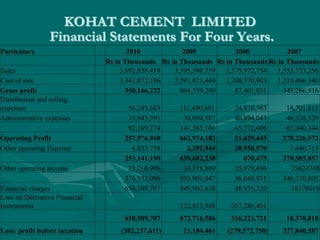

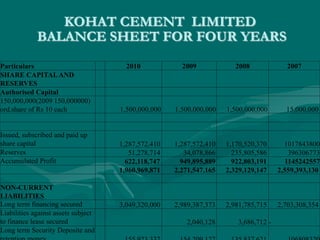

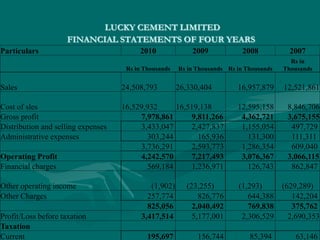

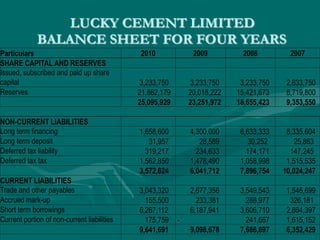

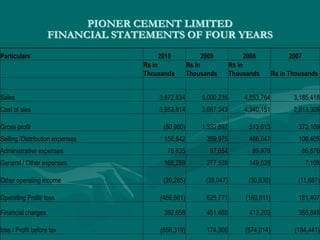

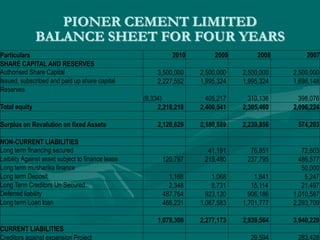

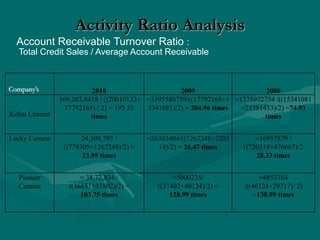

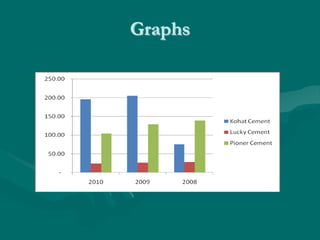

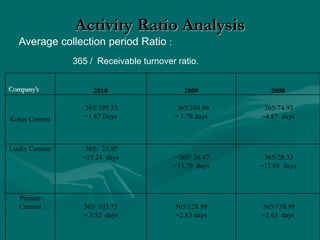

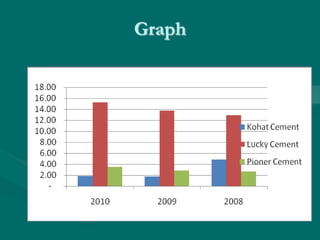

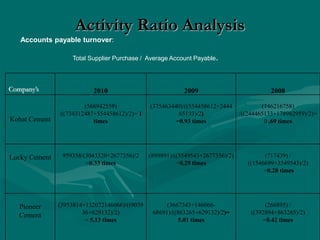

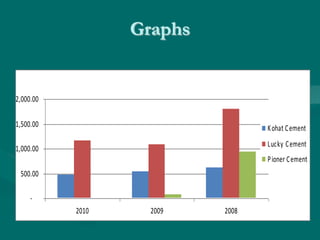

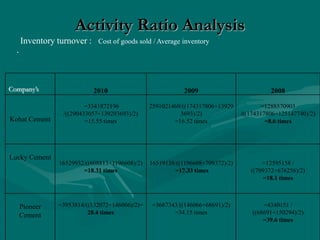

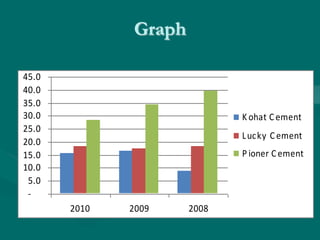

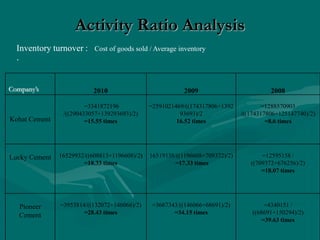

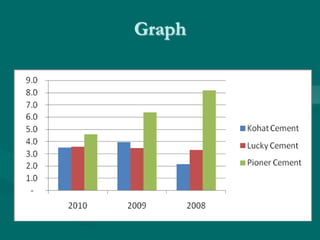

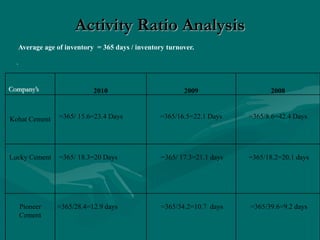

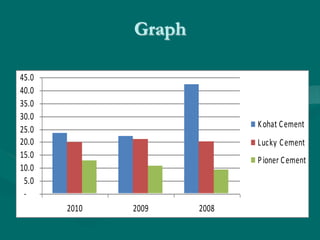

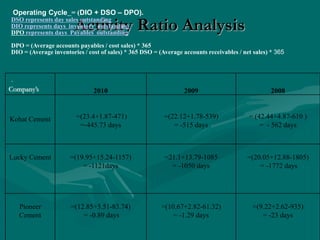

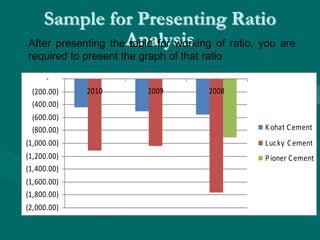

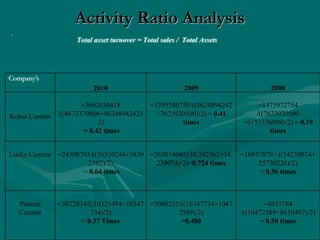

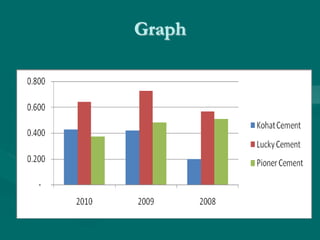

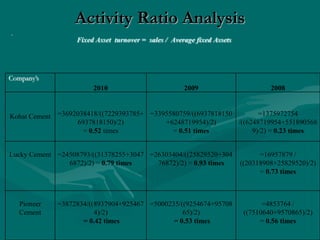

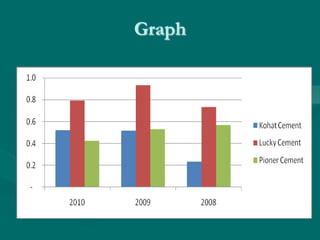

The document analyzes activity ratios for three cement companies - Kohat Cement, Lucky Cement, and Pioneer Cement - for the years 2008-2009 and 2010. It calculates key activity ratios including account receivable turnover, average collection period, account payable turnover, and inventory turnover for each company. Graphs are presented to compare the performance of the companies on these ratios over the given years. The analysis aims to measure and understand how effectively the companies manage their assets.