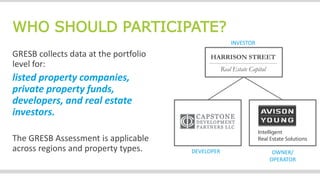

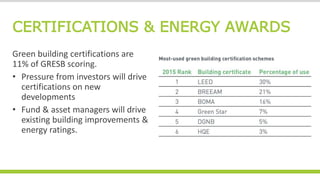

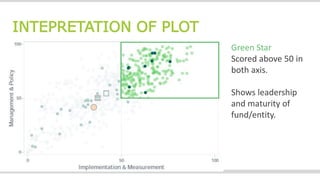

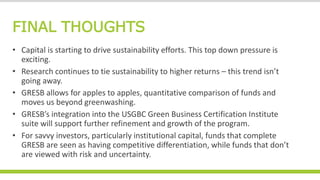

The document discusses the Global Real Estate Sustainability Benchmark (GRESB), which assesses the environmental, social, and governance (ESG) performance of real estate assets. It highlights the correlation between strong sustainability practices and improved financial performance, risk-adjusted returns, and market competitiveness for real estate funds. Additionally, it emphasizes the growing demand for standardized sustainability data from investors and GRESB's role in facilitating transparent comparisons among real estate portfolios.