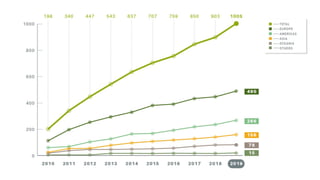

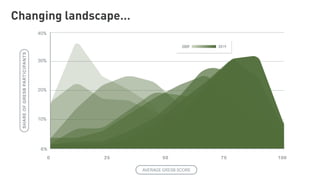

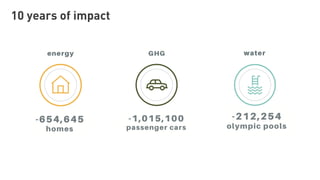

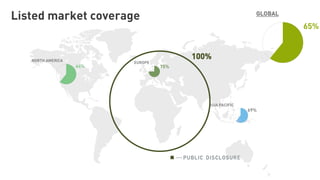

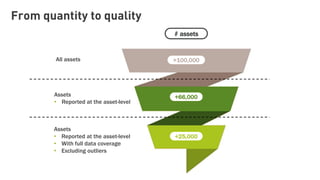

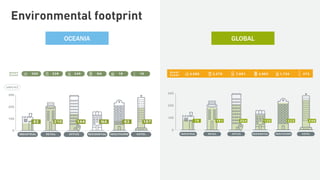

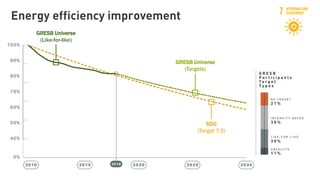

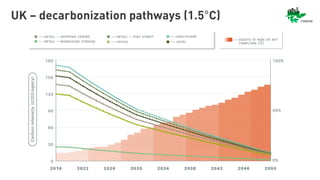

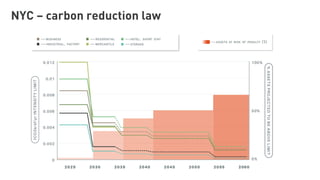

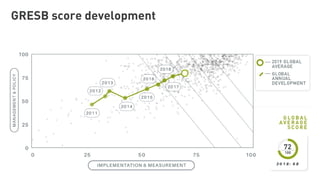

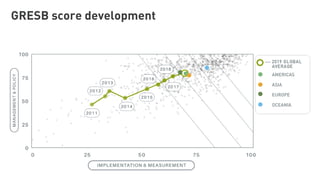

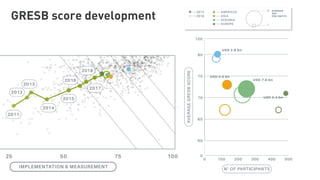

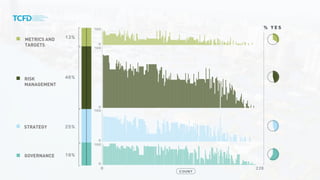

This document discusses the results of the 2019 GRESB survey, which assessed the environmental, social and governance performance of over 1,000 real asset investments worth over $100 billion. Some key findings included that listed market coverage was 65-75% globally and private market coverage was 100%, and that 38,274 assets reported data at the asset level. It also discussed trends in areas like energy efficiency, building certifications, and GRESB scores. Going forward, it highlighted that climate change will be a top priority and transparency will be a key driver of transformation, with a need for more metrics, targets, risk management and impact measurement.