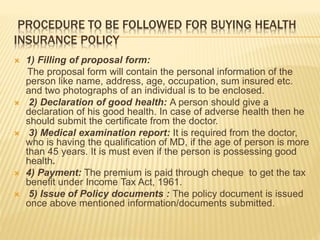

Health insurance covers an individual's medical and surgical expenses. To buy a health insurance policy, one must fill a proposal form with personal details, declare good health or provide a doctor's certificate, undergo a medical exam if over 45, and pay the premium. There are different types of policies like floater policies that cover a family with one sum, and critical illness policies that pay lump sums for listed illnesses. Deductions can be claimed on health insurance premiums paid under section 80D of the Income Tax Act.