The document provides advice for start-up hedge fund managers on selecting an investment strategy. It discusses the increased complexity managers face due to the wide range of available strategies. Managers are advised to choose a strategy that aligns with their strengths rather than following popular trends. The article profiles several managers and the hybrid strategies they employ, including distressed debt, real estate, and investing in other funds. Funds of funds managers are also discussed in terms of their approach to selecting sub-managers.

![4 THE HEDGE FUND START-UP SURVIVAL GUIDE JANUARY 2008

www.iinews.com

A Publication of Institutional Investor, Inc.

© Copyright 2008. Institutional Investor, Inc. All rights reserved. New York

Publishing offices:

225 Park Avenue South, New York, NY 10003 • 212-224-3800 •

www.iinews.com

Copyright notice. No part of this publication may be copied, photocopied or

duplicated in any form or by any means without Institutional Investor’s prior writ-

ten consent. Copying of this publication is in violation of the Federal Copyright

Law (17 USC 101 et seq.). Violators may be subject to criminal penalties as well

as liability for substantial monetary damages, including statutory damages up

to $100,000 per infringement, costs and attorney’s fees.

The information contained herein is accurate to the best of the publisher’s

knowledge; however, the publisher can accept no responsibility for the accura-

cy or completeness of such information or for loss or damage caused by any

use thereof.

PUBLISHING

BRISTOL VOSS

Publisher

(212) 224-3628

ARCHANA MARWAHA

Marketing Manager

(212) 224-3421

VINCENT YESENOSKY

Senior Operations Manager

(212) 224-3057

DAVID SILVA

Senior Fulfillment Manager

(212) 224-3573

REPRINTS

DEWEY PALMIERI

Reprints & Premission Manager

(212) 224-3675

dpalmieri@iinvestor.net

CORPORATE

GARY MUELLER

Chairman & CEO

CHRISTOPHER BROWN

President

STEVEN KURTZ

Director of Finance & Operations

ROBERT TONCHUK

Director/Central Operations & Fulfillment

Customer Service: PO Box 5016,

Brentwood, TN 37024-5016.

Tel: 1-800-715-9195. Fax: 1-615-377-0525

UK: 44 20 7779 8704

Hong Kong: 852 2842 6910

E-mail: customerservice@iinews.com

Editorial Offices: 225 Park Avenue

South, New York, NY 10003.

Tel: 1-212-224-3279

Email: eblackwell@iinews.com.

EDITORIAL

ERIK KOLB

Editor of Business Publishing

ANDREW BLOOMENTHAL

Contributing Reporter

GREGORY MORRIS

Contributing Reporter

ERIC ROSENBAUM

Contributing Reporter

PRODUCTION

AYDAN SAVASER

Art Director

MARIA JODICE

Advertising Production Manager

(212) 224-3267

ADVERTISING/BUSINESS

PUBLISHING

JONATHAN WRIGHT

Publisher

(212) 224-3566

jwright@iinews.com

ADI HALLER

Associate Publisher

(212) 224-3656

LANCE KISLING

Associate Publisher [Technology]

(212) 224-3026

MARA READ

Marketing Director

(917) 650-6351

LESLIE NG

Advertising Coordinator

Editor’s Note

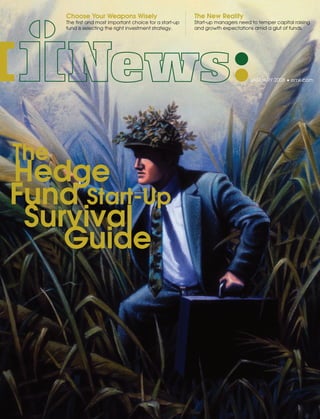

Welcome to the Hedge Fund Start-Up Survival Guide, an indis-

pensable manual to everything first-time managers need to know

about creating, growing and managing a successful hedge fund

in today’s market.

The Start-Up Survival Guide is chockfull of insight and advice from

throughout the hedge fund universe, beginning with the first thing

every manager needs to consider when they are starting a new fund:

strategy. A plethora of investment choices, as well as a number of

available hybrid models, have made the task daunting, but our guide

simplifies the process with a breakdown of the strategies and some

practical advice from industry experts (see story, page 6).

Next, the Start-Up Survival Guide

addresses the second most important

consideration: capital. Not only does the

guide provide advice on how to make a

fund attractive to capital providers, it also

explains how to continue attracting money

post-launch through a focused marketing

strategy (see story, page 12). Beyond that,

the guide also includes articles on legal

and regulatory requirements and techno-

logical and operational considerations, giv-

ing managers a complete compliment of

advice on the issues most relevant to their success.

The Hedge Fund Start-Up Survival Guide is the latest in a series of

special supplements produced by Institutional Investor News exclu-

sively for our newsletter subscribers. It is part of our commitment to

bringing our readers the freshest news and in-depth analysis on

important sectors and timely topics within the financial markets.

All the best in 2008,

Erik Kolb

Editor of Business Publishing

Institutional Investor News

JANUARY 2008 • emii.com

The New Reality

Start-up managers need to temper capital raising

and growth expectations amid a glut of funds.

Choose Your Weapons Wisely

The first and most important choice for a start-up

fund is selecting the right investment strategy.

From the publishers of:

HF SurvivalGuide-laydown 1/3/08 12:54 PM Page 4](https://image.slidesharecdn.com/eb21cdc2-8f15-4e90-8fe5-52f93c5373d8-160325190210/85/HF-Survival-Guide-08-4-320.jpg)