Embed presentation

Downloaded 17 times

![Gratuity Calculation= [ (Basic Pay + D.A) x 15 days x No. of

years of service ] / 26 Where, D.A = Dearness Allowance.

End of Service Benefits Eligibility : 1. Any person employed on

wages/salary. 2. At the time of retirement or resignation or on

superannuation, an employee should have rendered

continuous service of not less than five years. 3. Payable

without completion of five years only when death and

disablement.](https://image.slidesharecdn.com/9-170628043629/85/HOW-TO-CALCULATE-GRATUITY-4-320.jpg)

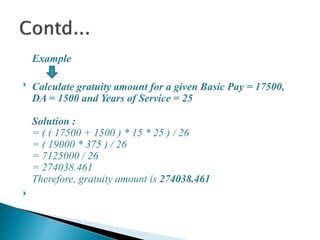

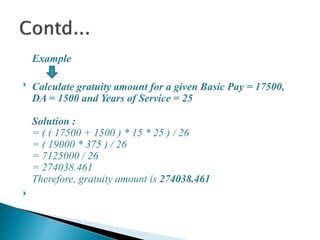

Gratuity is an amount paid by an organization to employees as a benefit upon retirement or resignation after 5 years of continuous service. It is calculated based on an employee's average salary, dearness allowance, and number of years worked. The document provides an example calculation for an employee with a basic pay of Rs. 17500, dearness allowance of Rs. 1500, and 25 years of service, resulting in a gratuity amount of Rs. 274038.461.

![Gratuity Calculation= [ (Basic Pay + D.A) x 15 days x No. of

years of service ] / 26 Where, D.A = Dearness Allowance.

End of Service Benefits Eligibility : 1. Any person employed on

wages/salary. 2. At the time of retirement or resignation or on

superannuation, an employee should have rendered

continuous service of not less than five years. 3. Payable

without completion of five years only when death and

disablement.](https://image.slidesharecdn.com/9-170628043629/85/HOW-TO-CALCULATE-GRATUITY-4-320.jpg)