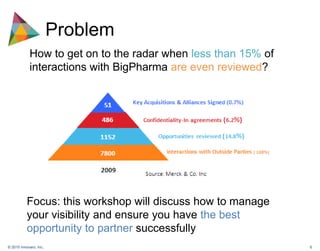

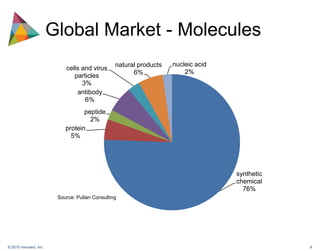

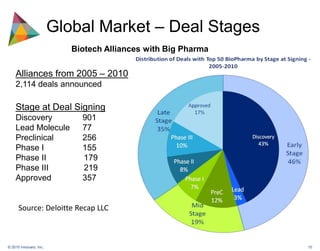

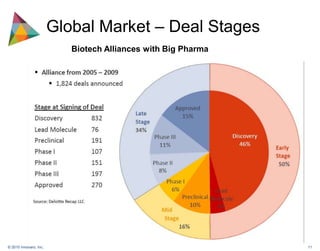

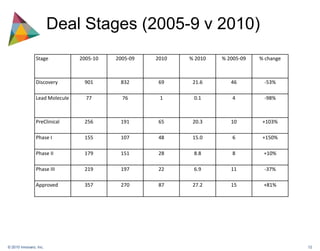

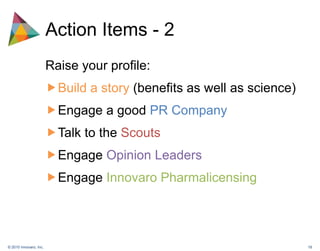

This document provides advice to small and medium pharma-biotech companies on partnering with large pharmaceutical companies ("BigPharma"). It notes that BigPharma are losing revenue as blockbuster drugs go off patent, creating opportunities for partnering. However, only 15% of small company proposals are reviewed. The document recommends understanding BigPharma therapeutic interests and deal stages, positioning IP accordingly. Companies should understand each BigPharma partner's needs and consider different deal structures. Raising their profile through marketing, conferences, and consultants can help small companies get noticed. The overall goal is for small companies to effectively engage BigPharma around innovative assets that meet strategic priorities.