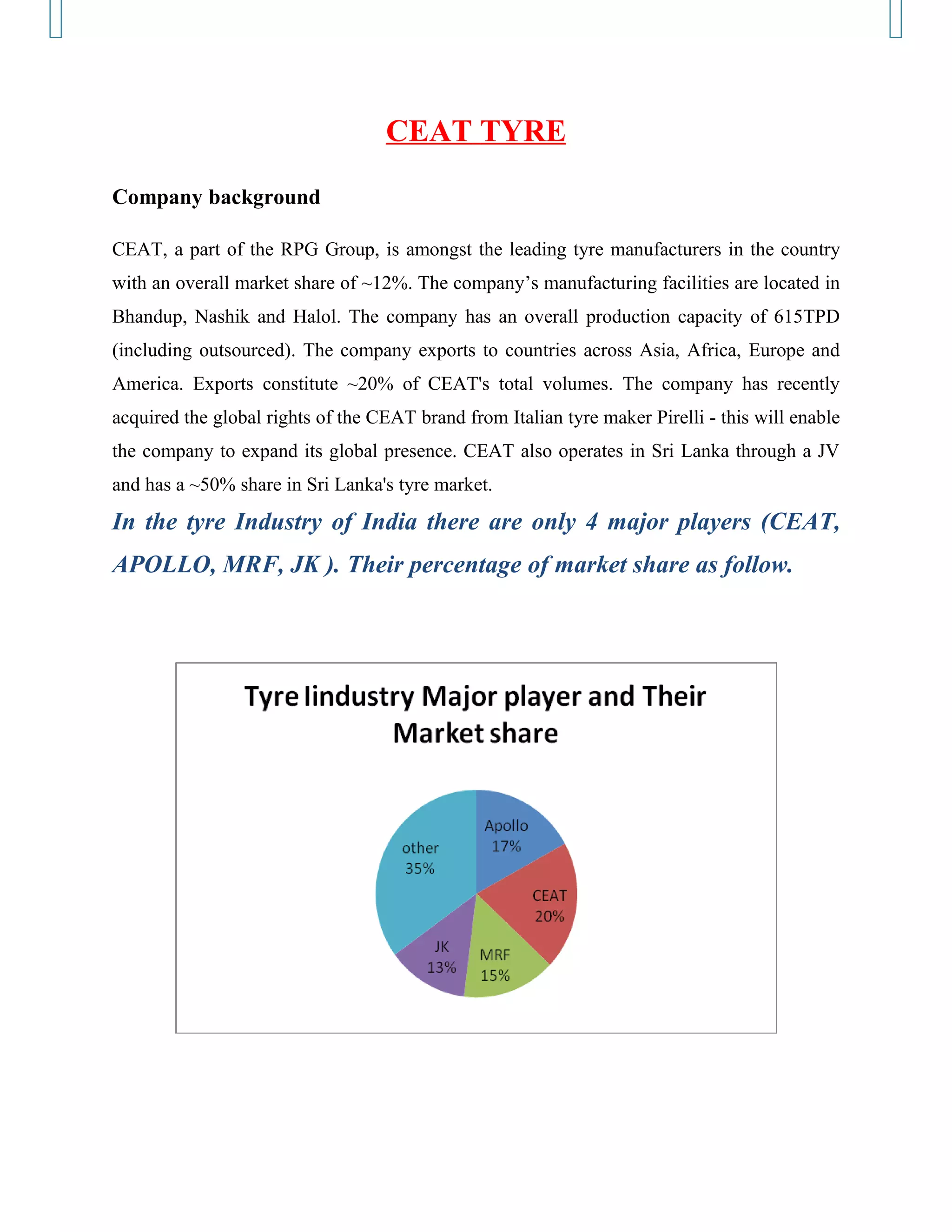

This document provides an analysis of the financial statements of CEAT Tyres over 2011-2012. Some key findings include:

- Net sales increased 28% to Rs. 4,440 crore in FY 2011-12 compared to the previous year. Operating profit margin improved to 5.7% and operating profit increased 74% to Rs. 255.56 crore.

- Interest and depreciation costs increased sharply by 91% and 106% respectively, causing profit before tax to fall 71% to Rs. 9.78 crore.

- Debt levels increased slightly by Rs. 94 crore due to higher inventory and lower demand. The debt to equity ratio remained around 1.3x.

- Gross