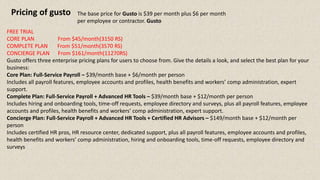

Gusto is a cloud-based payroll, benefits, and HR platform that automates payroll tax calculations and filings for small businesses. It offers an all-in-one platform that handles payroll, benefits administration, time tracking, and HR tasks. Gusto's pricing starts at $39 per month plus $6 per employee. It offers three plans - Core, Complete, and Concierge - that provide different features and services for small businesses.

![.

How it started/ Its origin

Gusto was part of Y Combinator's

Winter 2012 batch.(The program

teaches founders to market their

product, team and market, refining

their business model, achieving

product/market fit)

The service launched officially on

December 11, 2012 in California

On June 2013, gusto announced

support for paying contract workers,

this was taughted by some technology

writers as giving the company an

advantage over competitors such as

ADP and Paychex

In August 2013, Gusto announced that

it had crossed $100 million in

payments processed annually, and was

launching in Florida, Texas,

and Washington state.

In April 2015, Gusto announced support for all 50

states.

In July 2015, Gusto announced that it had expanded its

business and opened a new office in Denver, Colorado]

In September 2015, it was announced that Zen Payroll

had changed its name to Gusto, and was broadening

its focus to integrate health benefits and workers'

compensation into its payroll software.](https://image.slidesharecdn.com/gustopayrollppt-190916144720/85/Presentation-on-gusto-payroll-5-320.jpg)