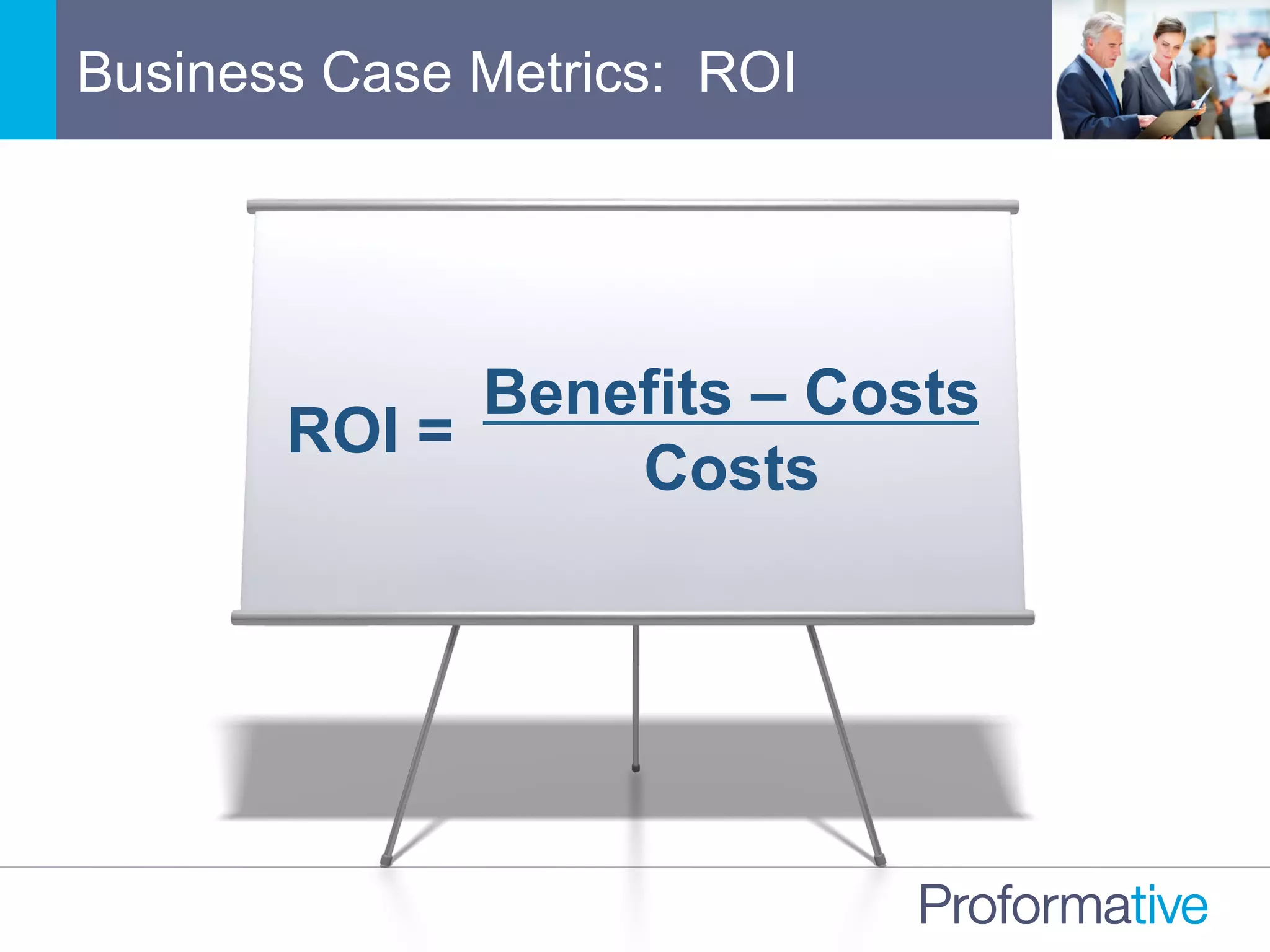

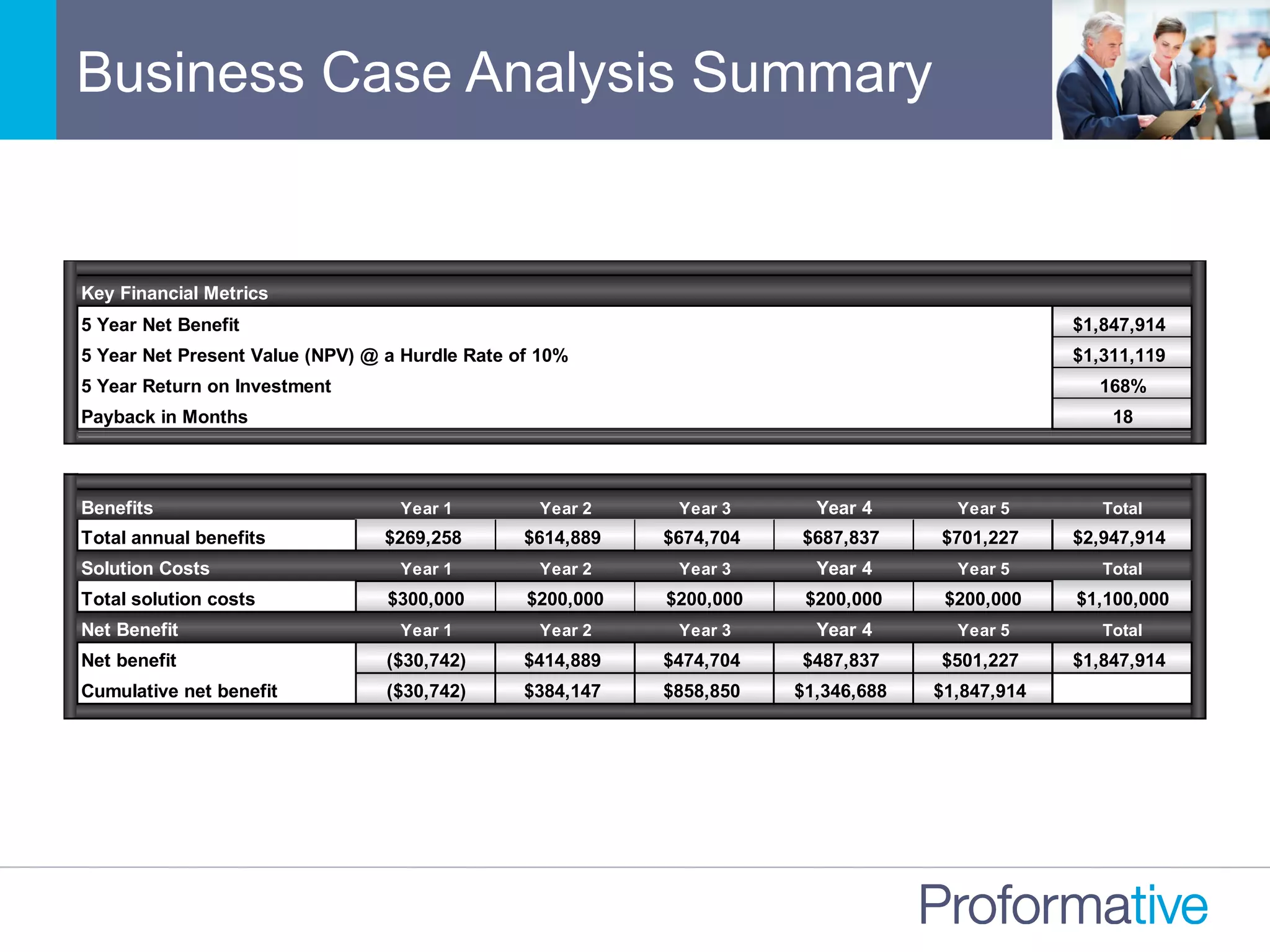

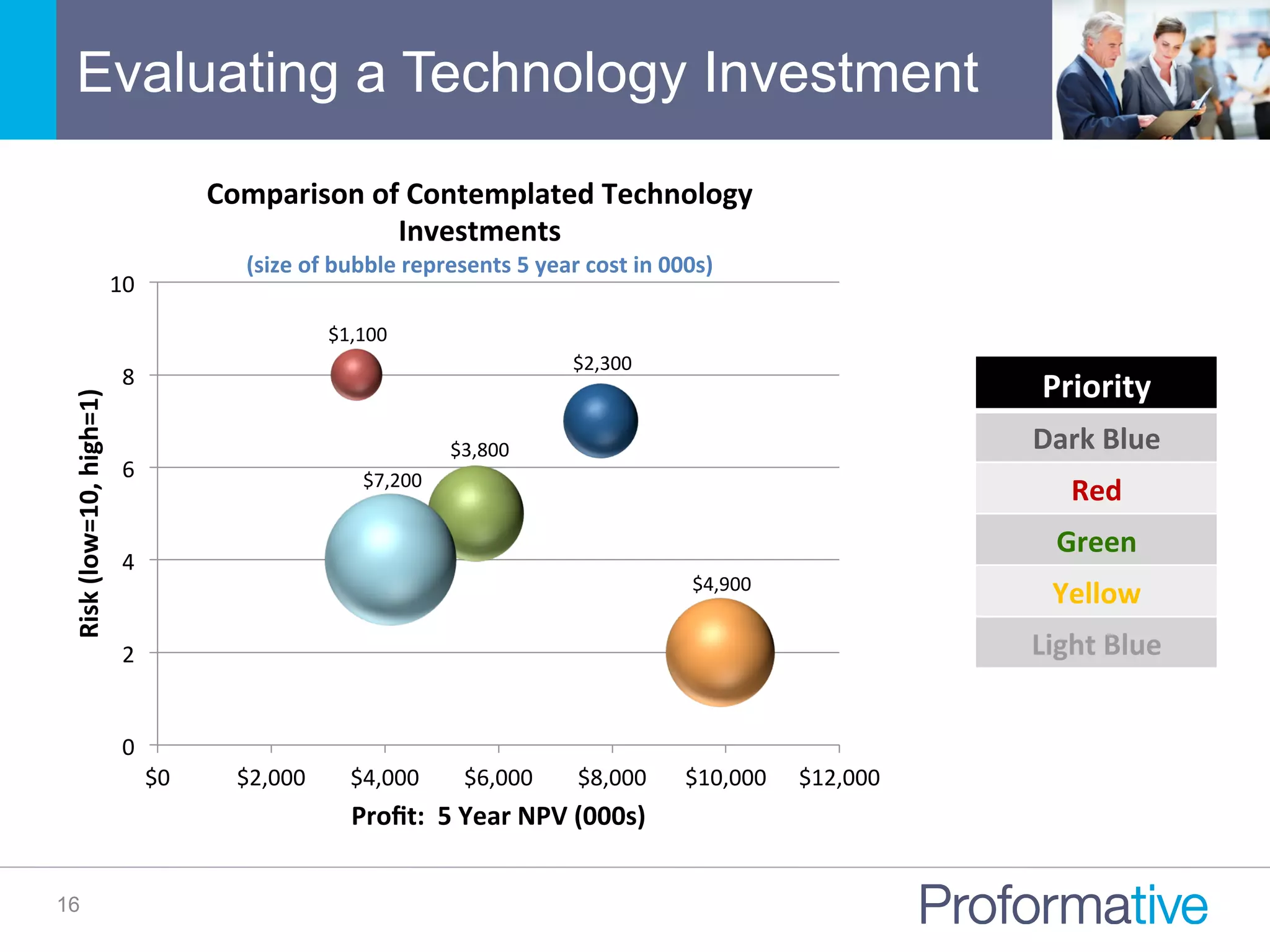

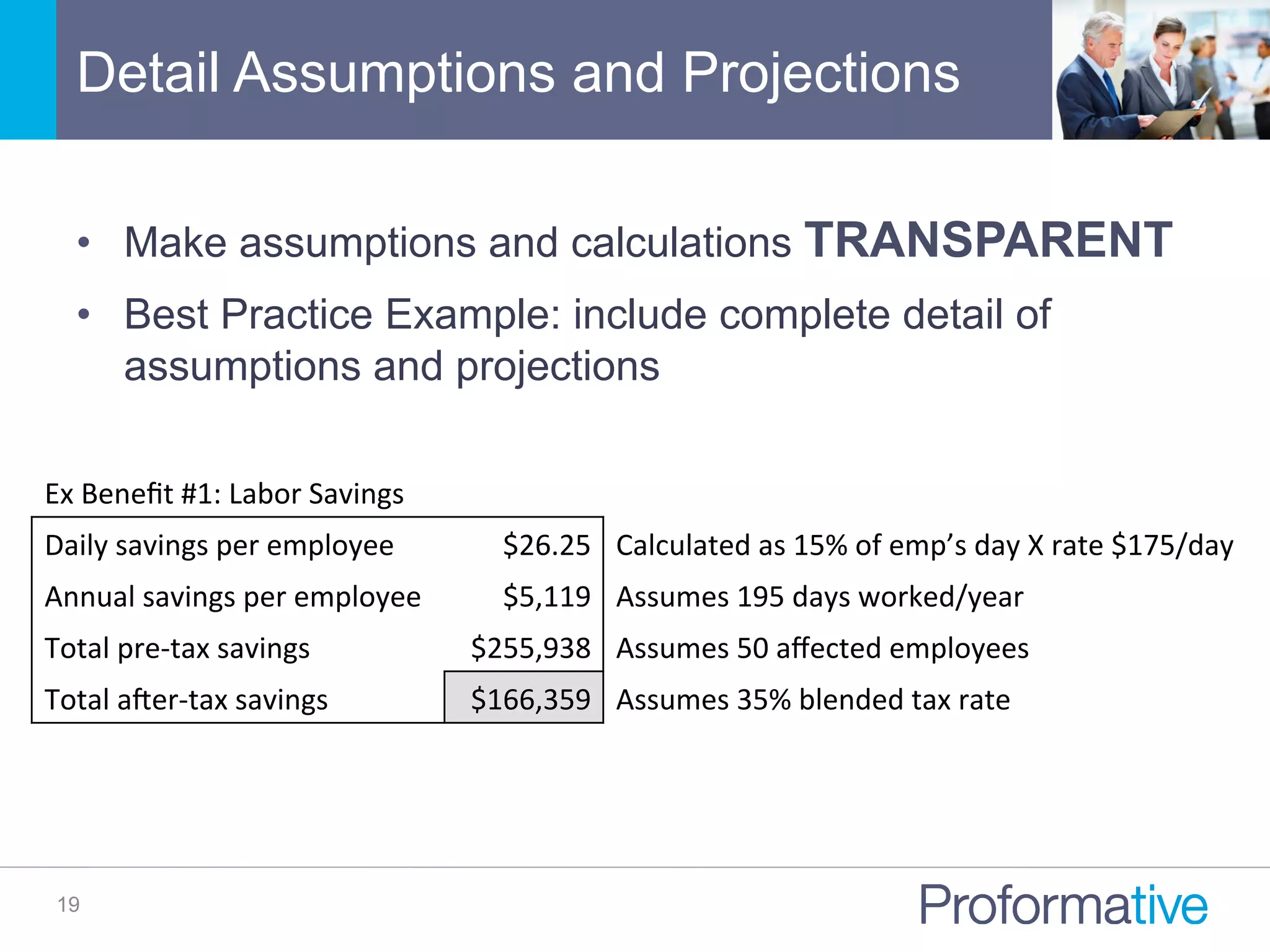

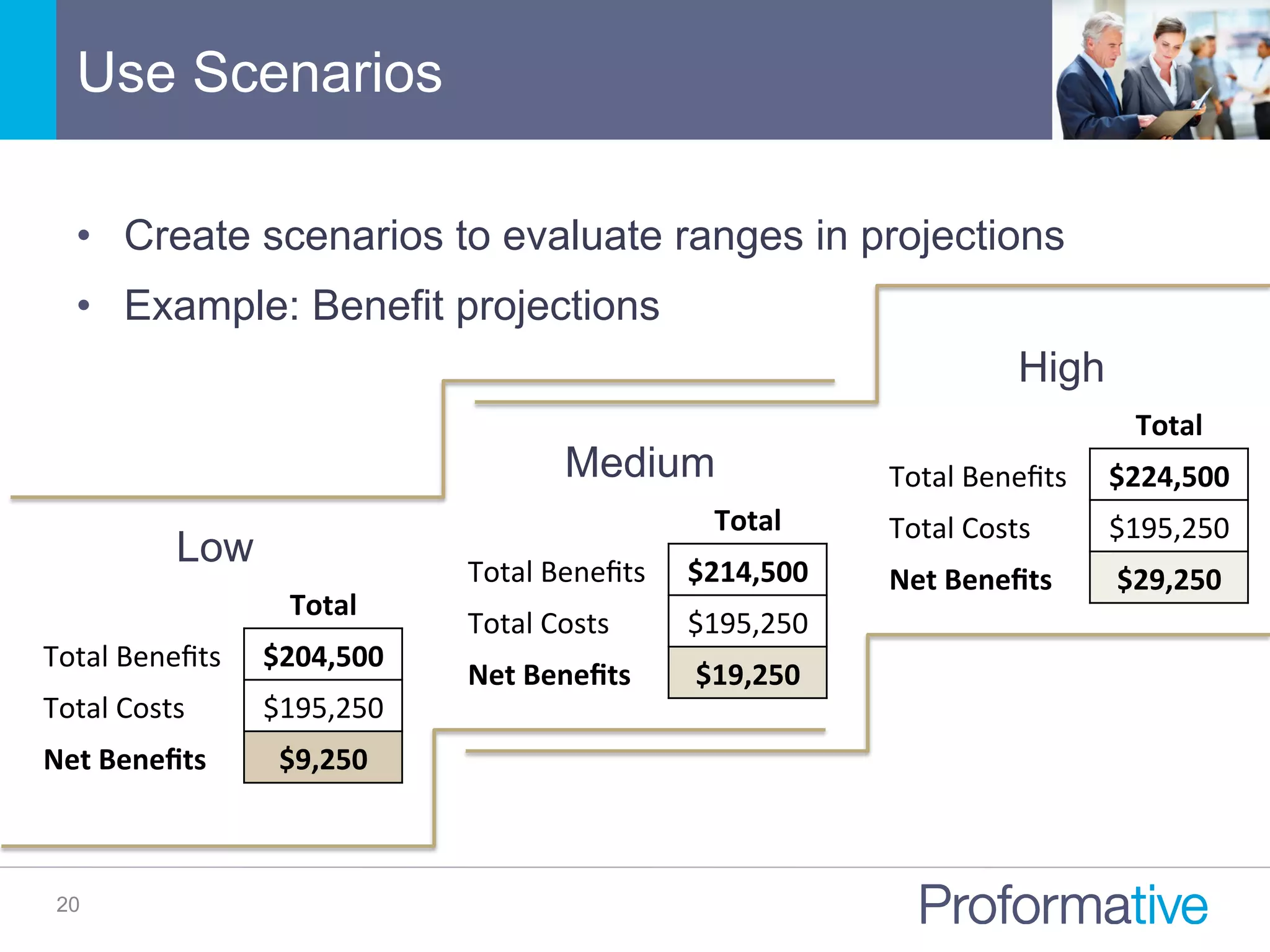

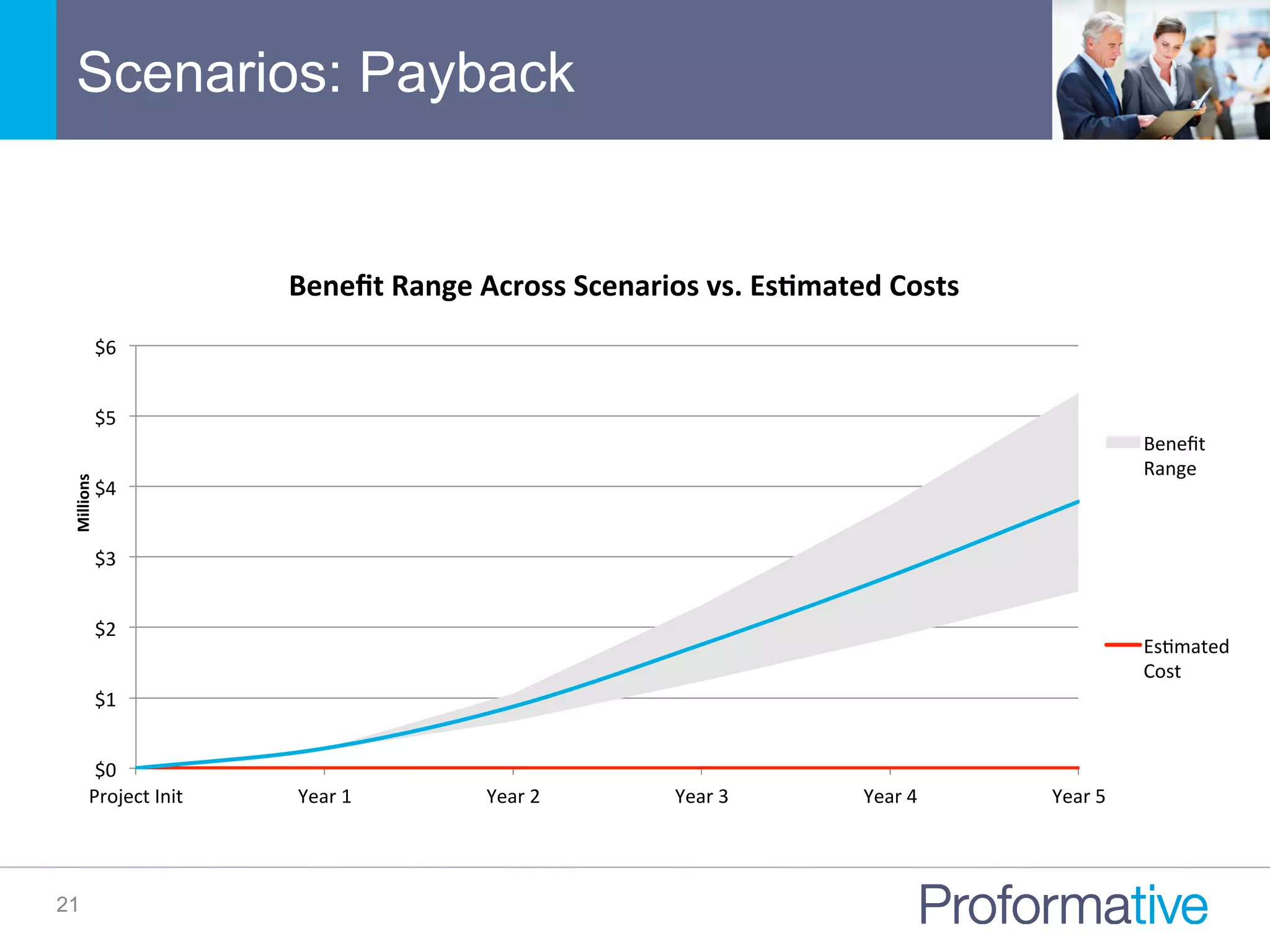

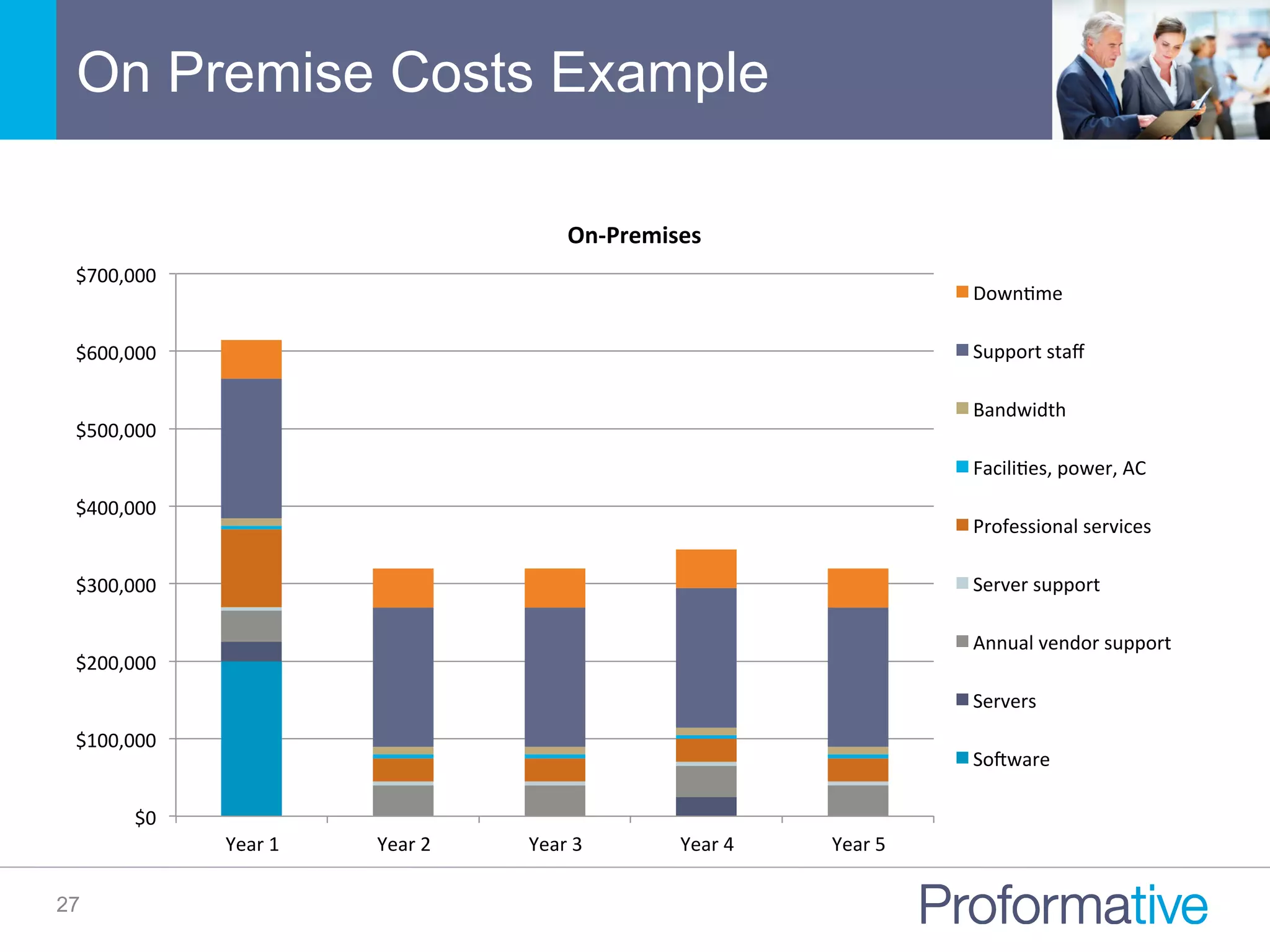

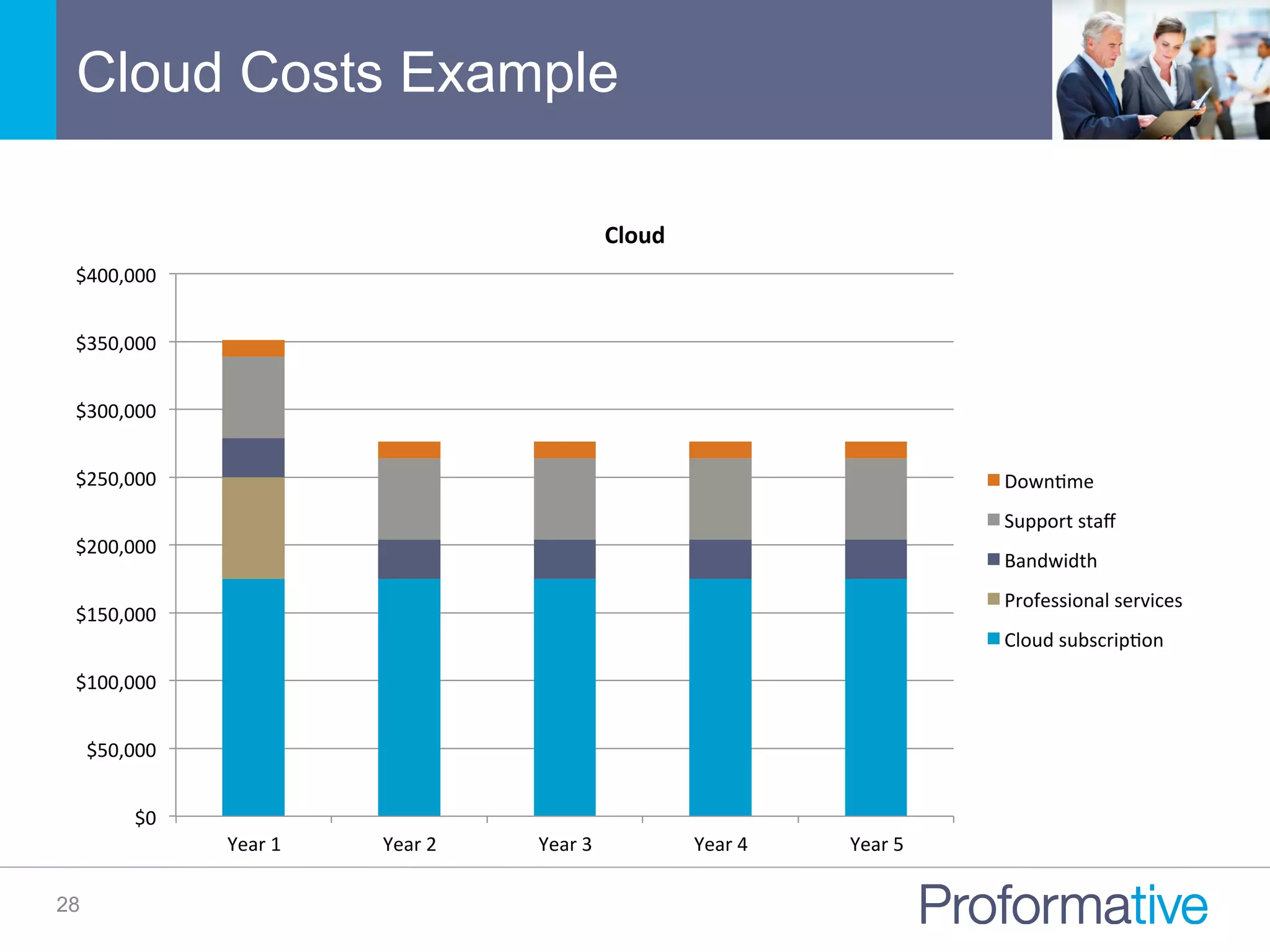

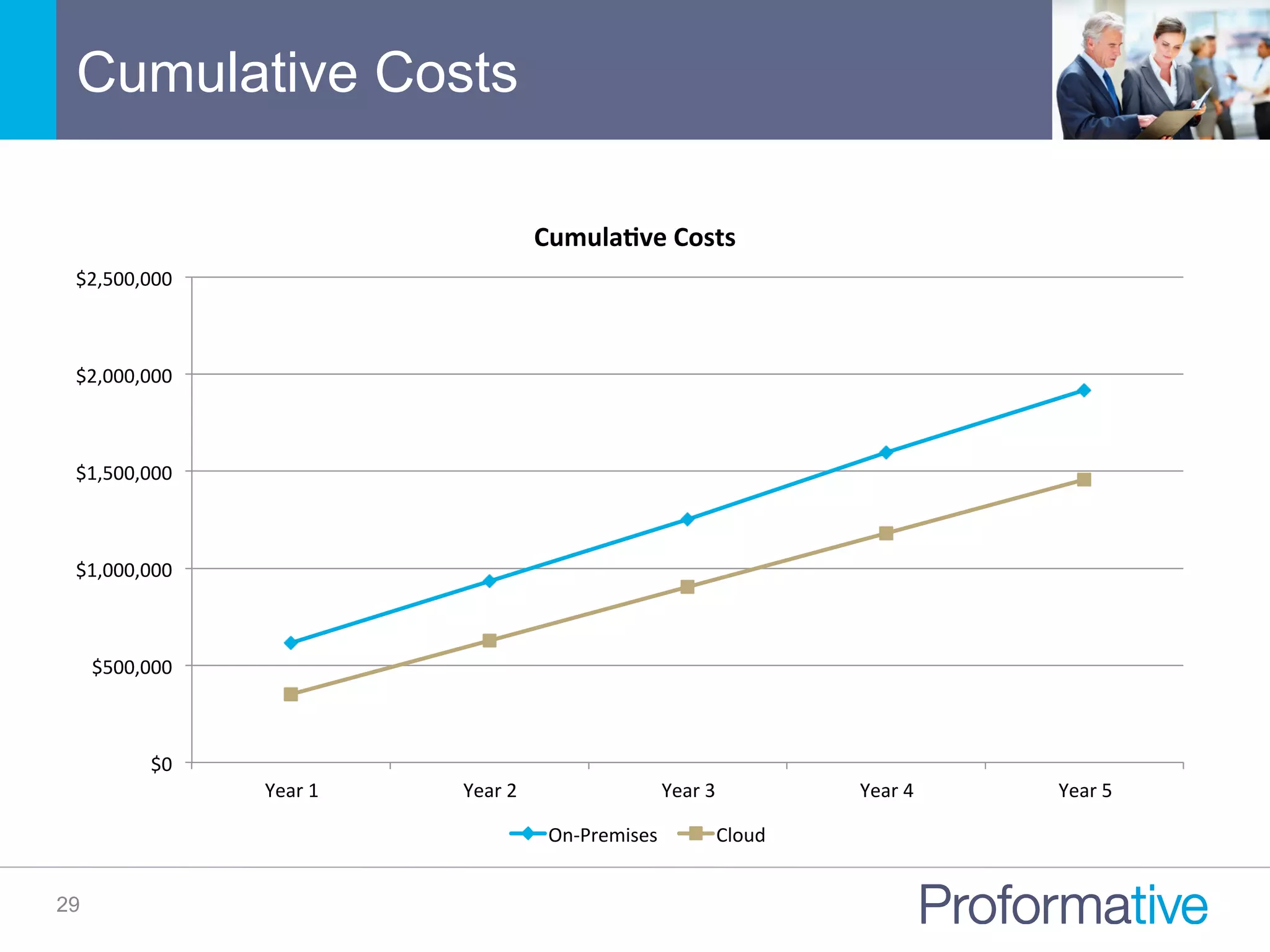

The document discusses the significance of Business Case Analysis (BCA) for technology investments, highlighting that many IT projects face severe cost and schedule overruns, contributing to substantial financial losses. It outlines the components of effective BCA, key financial metrics, and the benefits of cloud vs. on-premise solutions, emphasizing accuracy, transparency, and scenario planning in decision-making. Ultimately, it underscores the need for thorough evaluation and strategic planning to maximize investment outcomes.

![Comprehensive BCA Inclusions

9

• Increased

labor

producNvity

• Reduce

costs

• Increased

revenue

(and

associated

margin)

Forecast

benefits

• Upfront

costs

• Recurring

costs

Project

costs

• Ramp

up

• [Benefits

–

Costs

=

Annual

Net

Benefits]

Map

benefit

and

cost

projecNons

Calculate

key

financial

metrics](https://image.slidesharecdn.com/gotransversebusinesscaseanalysisfortechinvestments-151109213948-lva1-app6891/75/How-to-Build-a-Great-Cloud-SaaS-Business-Case-Analysis-for-Technology-Investment-9-2048.jpg)

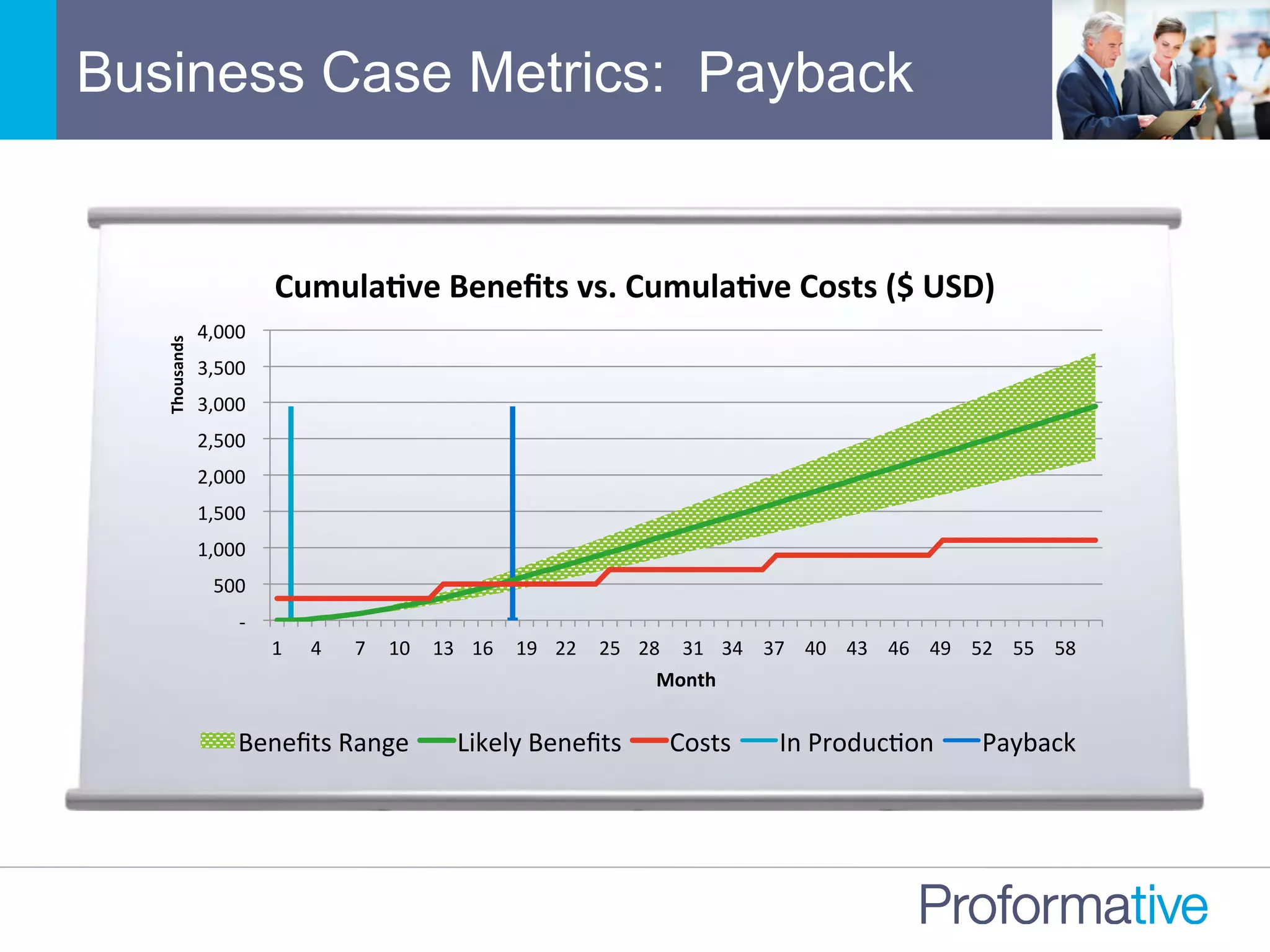

![Meaningful Financial Metrics

10

Return

on

Investment

(ROI)

• [Total

Net

Benefits

–

Total

Costs]

/

[Total

Costs]

• Does

not

take

into

account

Nme

value

of

money

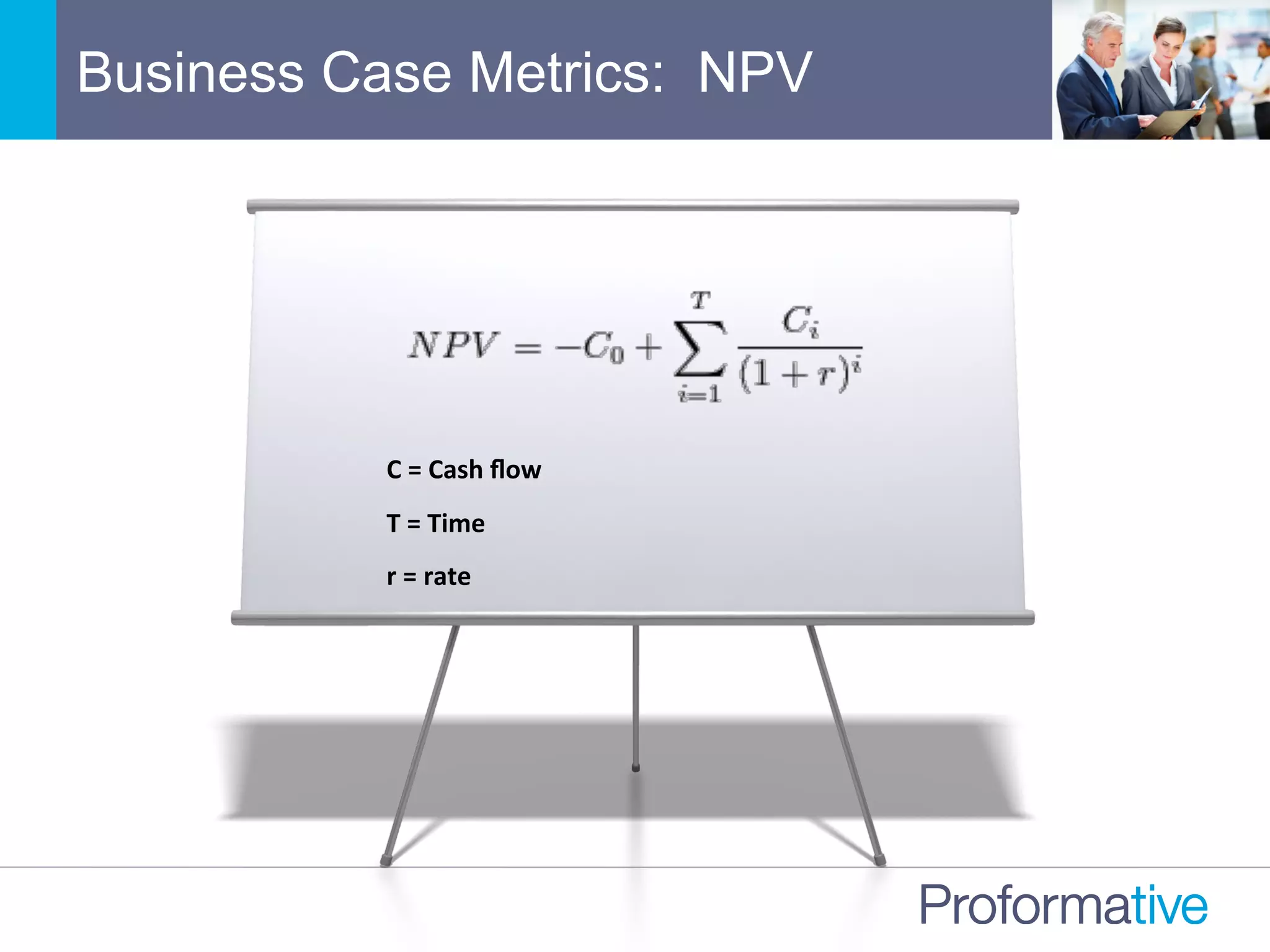

Net

Present

Value

(NPV)

• Uses

cost

of

capital

to

discount

to

“current”

dollars

• NPV

<

0

is

by

definiNon

a

poor

investment

Payback

Period

• Net

benefit

crosses

from

negaNve

to

posiNve

• CriNcal

if

expediNous

return

of

capital

is

needed!

Internal

Rate

of

Return

(IRR)

• Discount

rate

where

NPV

=

0](https://image.slidesharecdn.com/gotransversebusinesscaseanalysisfortechinvestments-151109213948-lva1-app6891/75/How-to-Build-a-Great-Cloud-SaaS-Business-Case-Analysis-for-Technology-Investment-10-2048.jpg)