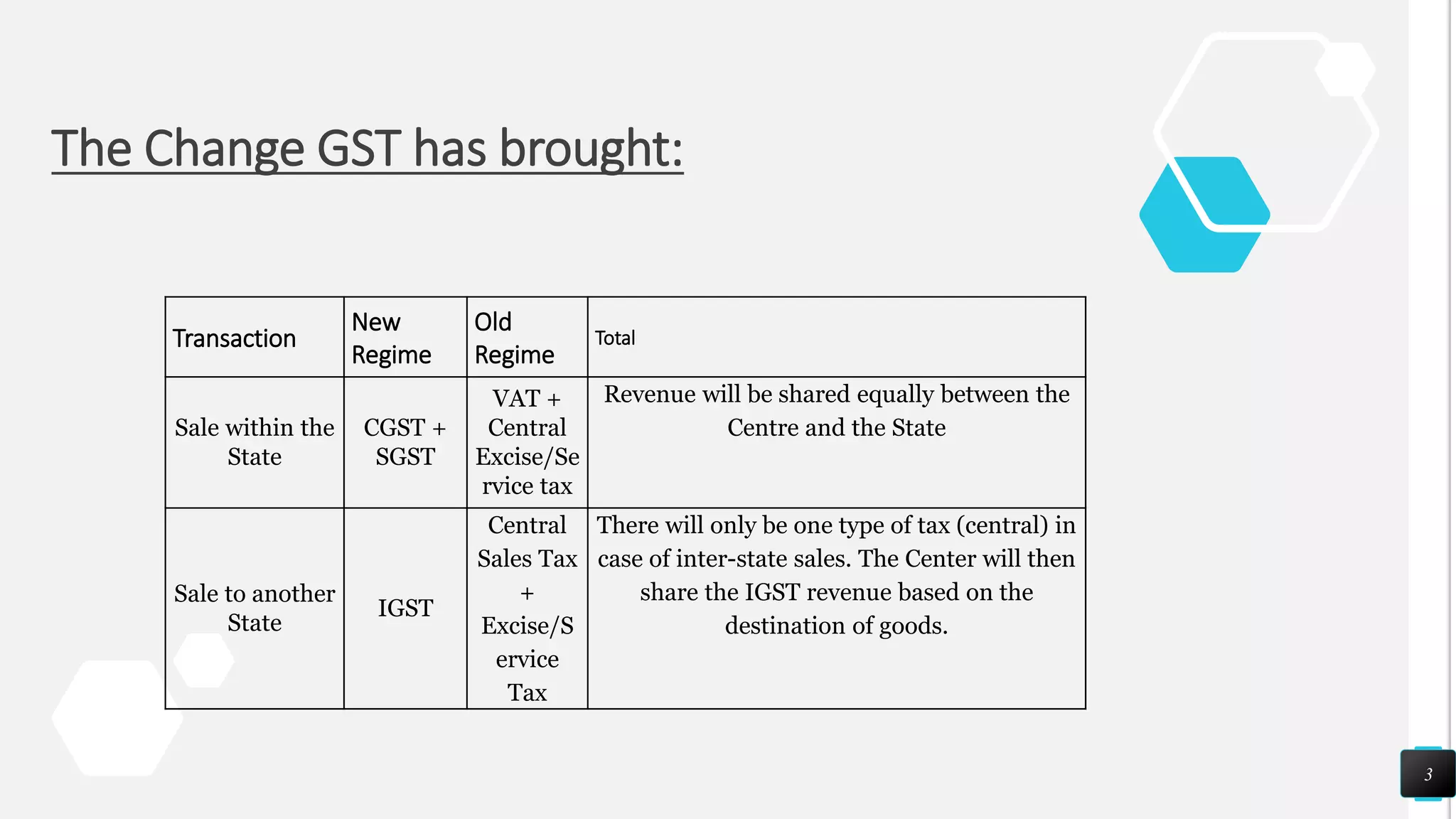

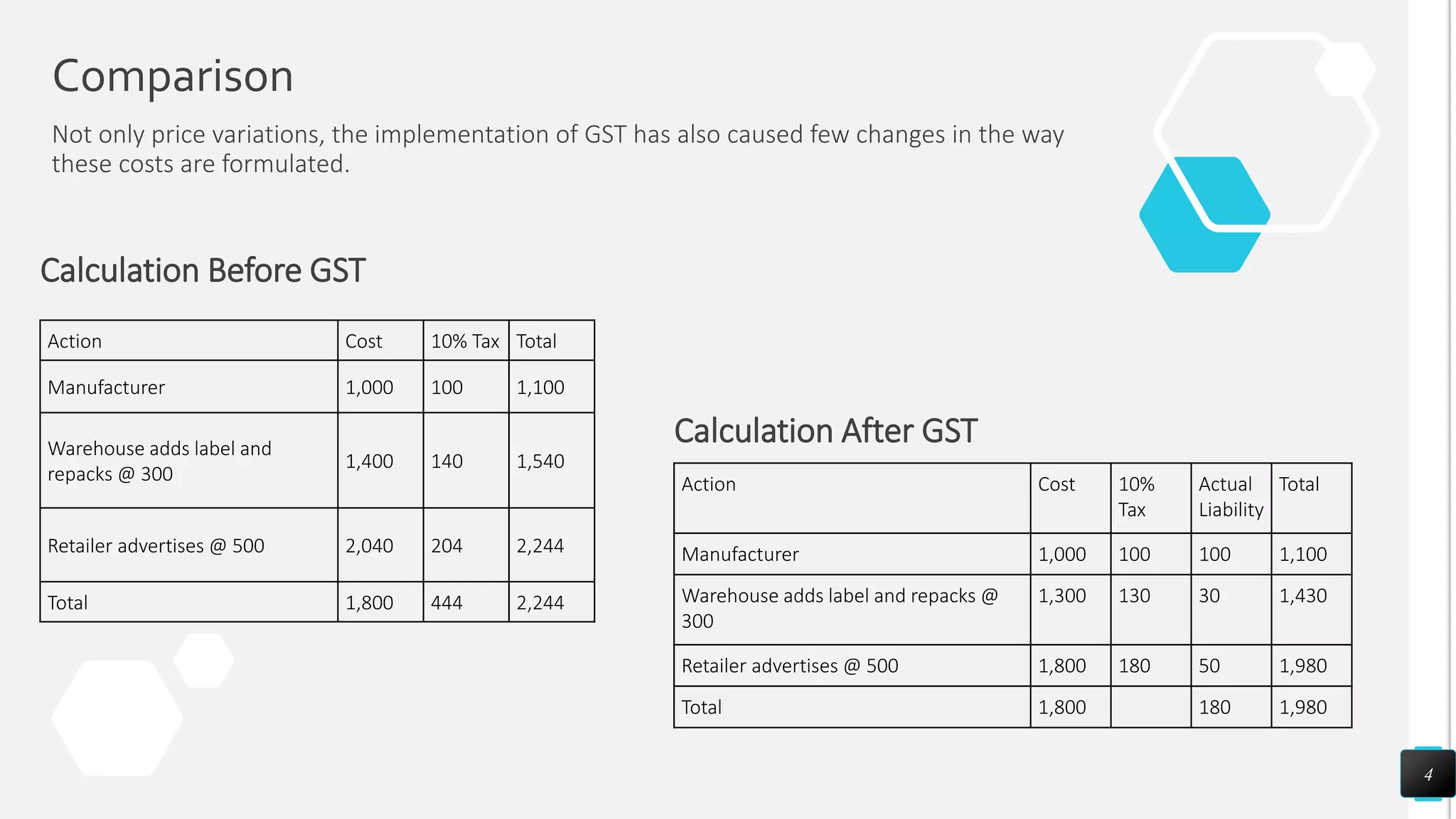

Goods and Services Tax (GST) is an indirect tax in India that has replaced various previous taxes, comprising CGST, SGST, and IGST based on the nature of sales. The implementation of GST has revamped tax calculations and revenue sharing between the central and state governments, with rates varying significantly for basic and luxury goods. The document also outlines specific GST rates and HSN codes for cotton and synthetic products, along with the advantages of GST such as reduced compliance and improved efficiency in logistics.