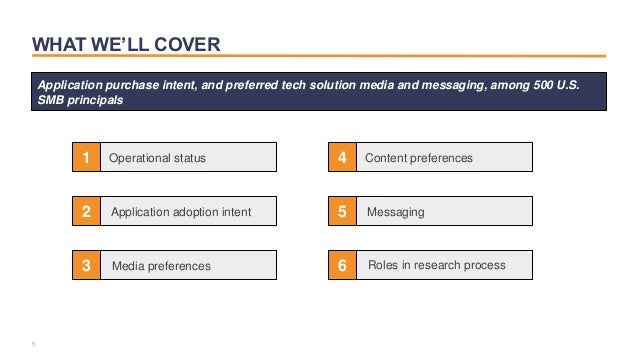

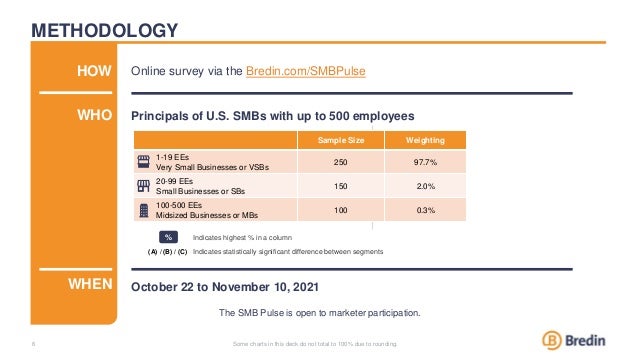

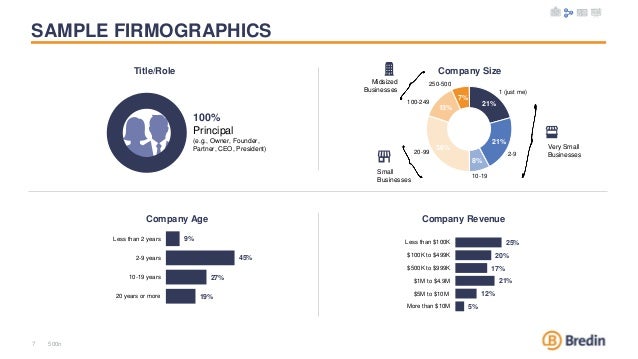

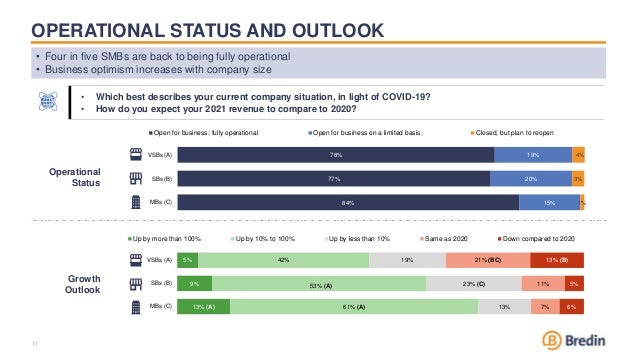

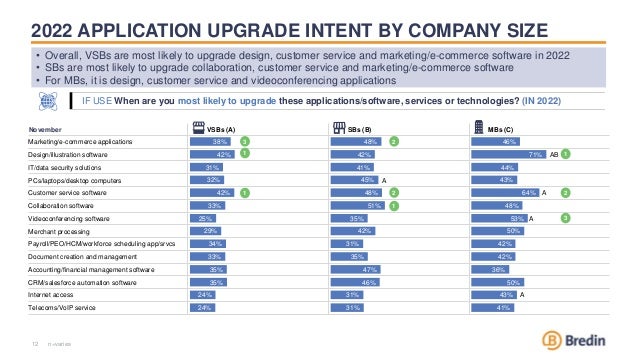

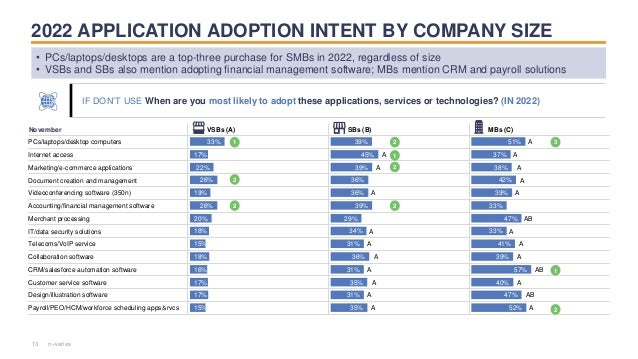

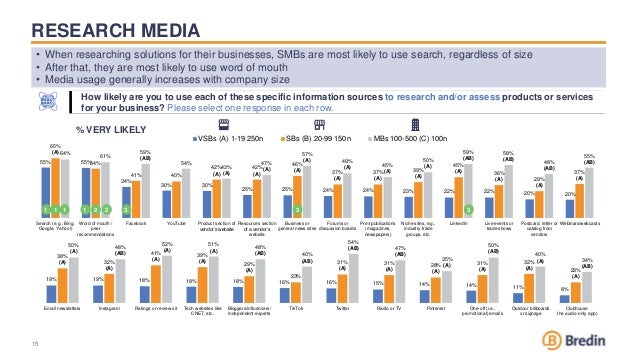

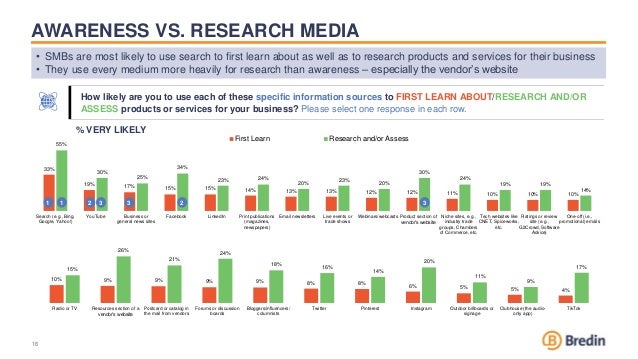

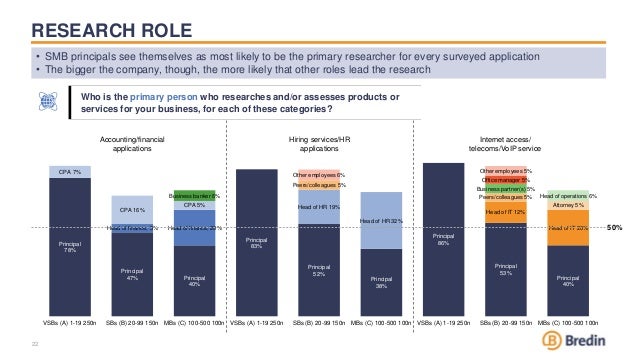

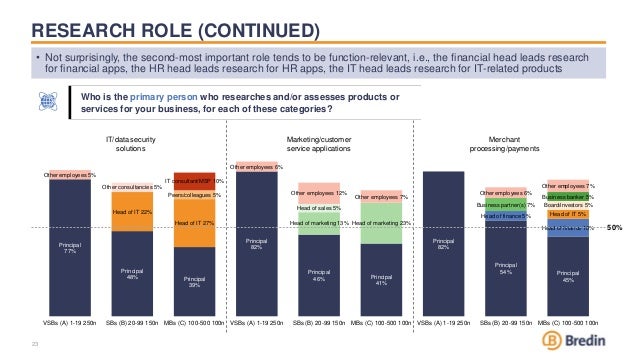

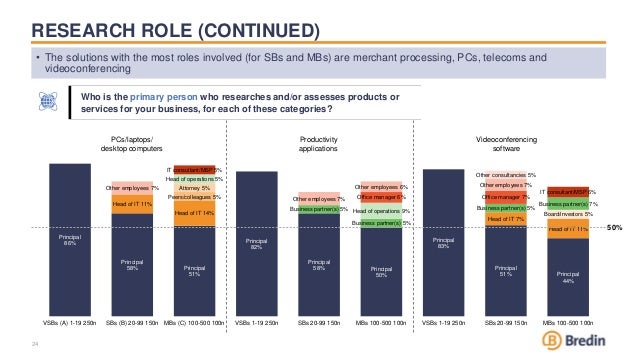

The document presents findings from a survey conducted on U.S. SMBs regarding their operational status, technology adoption intent, and research behaviors. Key insights reveal that a majority of SMBs are fully operational post-COVID-19, with variations in optimism and technology upgrades based on business size. It highlights their preferred channels for researching products and services, emphasizing the significance of search engines and peer recommendations.