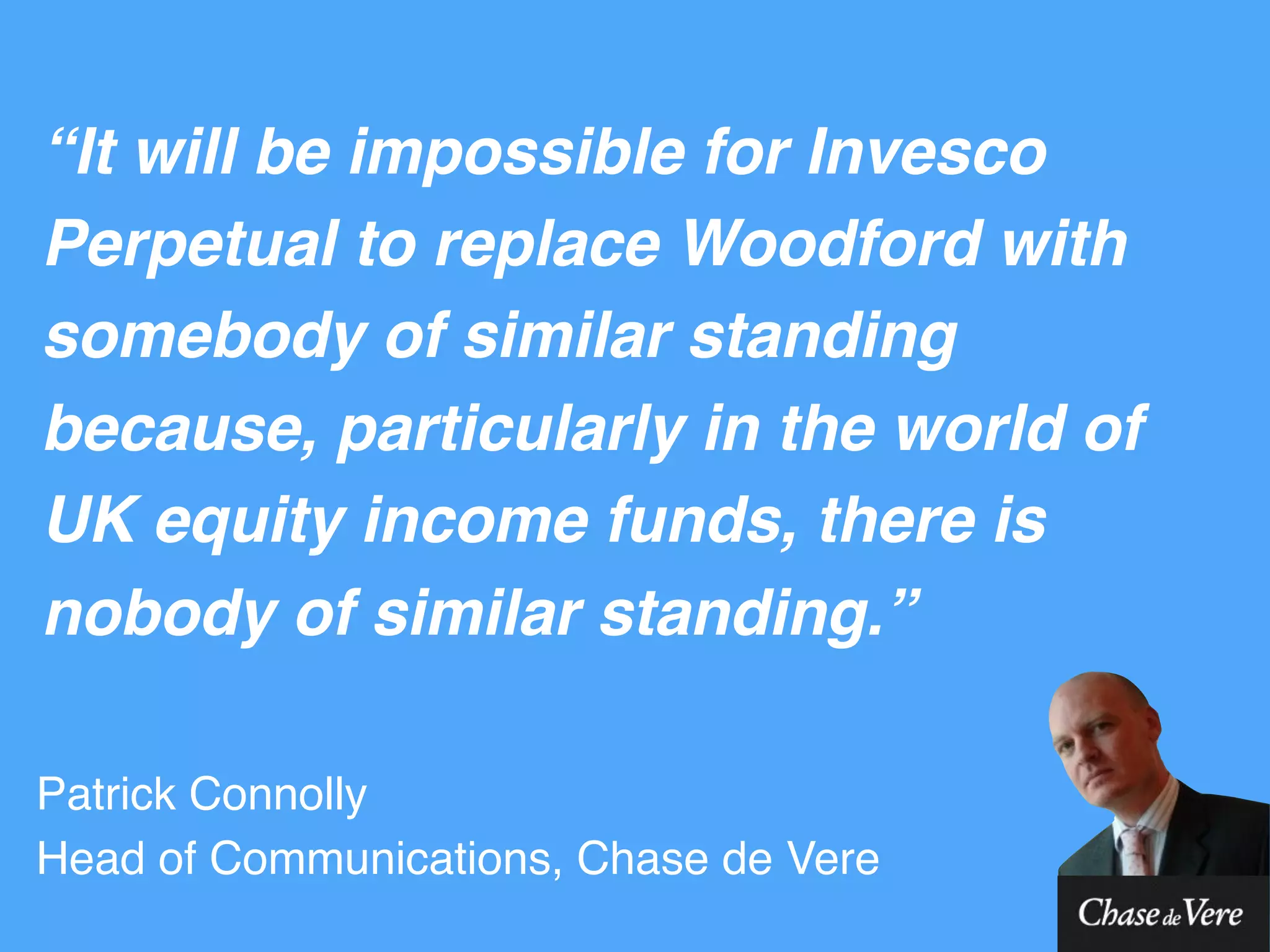

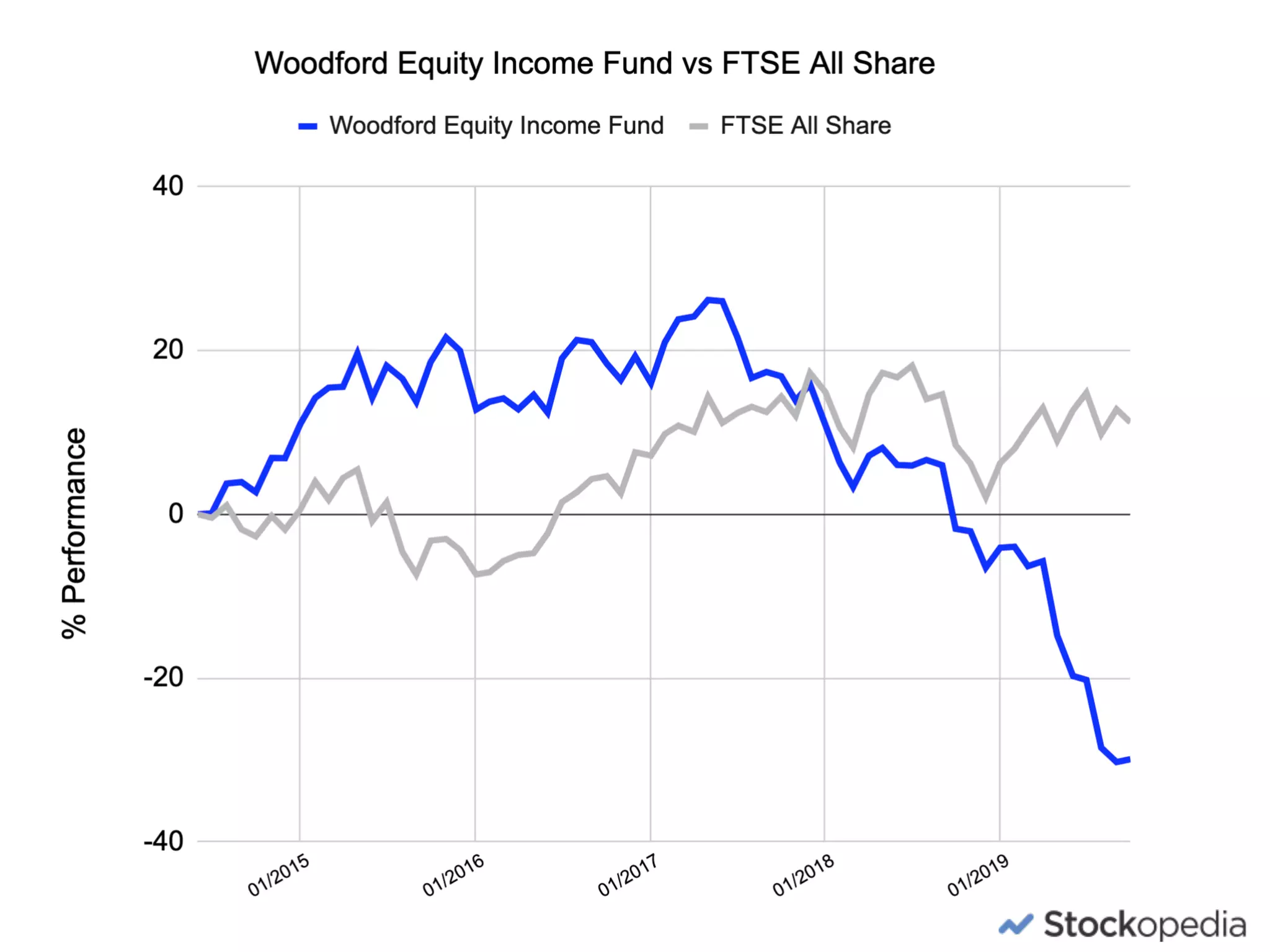

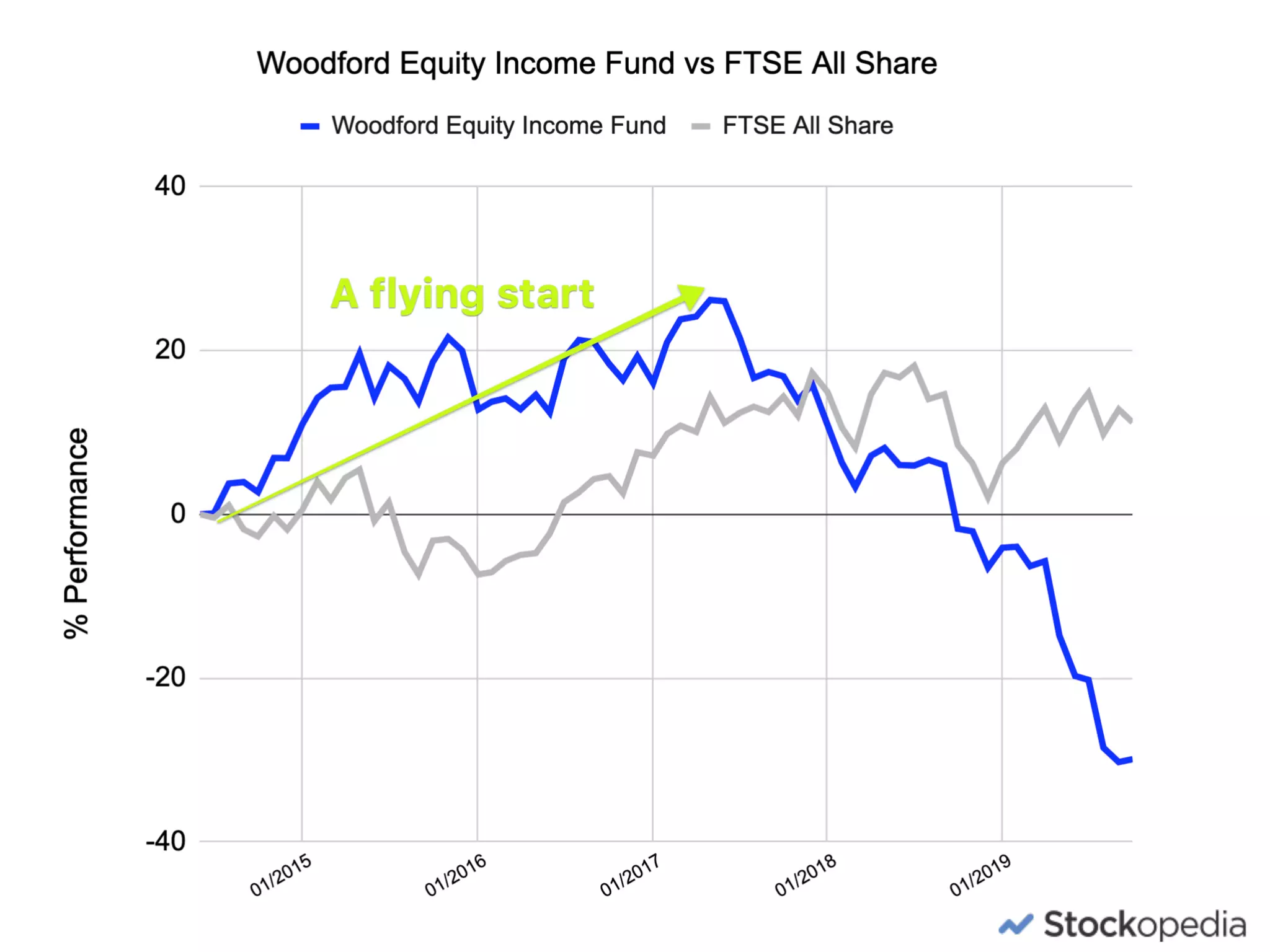

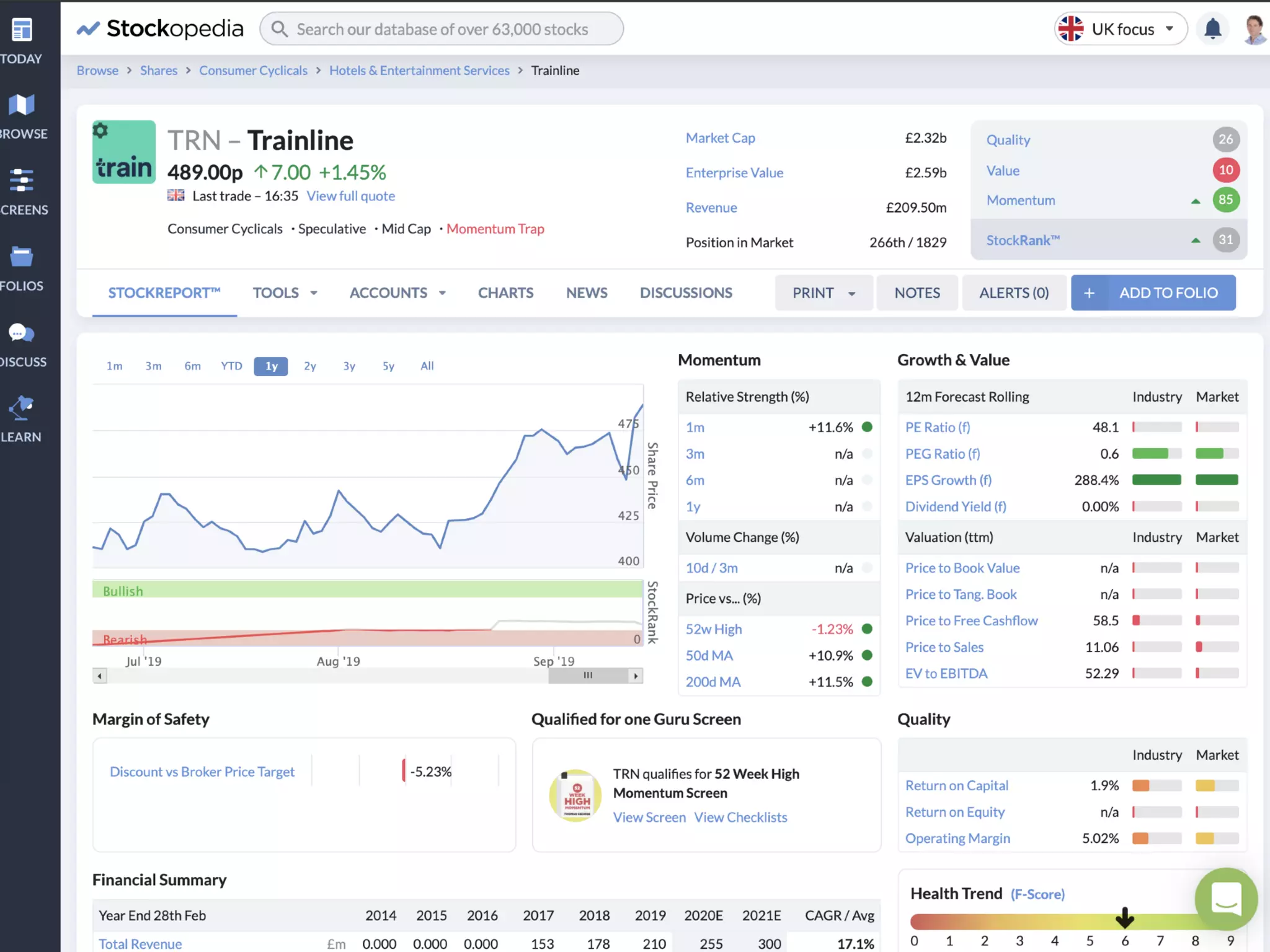

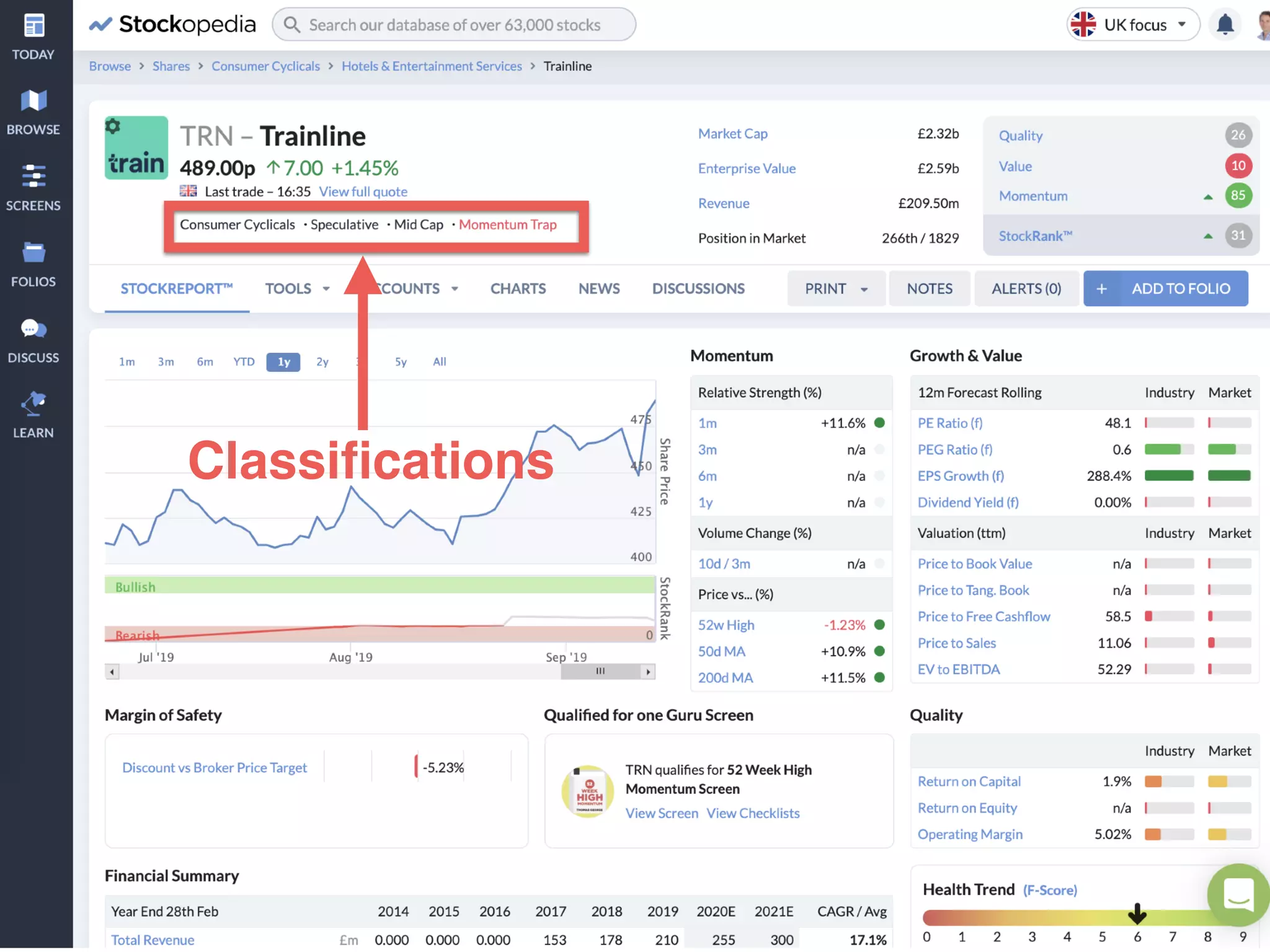

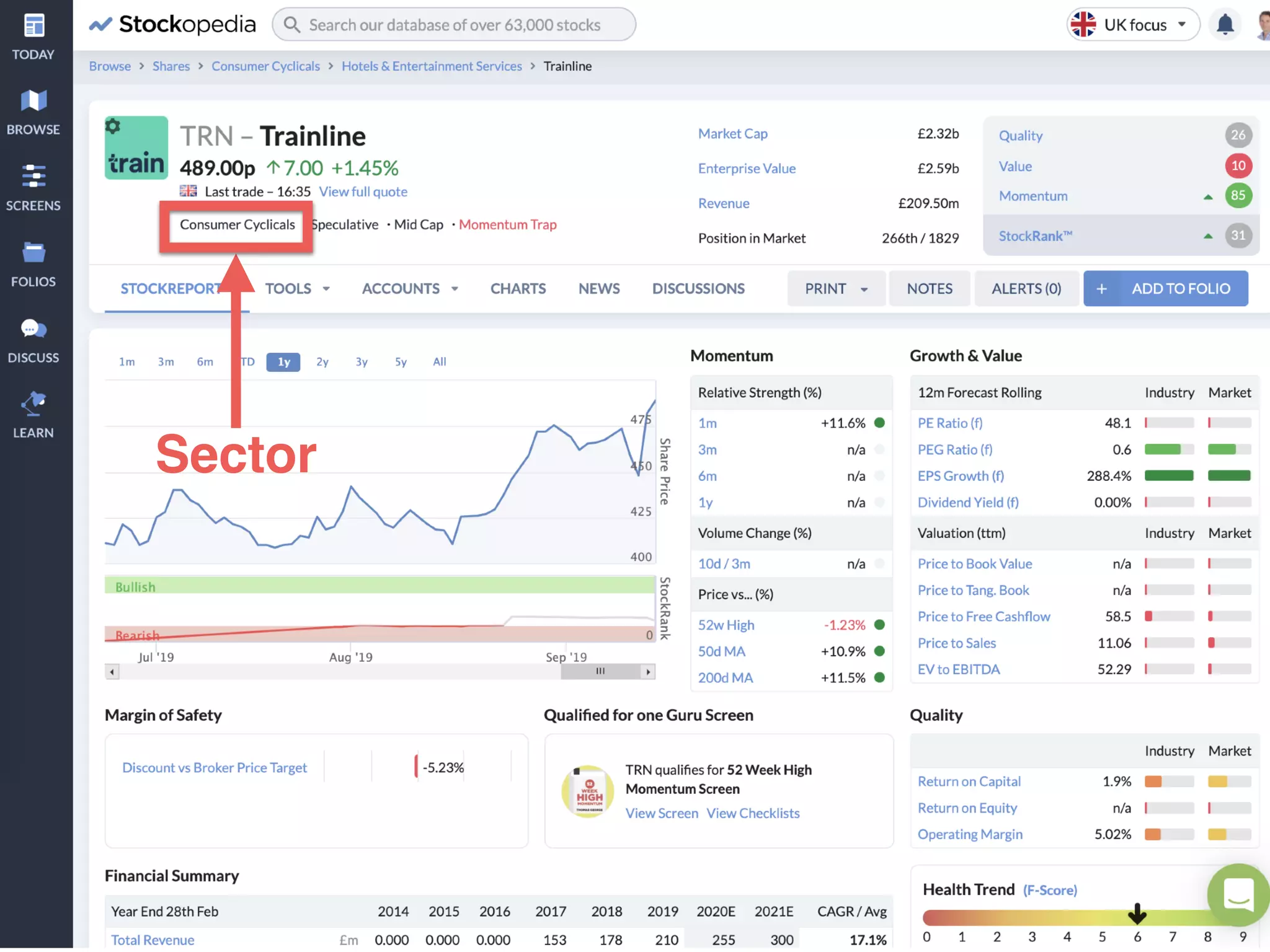

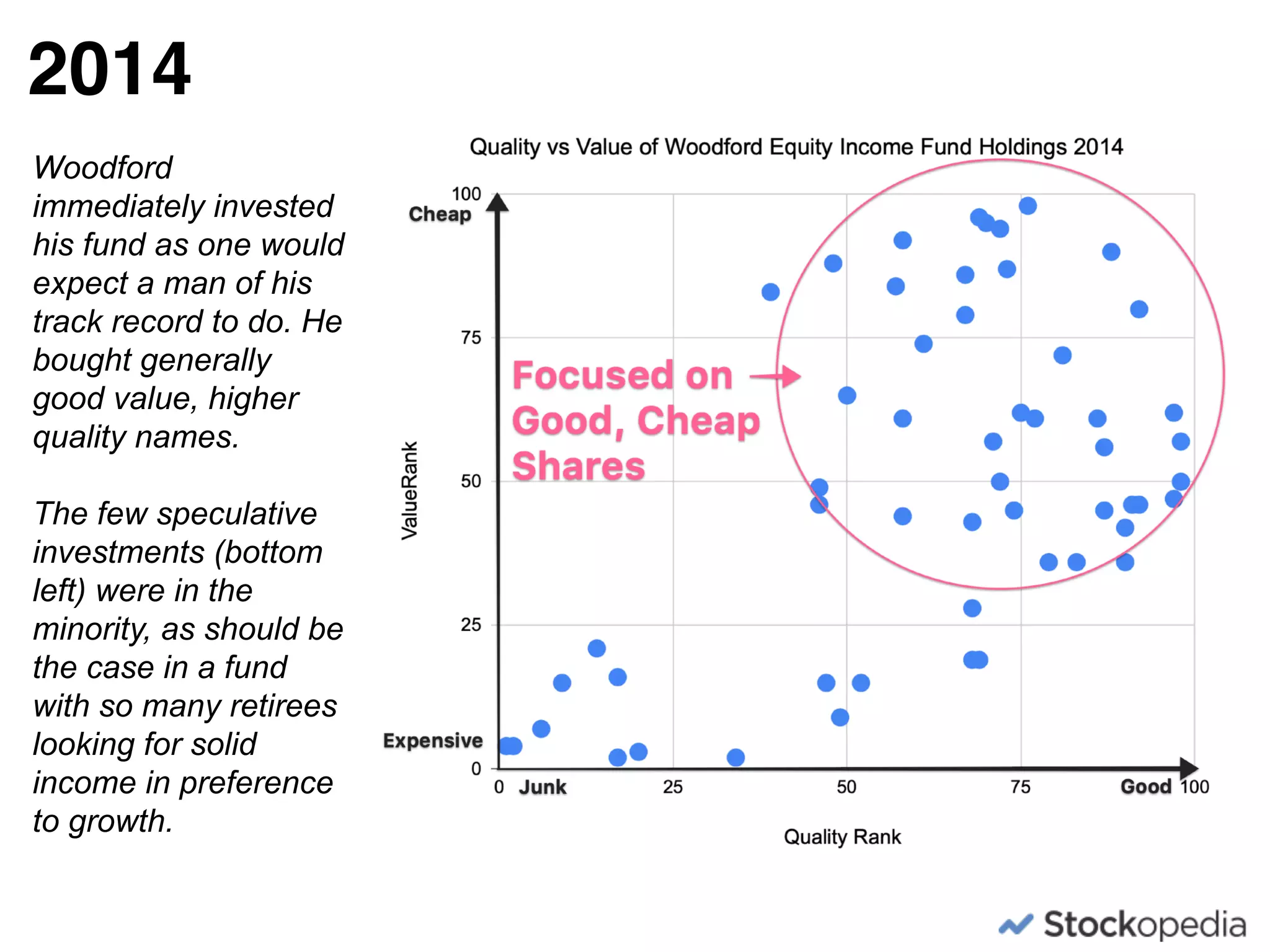

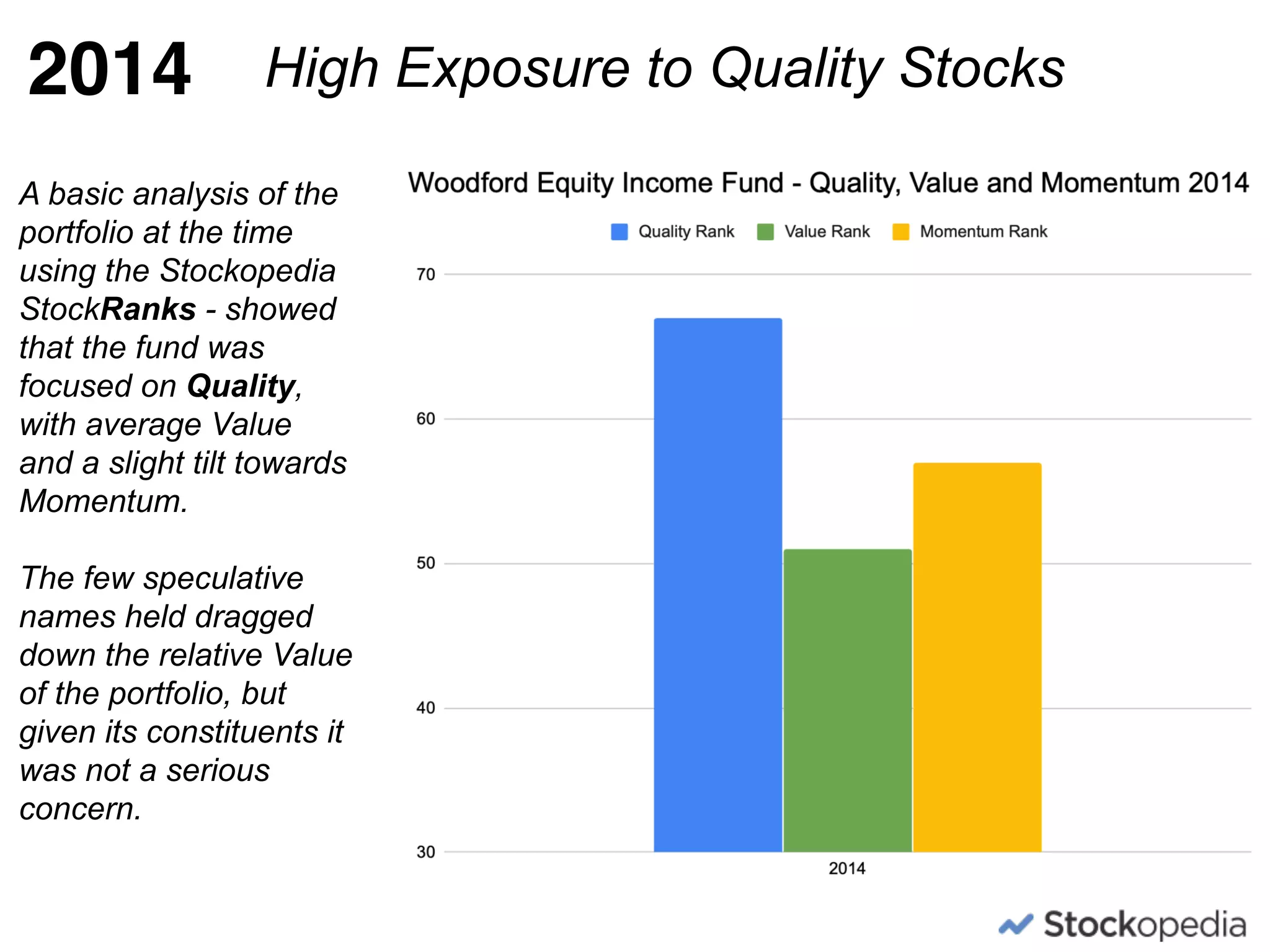

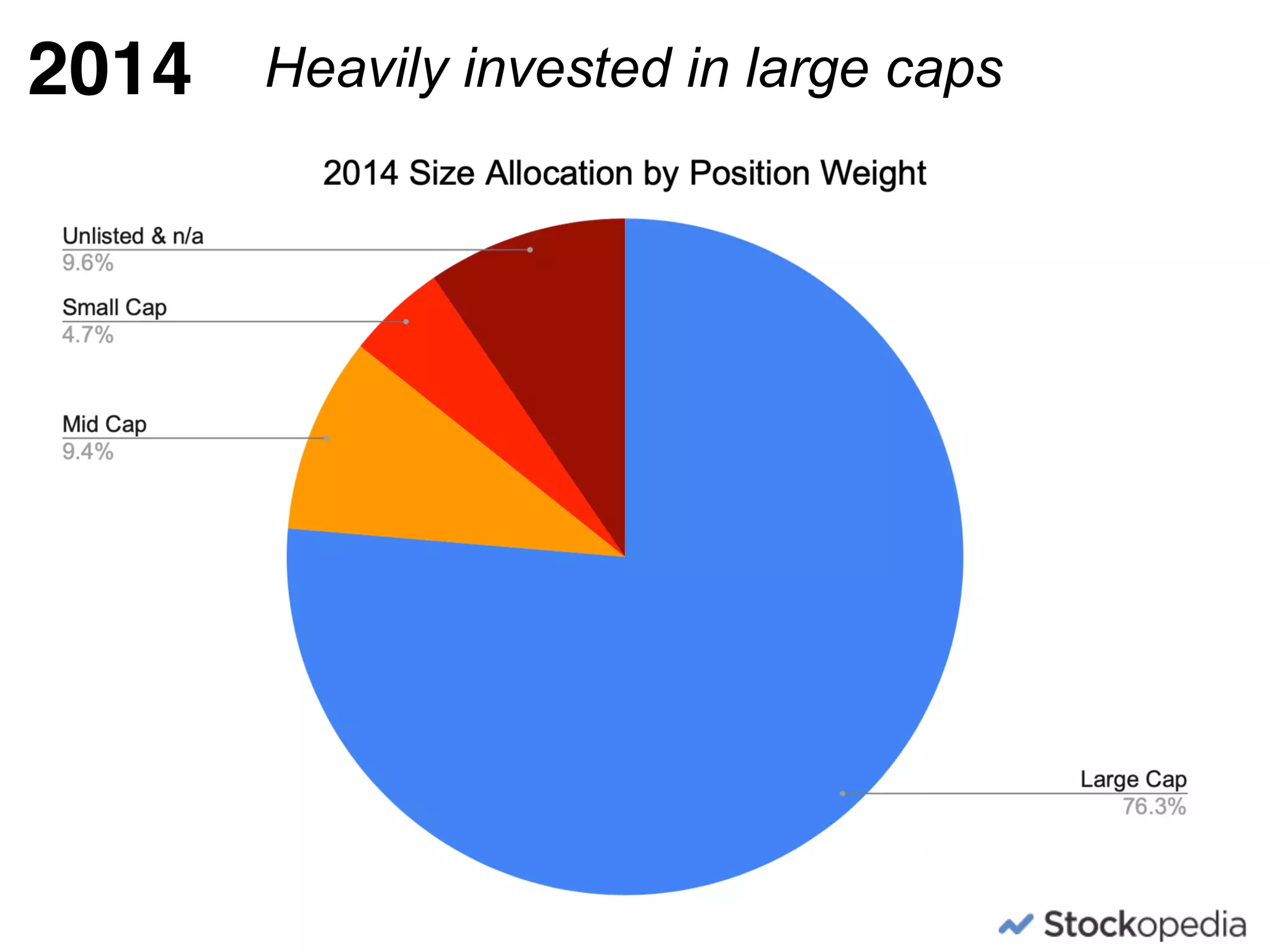

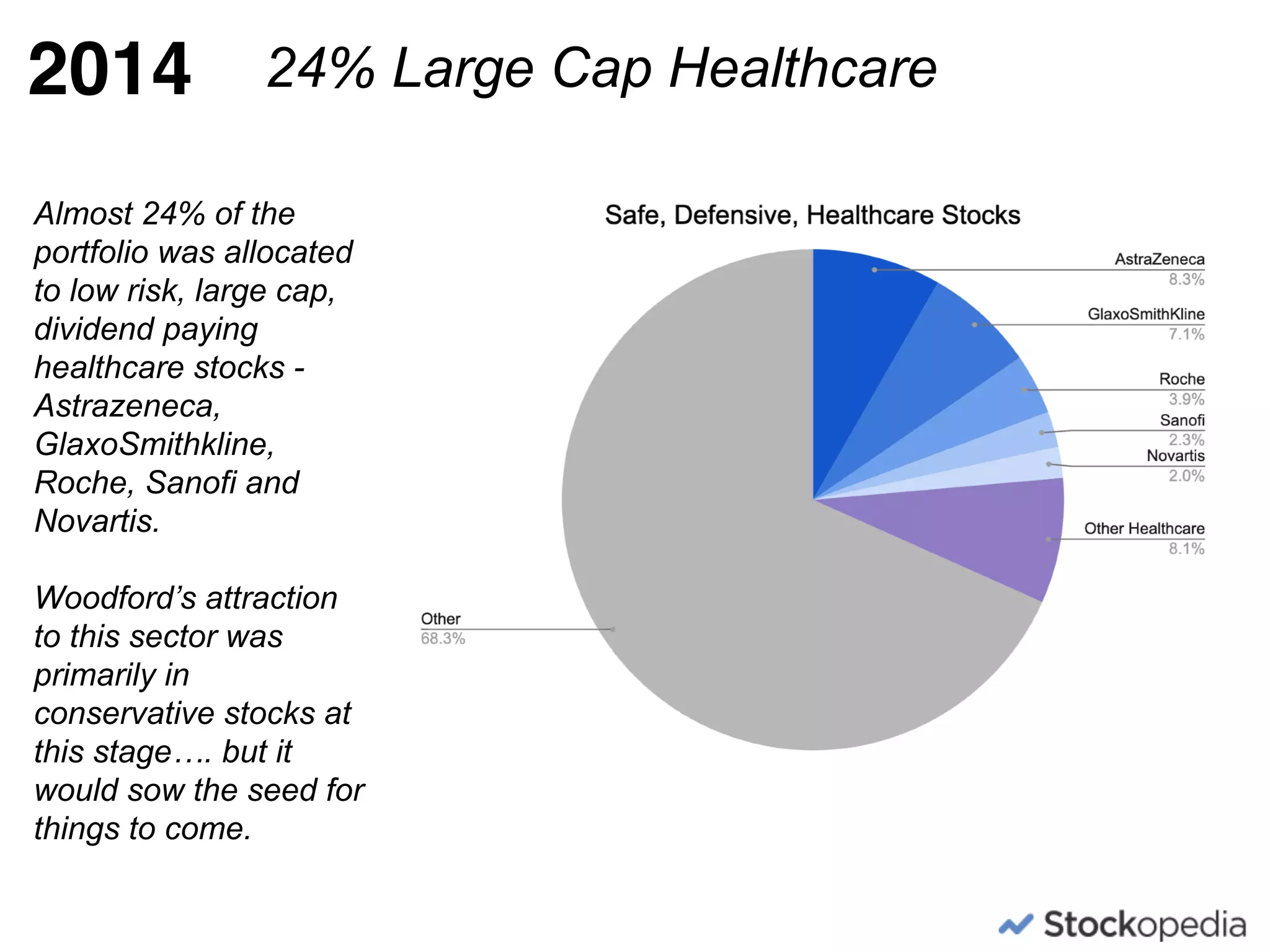

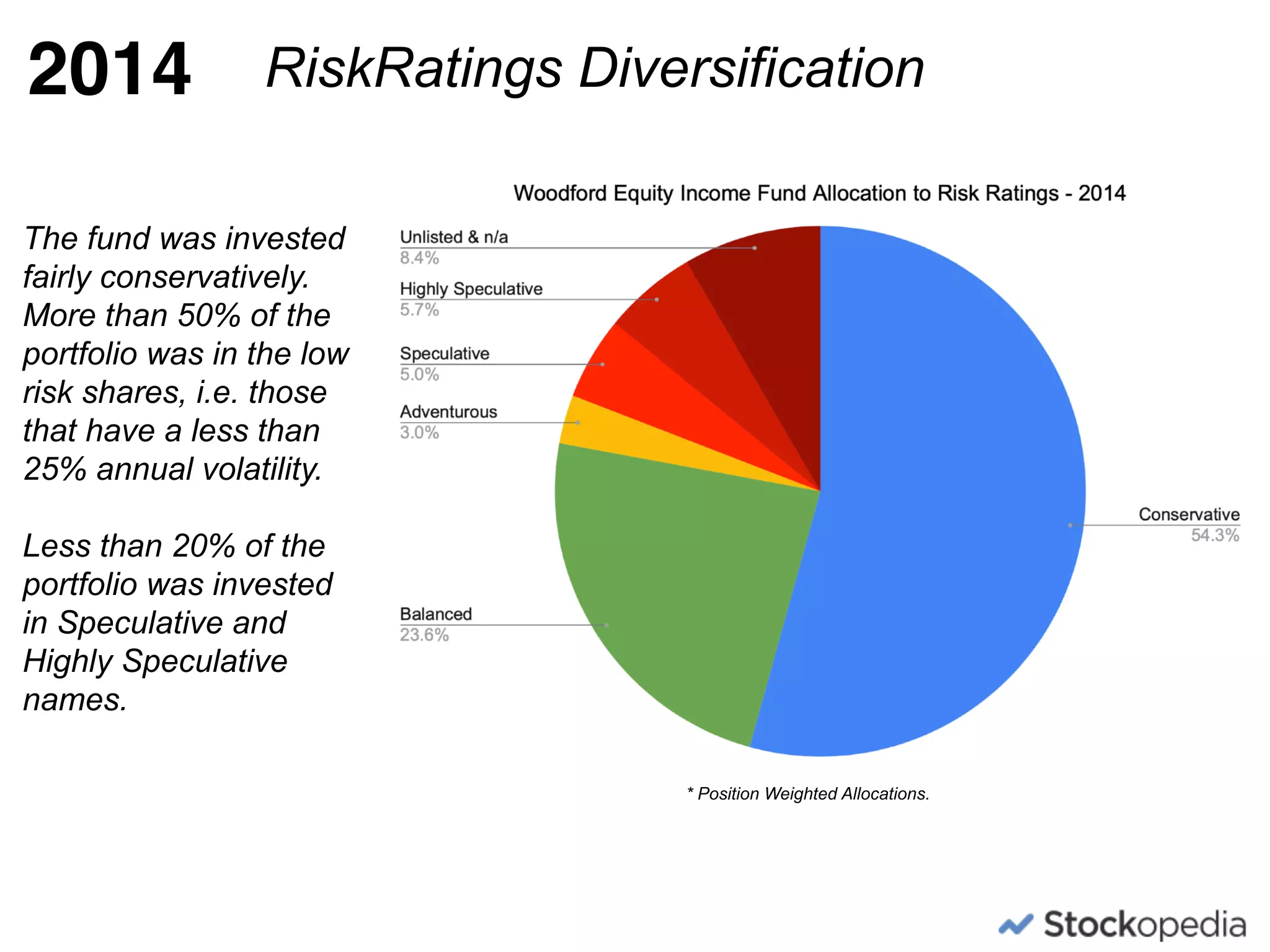

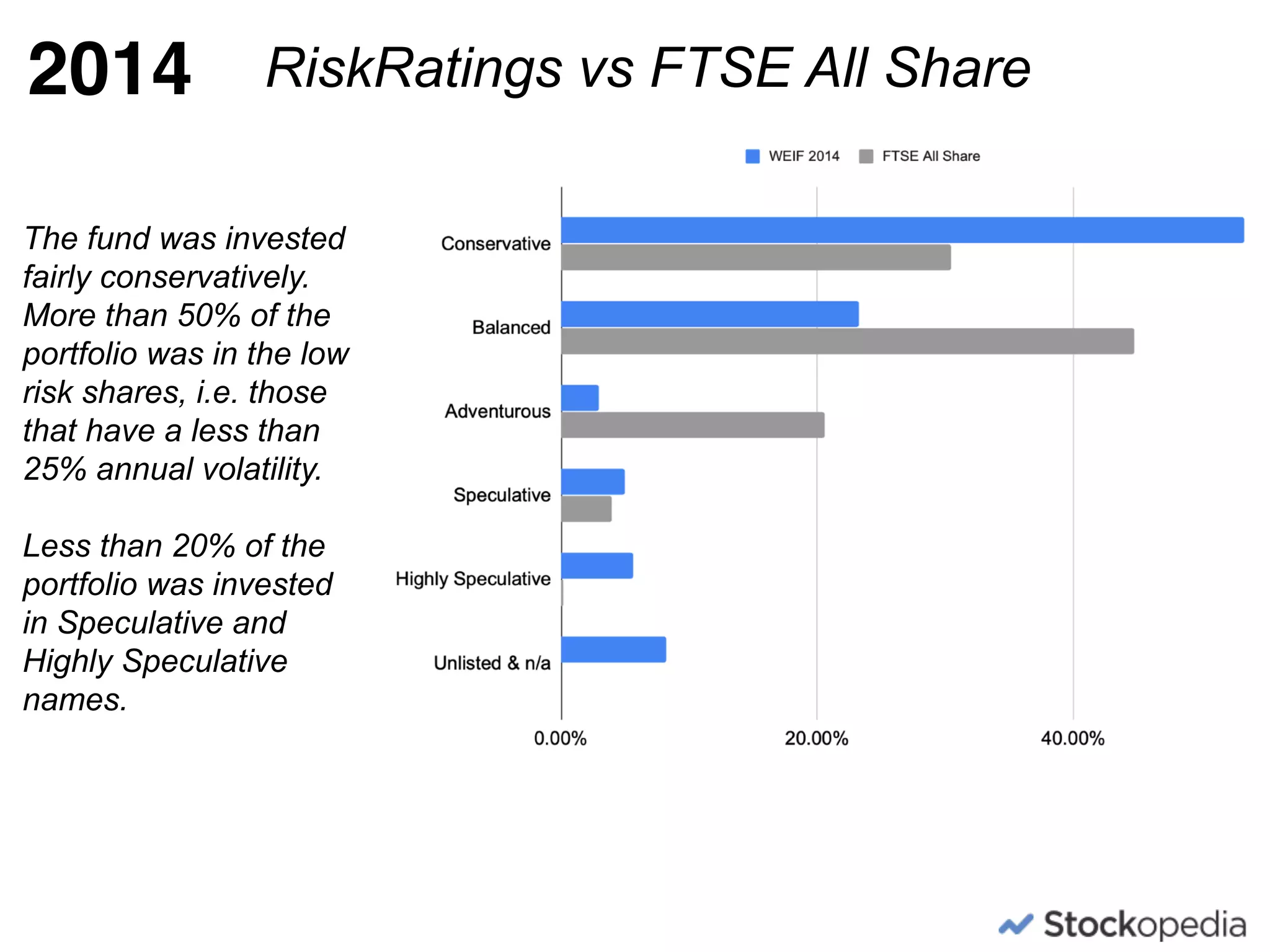

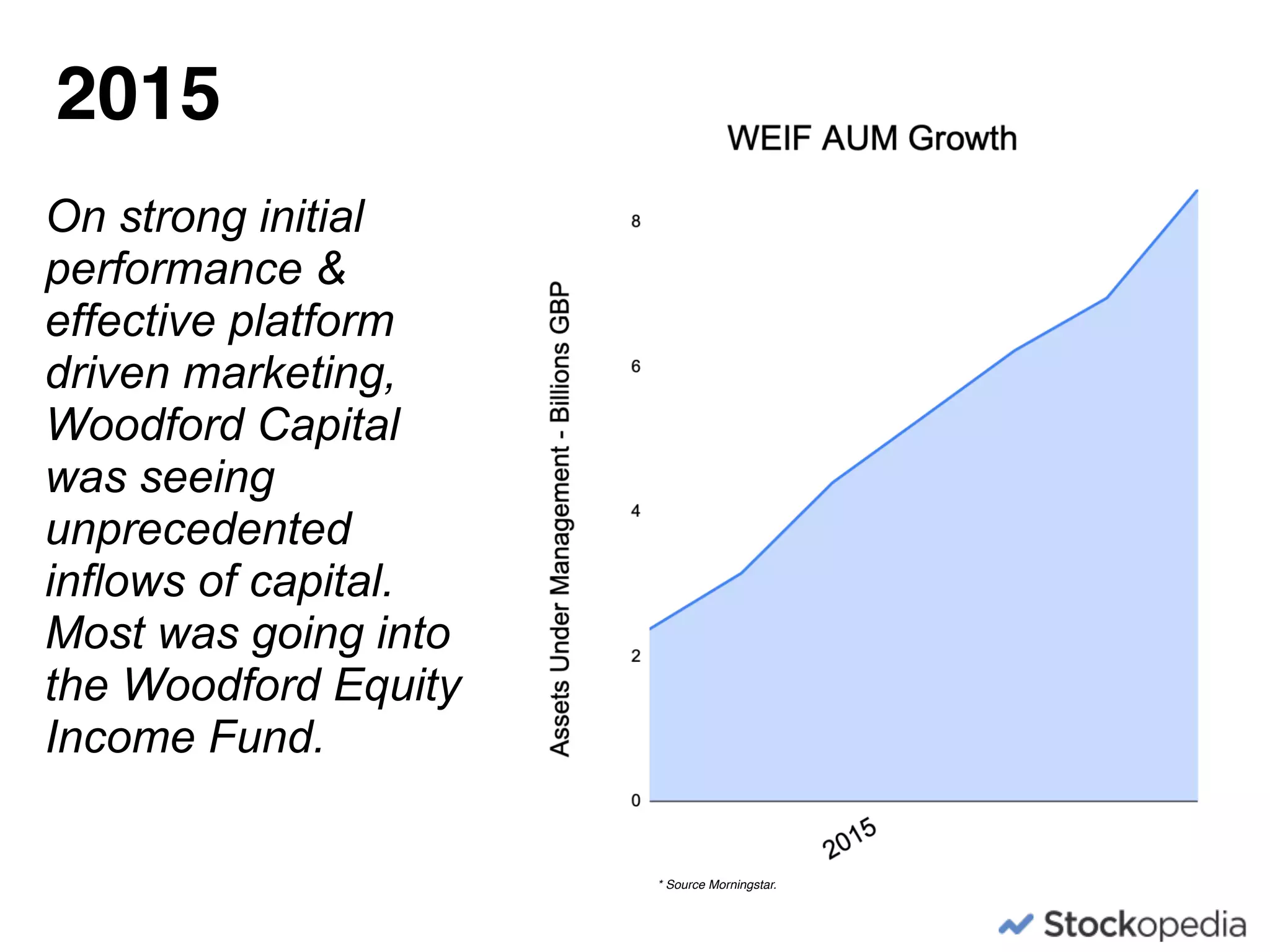

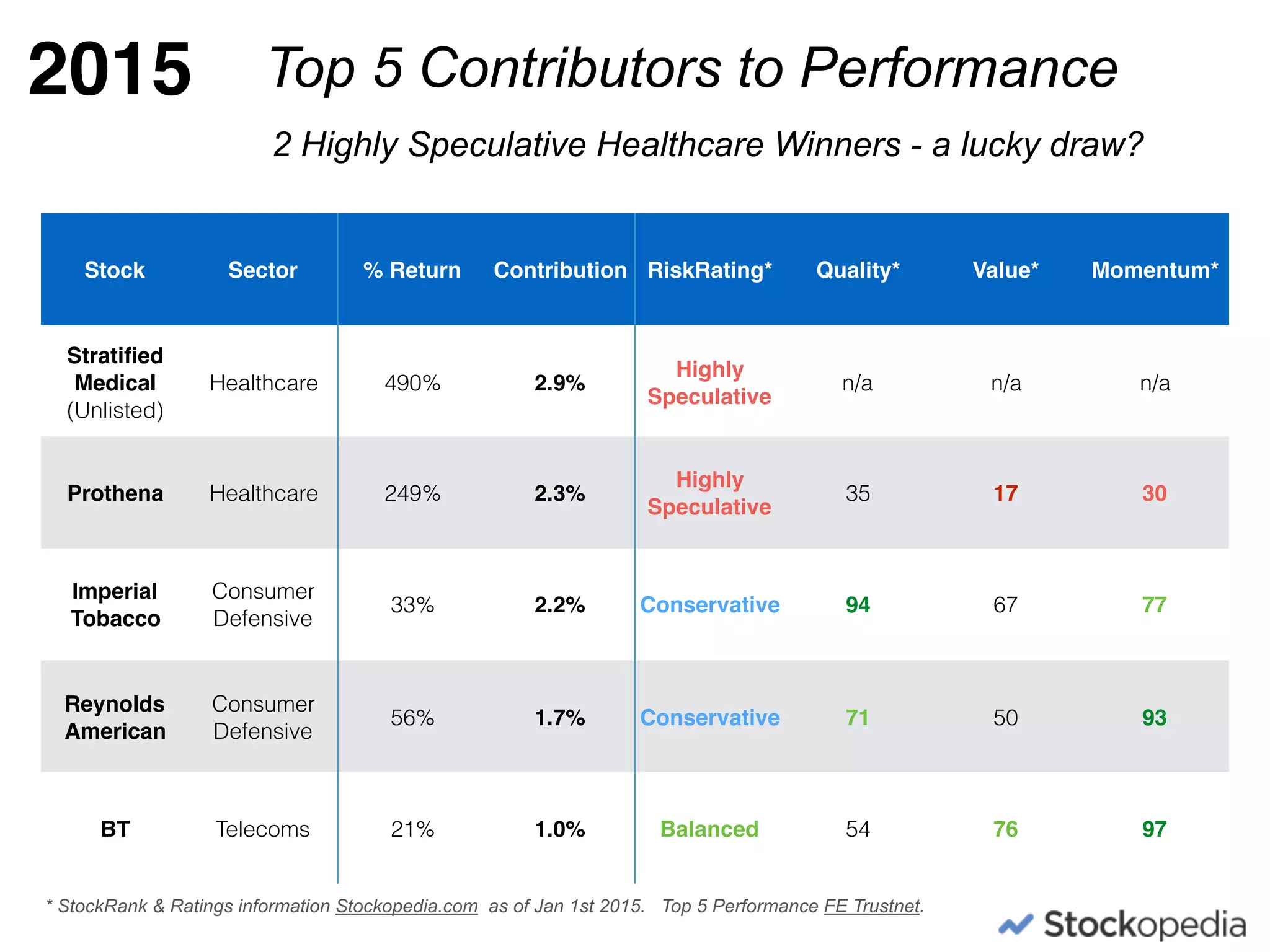

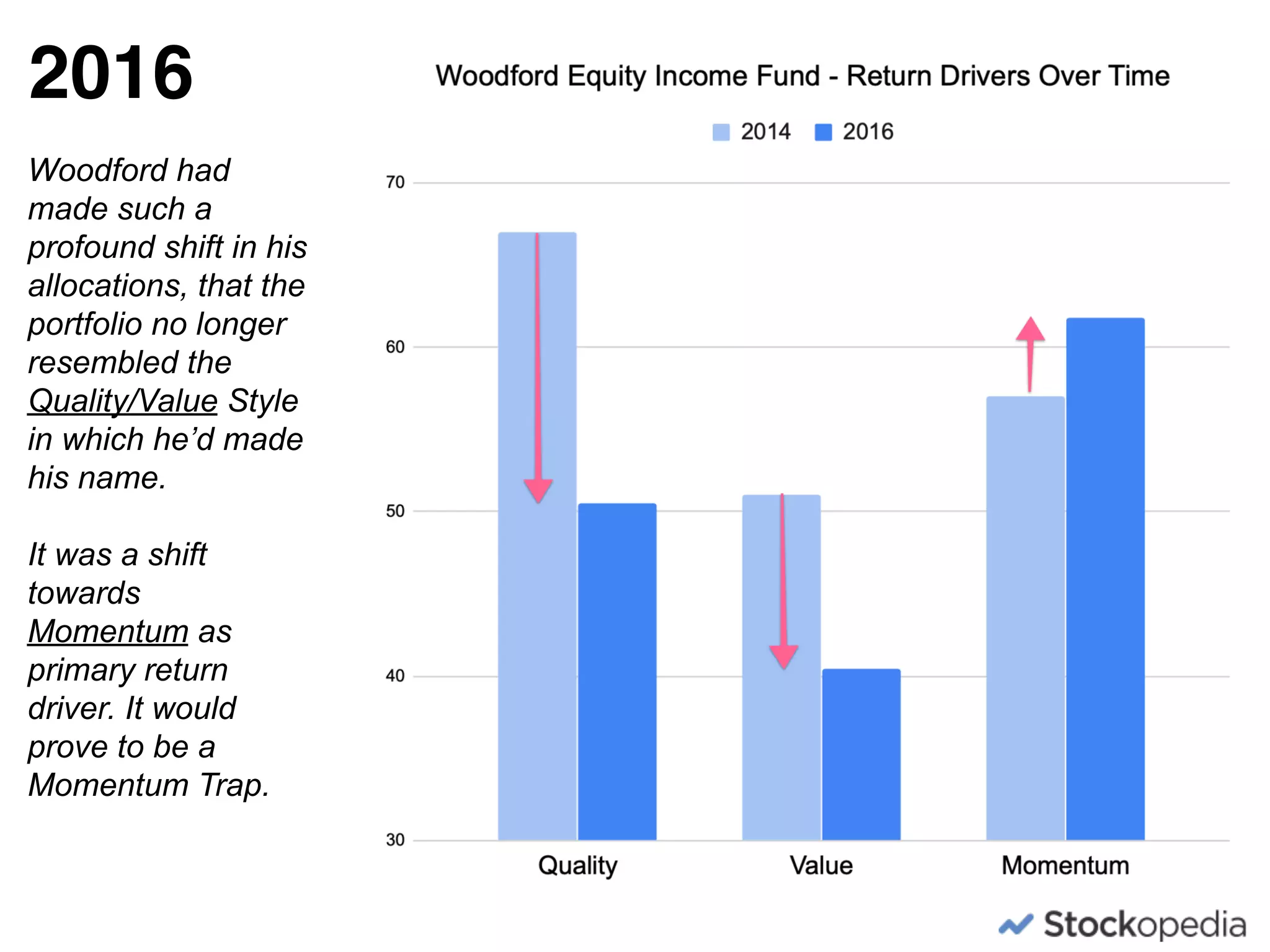

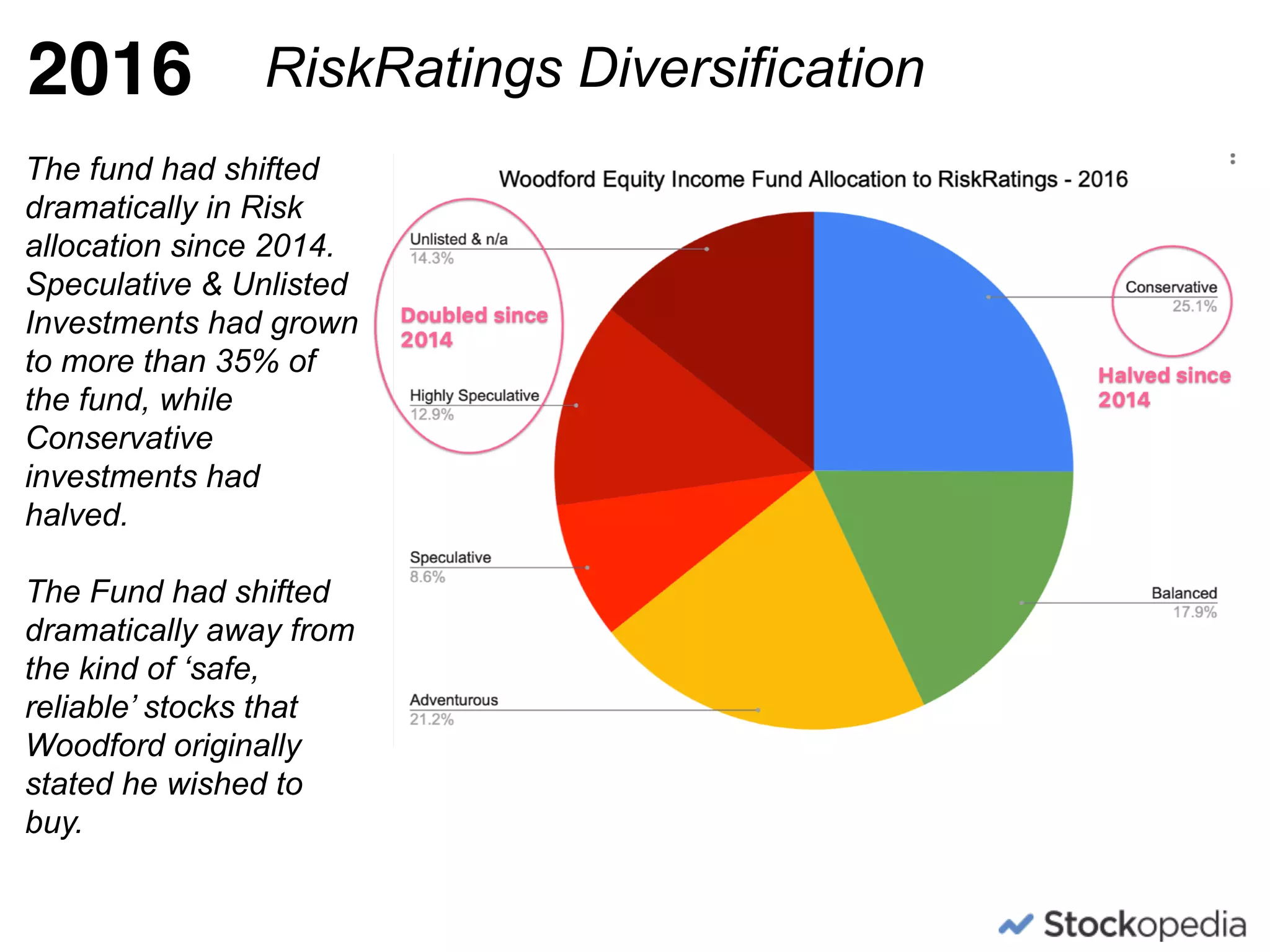

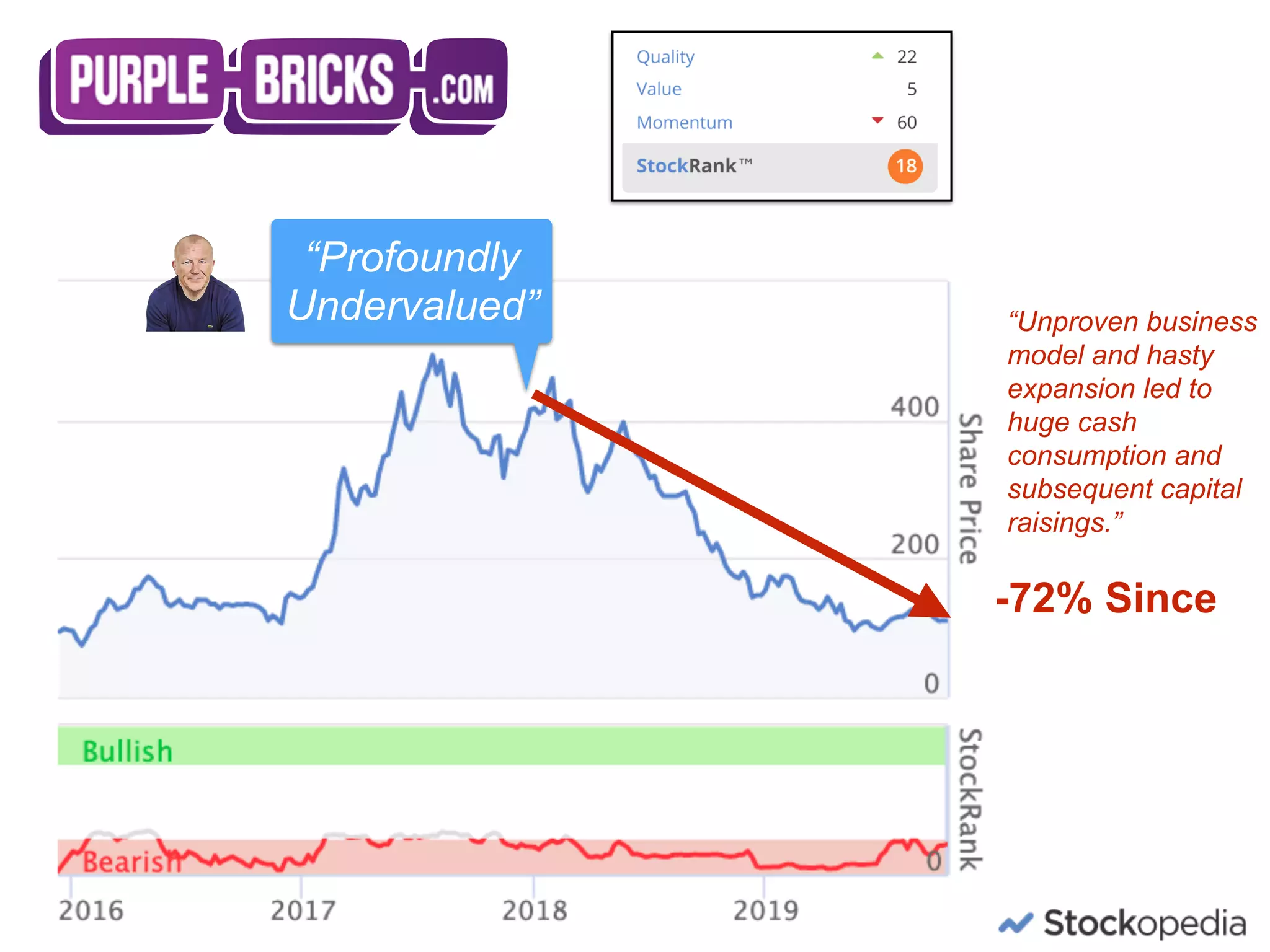

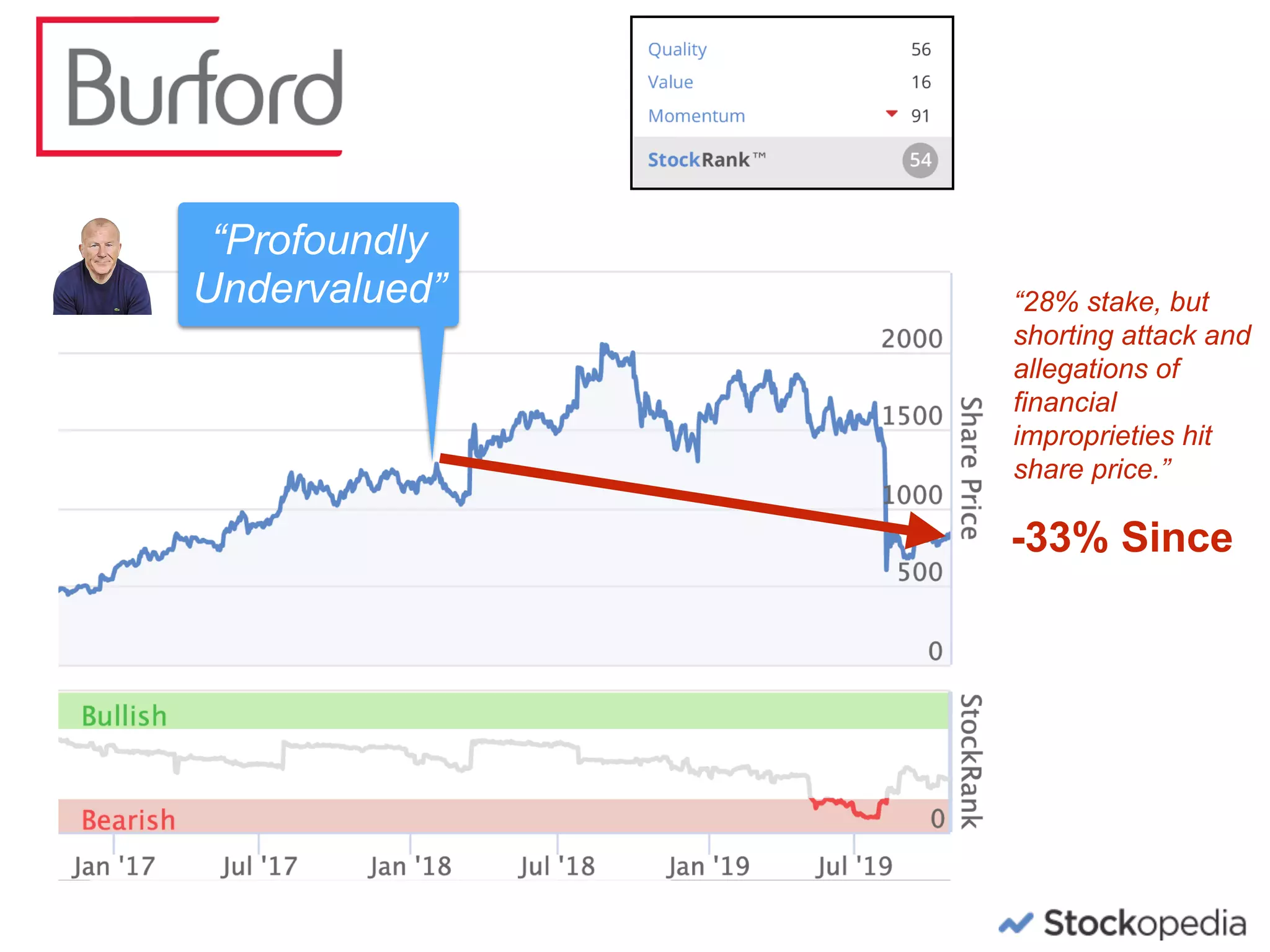

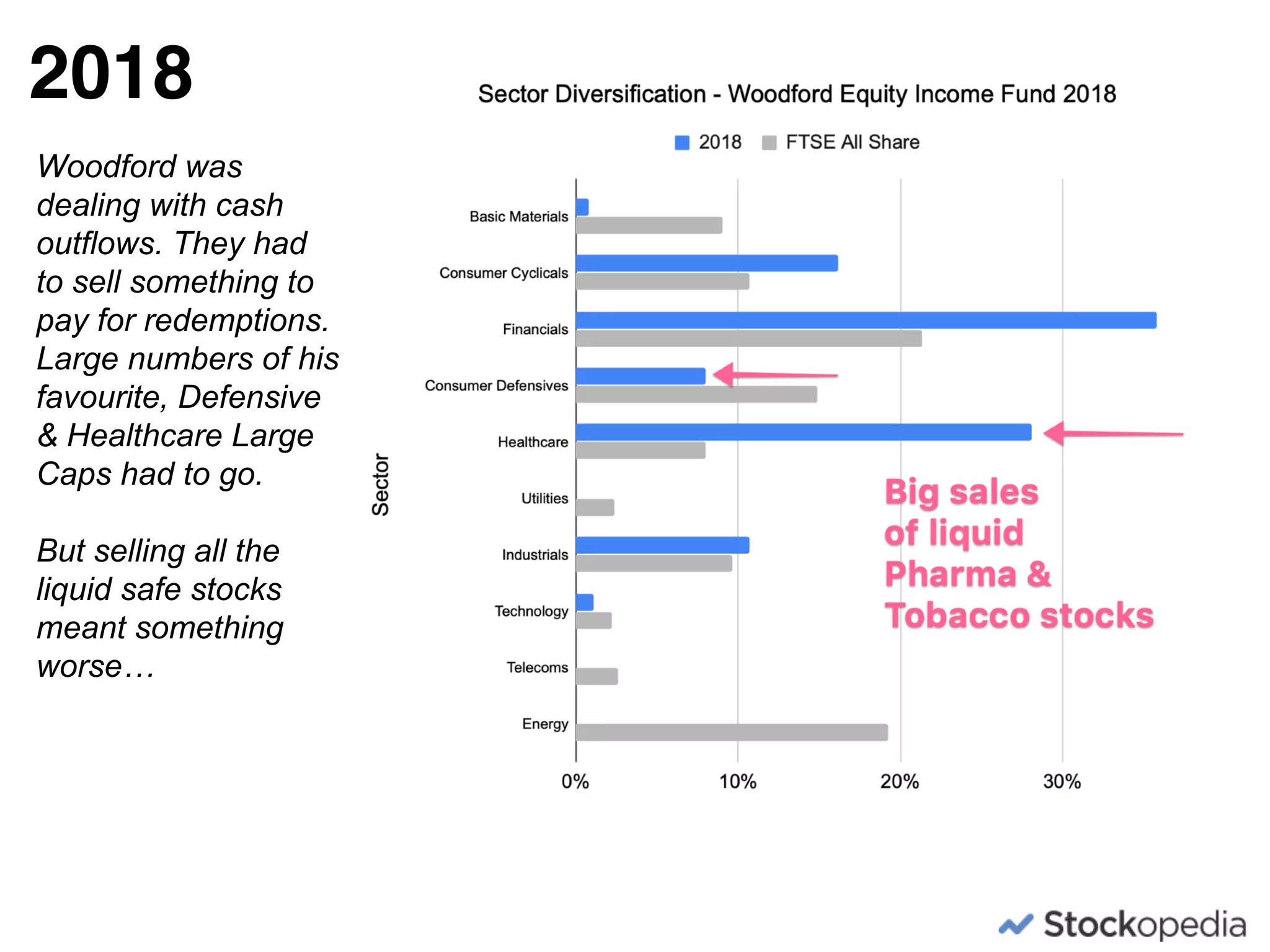

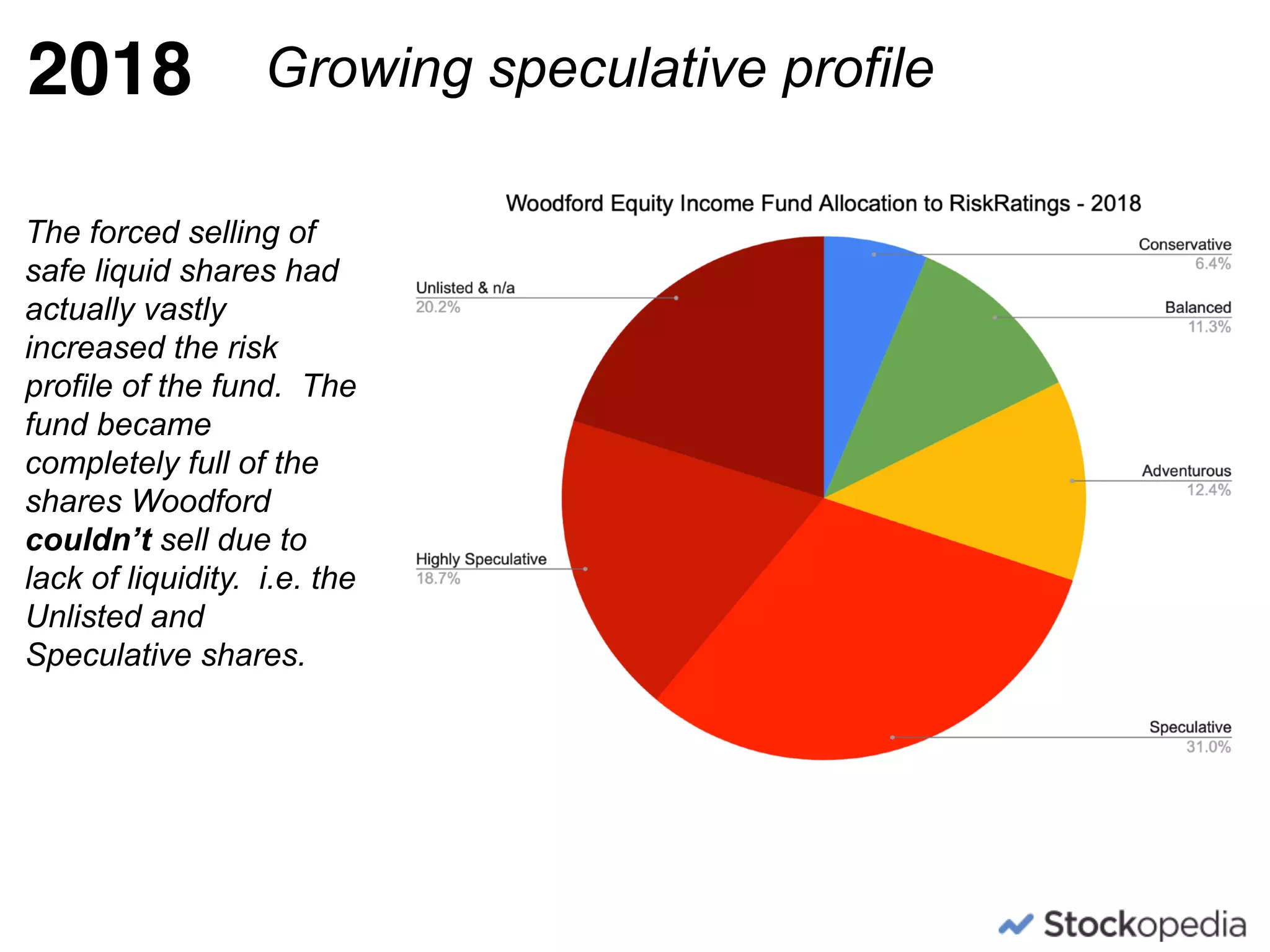

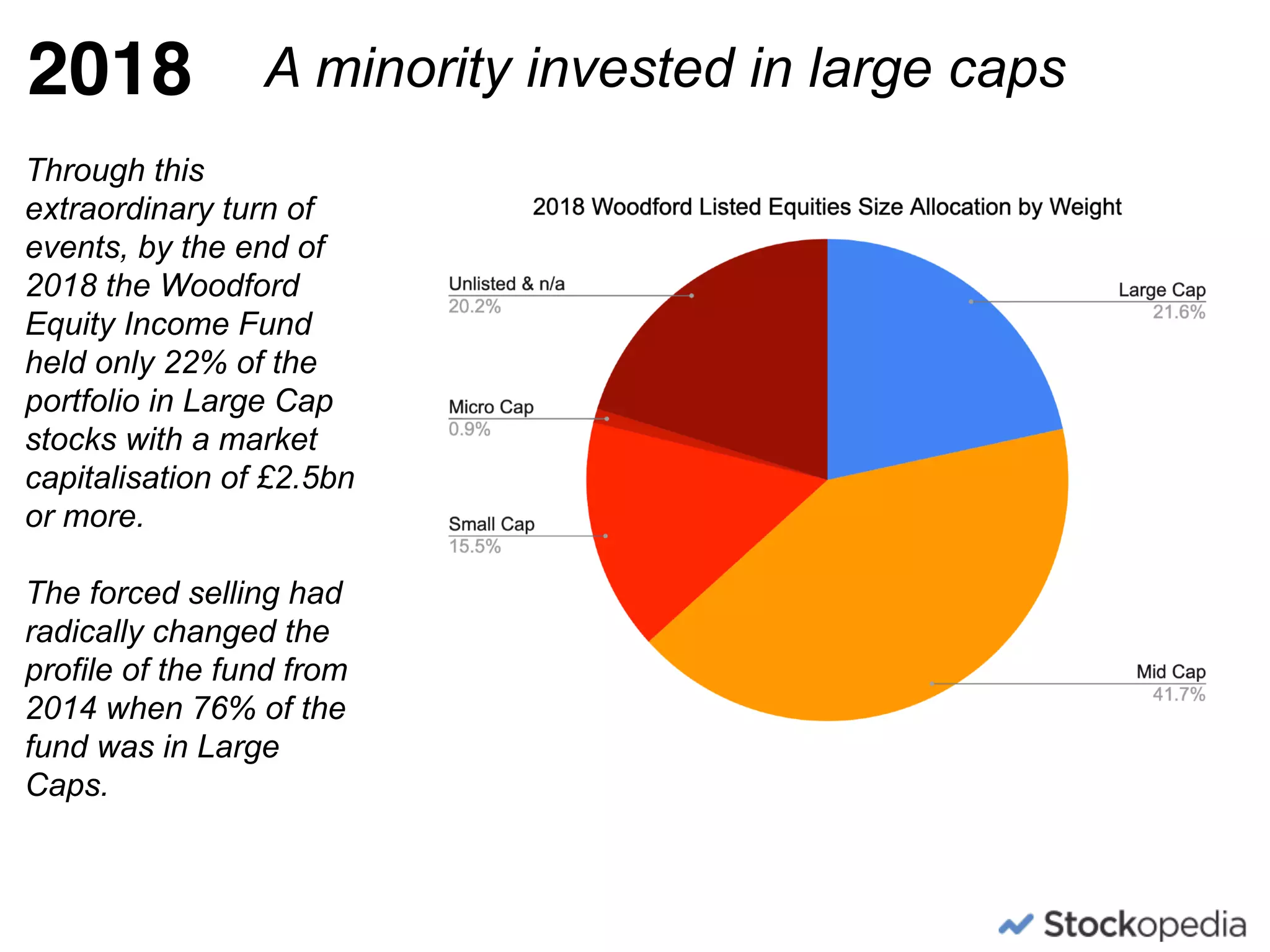

The document provides an analysis of Neil Woodford's Equity Income Fund from its inception in 2014 until its closure in 2019. It outlines an agenda to discuss the fund's history, performance analysis based on holdings from 2014-2019, charts of key metrics over time, lessons for investors, and how to analyze one's own portfolio to avoid similar mistakes. The analysis of the initial 2014 portfolio shows that Woodford initially invested conservatively in generally higher quality, value stocks, with a focus on large cap healthcare names. However, he noted plans to also invest a small portion in early-stage, undervalued quoted and unquoted businesses.

![+70% Since

“Not a great deal has

changed [in] the

investment case”](https://image.slidesharecdn.com/whatwentwrongatwoodfordwebinar-2019-better-191104134552/75/What-Went-Wrong-at-Woodford-A-Forensic-Analysis-82-2048.jpg)