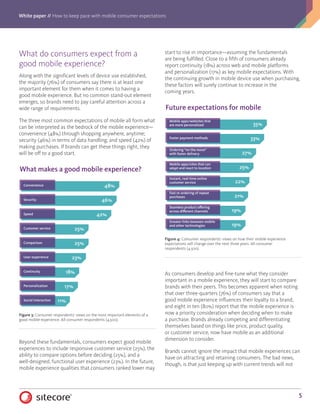

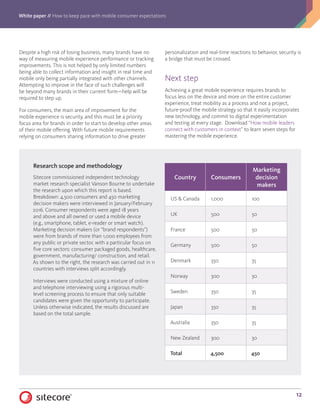

This white paper discusses the growing gap between consumer expectations and brand offerings in mobile experiences, emphasizing the need for brands to adapt to the evolving mobile landscape. Key findings indicate that convenience, security, and speed are critical components of a good mobile experience, yet many brands overestimate their ability to meet these consumer needs. As consumer reliance on mobile increases, brands must innovate to enhance customer engagement or risk losing consumer loyalty.