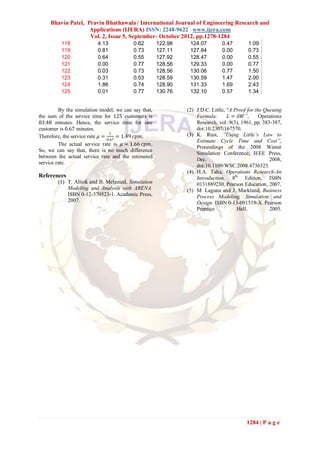

This paper investigates the application of queuing theory to analyze bank ATM usage, focusing on the M/M/1 queuing model to derive key metrics such as arrival and service rates, average waiting times, and customer behavior. It concludes that optimizing ATM service rates can improve customer retention and reduce waiting times, particularly during peak hours on weekdays. The findings can be utilized to enhance the quality of service and operational efficiency at bank ATMs.