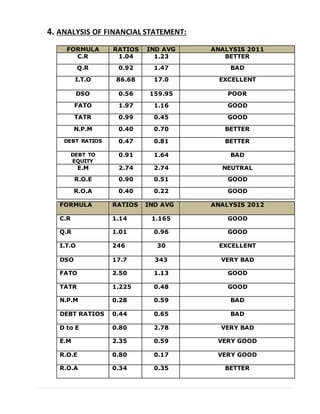

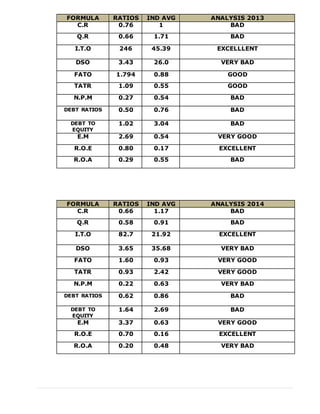

The document is a financial statement analysis report submitted by Umair Khan for Fauji Fertilizer Company Ltd from 2011-2015. It includes ratios to analyze the company's liquidity, asset efficiency, debt, profitability, and investor returns. The analysis found that in 2011 and 2012, the company had excellent inventory turnover but poor days sales outstanding. In subsequent years, current ratios were below industry averages, indicating potential liquidity issues. Overall, the ratios analyzed trends in the company's financial performance and health over the five-year period.