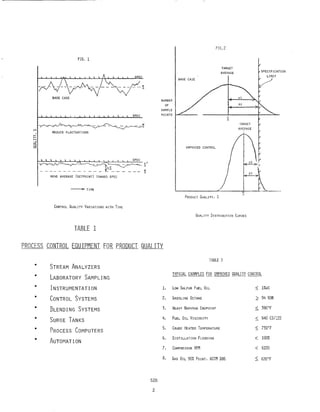

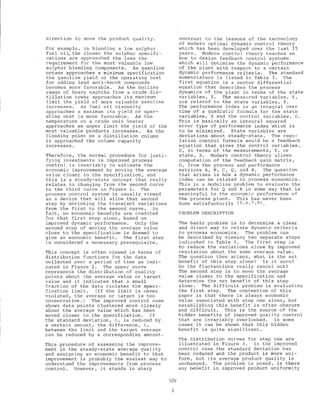

This document discusses the hidden economic benefits of improved process control that come from reducing quality variations, rather than just moving the average quality closer to specifications. It presents the typical approach of justifying process control investments based on improving the steady-state average. However, it argues this overlooks benefits from better dynamic performance. The document lays out the problem of relating dynamic control criteria to economic impacts, in order to properly assess the full financial benefits of reduced variations, not just improved averages.

![PROF IT

¢/LB

FIG, 5

PROF IT DEPENDS ~ QUALI TY

PROFIT = SELLING PRICE - COST

P = SP - C, ¢/LB

P = SP + (0 - ci) (~1-_5~2] - C2, C2> Cl

QUALITY,5

EXAMPLE CALCULAT I ON: AVERAGE SULFUR FROM 0.95 TO 0.98

AP = (C2 - ci) [~J -(C2 - ci ) [~JSl - S2 51 - 52

(C2 cr) [0.98 - 0.95] = (1.33 _ 1) [--.JWl.L....]Sl S2 1.1 - 0.2

AP = 0.0111 ¢iLB = 3. 3¢/B

Cl , COST OF LSoO, ¢/La

C2 c COST OF LGO, ¢ ILa

Sl " L500 SULFUR, ~

S2 c LGO SULFUR,

PROFIT

¢ILB

FIG, 6

SPEC VIOLATION PENALTY

SPO - a(S - SPEc) + (0 - ci) [~1-_S~2] - C2

PENALTY TERM COST TERM

/

/~

/ COST TERM

/

PENAL TY~-),

TERM

QUALITY, S

SPEC

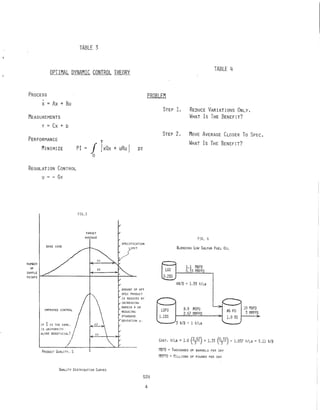

TABLE 5

SUPPOSE THE SPECIFICATION II NOT MET

S > SPEC

PROFIT = SELLING PRICE - COST

P = SP' - C ¢/LB

CASE 1. WORTHLESS: SP = 0, SO P < 0

CASE 2, PENALTY: 2% 5 WORTH 2.41 $/B

1% 5 WORTH 3.11 $/B

70 ¢/B/%S = 0.233 ¢lLa/%s

SP = SPo - 0.233 (5 - SPEC)

P = SP 0 - a (5 - SPEel + (C2

) [L:....S.L] - C2- Cl 51 - 52

CASE 3, LOSE CUSTONERS: Cl INCREASES AT LmlER VOLUflE

Cl = Clo + P (S - SPEel , B> 0

C = (ClO - C2) [~SnJ + C2 + B(S - SPEC) [L-_5~2J

P = Sf> + (0 - Clo) [~l- _ SL] - C2 - ~ (i -S(S2+5PEC)+S2 SPEC)

FIG, 7

PROFIT DEPENDS ON AVERAGE QUALITY

PROFIT

¢ILB

BASE CASE

528

6](https://image.slidesharecdn.com/020c3666-0679-4013-bccc-450dd0acaa38-160621223352/85/HiddenBenefit-ISAOct76-7-320.jpg)