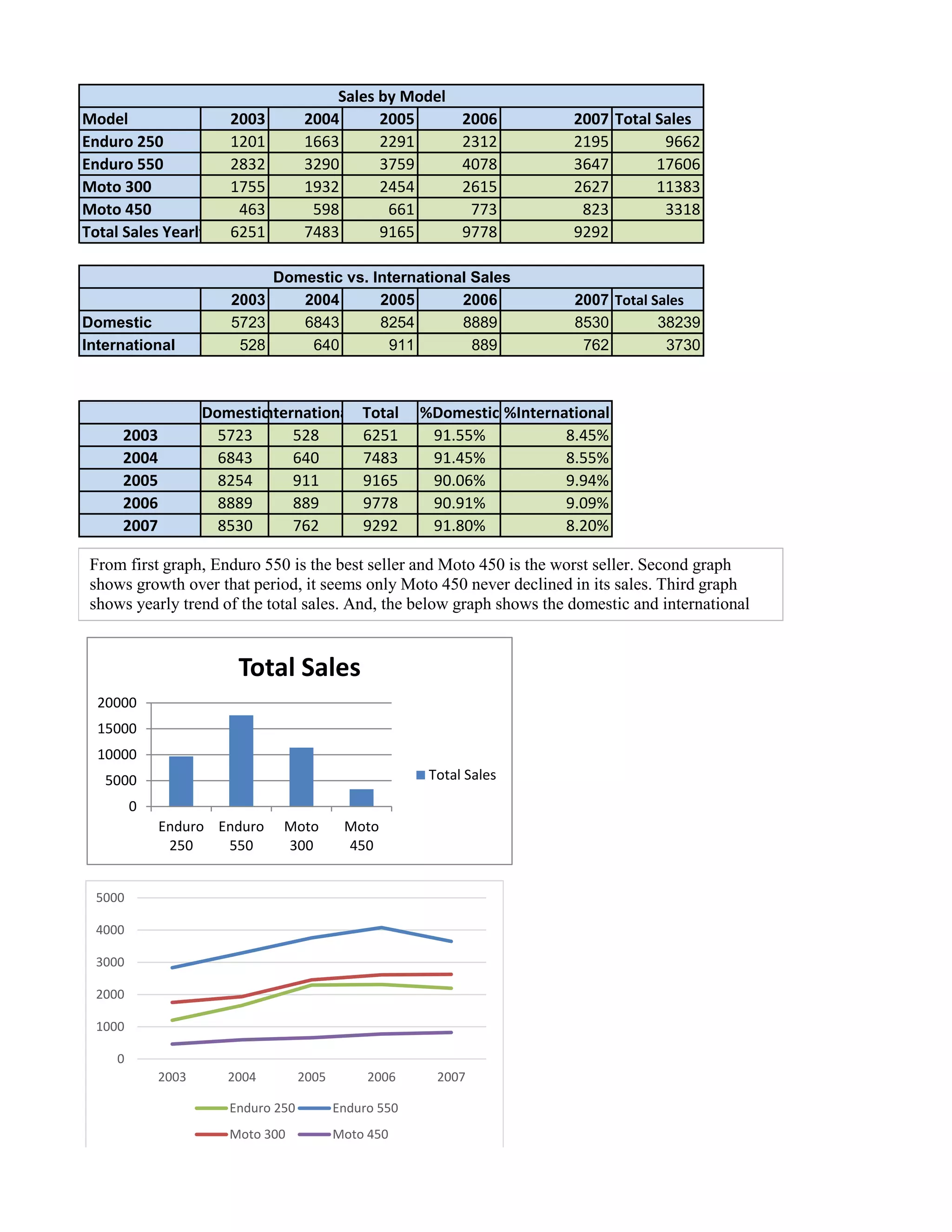

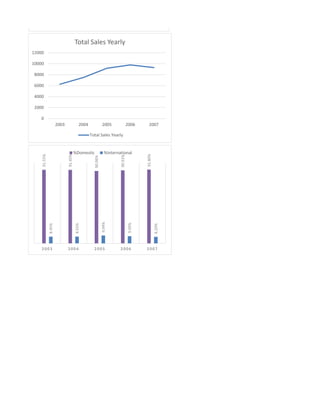

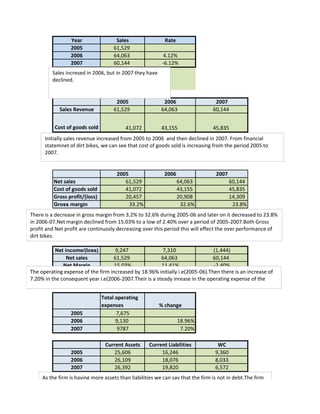

The document provides sales data for different dirt bike models from 2003 to 2007, highlighting that the enduro 550 is the best seller while the moto 450 is the worst. Despite an increase in total sales and revenue from 2005 to 2006, there was a decline in 2007, with gross and net profit margins decreasing significantly. The operating expenses have also increased, but the firm maintains more assets than liabilities, indicating a stable financial position.