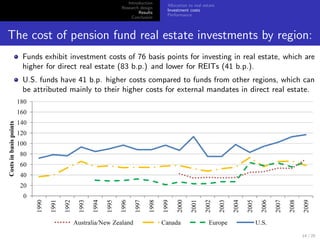

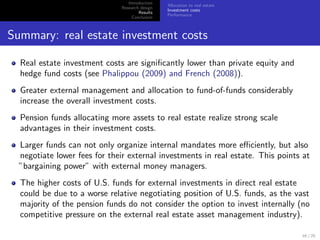

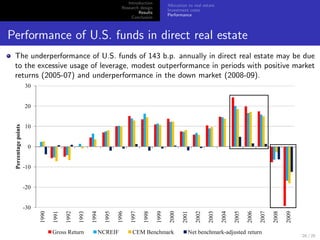

The document examines pension fund investments in real estate, highlighting the significant growth in real estate allocations and the volatility of performance over time. Key findings include that larger pension funds tend to invest more internally, while smaller funds often outsource investments to external managers, and that real estate investment costs vary significantly by region and investment approach. The study utilizes a comprehensive database to analyze the impact of fund size, investment strategies, and market dynamics on real estate performance and costs.

![Introduction

Allocation to real estate

Research design

Investment costs

Results

Performance

Conclusion

How pension funds invest in real estate - approach

Larger funds are more likely to invest internally; smaller funds are more likely to invest

externally and via fund-of-funds;

Funds with greater allocation to other alternative assets are more likely to invest

externally in real estate.

Logit regressions: choosing an investment approach

Internal Internal External External FoF FoF

Fund size 0.075*** 0.100*** -0.015 -0.026** -0.005* -0.005**

[0.013] [0.016] [0.010] [0.010] [0.003] [0.002]

Alternatives -1.200*** -0.397 1.064*** 0.507** 0.033 0.015

[0.309] [0.279] [0.280] [0.215] [0.024] [0.015]

%REITs 0.138** 0.192*** -0.104** -0.123*** -0.016 -0.016*

[0.055] [0.050] [0.046] [0.033] [0.016] [0.010]

Canada 0.467*** -0.284*** -0.018**

[0.062] [0.050] [0.008]

Europe 0.409*** -0.232*** 0.021

[0.101] [0.087] [0.017]

Aus/Nzd 0.180 0.018 0.027

[0.137] [0.071] [0.028]

Plan type No Yes No Yes No Yes

Year dummies Yes Yes Yes Yes Yes Yes

Observations 3928 3928 3928 3928 3928 3928

Fund clusters 668 668 668 668 668 668

Pseudo R2 0.093 0.253 0.042 0.160 0.109 0.215

12 / 25](https://image.slidesharecdn.com/aekslidesnk052712-120527112559-phpapp02/85/The-Performance-of-Pension-Funds-Investments-in-Real-Estate-12-320.jpg)

![Introduction

Allocation to real estate

Research design

Investment costs

Results

Performance

Conclusion

Regression results: real estate investment costs

yi,t = βMandatei,t + γInvApproachi,t + δYearDumt + ci + ui,t , t = 1, 2, ..., 20 (2)

Cons. Mandate %Ext %Act %FoF %LP FE R2

Panel A: Costs regressions for all funds and by region

All funds 185.96*** -32.25** 21.36** 122.03*** Yes 0.25

[65.96] [14.24] [9.31] [41.95]

U.S. 222.76** -41.51** 30.87 151.48*** Yes 0.20

[97.62] [20.91] [21.15] [52.75]

Canada 71.57*** -10.71*** 23.43** -28.31 Yes 0.43

[16.73] [3.93] [11.09] [26.81]

Europe 154.03 -20.04 15.85** 72.79** Yes 0.76

[133.85] [22.10] [6.76] [35.82]

Aus/Nzd -10.65 1.79 23.75 131.28*** Yes 0.83

[27.83] [4.59] [16.53] [35.60]

Panel B: Costs regressions by real estate subcategory

REITs 185.22 -32.99 33.27** 10.88 Yes 0.47

[151.45] [27.44] [16.07] [17.58]

Direct 164.89*** -25.82* 17.76** 135.81*** 111.42* Yes 0.61

[62.37] [13.33] [8.82] [44.68] [62.76]

Panel C: Costs regressions by investment approach

Internal 58.34*** -6.84** Yes 0.65

[16.43] [3.06]

External 218.12*** -34.92** Yes 0.21

[63.15] [15.68]

15 / 25](https://image.slidesharecdn.com/aekslidesnk052712-120527112559-phpapp02/85/The-Performance-of-Pension-Funds-Investments-in-Real-Estate-15-320.jpg)

![Introduction

Allocation to real estate

Research design

Investment costs

Results

Performance

Conclusion

Benchmark-adjusted returns

Self-declared benchmarks (usually market indexes); random coefficient model;

All Assets REITs Direct RE Internal External FoF

Panel A: Gross benchmark-adjusted returns (percent)

All funds -0.10 1.13** -0.18 1.08** -0.20 -1.71

[0.26] [0.52] [0.30] [0.49] [0.31] [3.21]

U.S. -0.38 1.06 -0.47 0.47 -0.38 -2.08**

[0.34] [0.67] [0.40] [0.90] [0.38] [0.91]

Canada 0.40 1.92 0.31 1.20* 0.28 -

[0.50] [1.48] [0.50] [0.72] [0.61] -

Europe 0.42 1.56 0.40 1.75** -0.25 -

[0.75] [1.23] [1.10] [0.89] [1.43] -

Aus/Nzd 0.02 -0.06 -0.04 - 0.14 -

[1.45] [0.35] [1.58] - [1.64] -

18 / 25](https://image.slidesharecdn.com/aekslidesnk052712-120527112559-phpapp02/85/The-Performance-of-Pension-Funds-Investments-in-Real-Estate-18-320.jpg)

![Introduction

Allocation to real estate

Research design

Investment costs

Results

Performance

Conclusion

Benchmark-adjusted returns

Self-declared benchmarks (usually market indexes); random coefficient model;

All Assets REITs Direct RE Internal External FoF

Panel A: Gross benchmark-adjusted returns (percent)

All funds -0.10 1.13** -0.18 1.08** -0.20 -1.71

[0.26] [0.52] [0.30] [0.49] [0.31] [3.21]

U.S. -0.38 1.06 -0.47 0.47 -0.38 -2.08**

[0.34] [0.67] [0.40] [0.90] [0.38] [0.91]

Canada 0.40 1.92 0.31 1.20* 0.28 -

[0.50] [1.48] [0.50] [0.72] [0.61] -

Europe 0.42 1.56 0.40 1.75** -0.25 -

[0.75] [1.23] [1.10] [0.89] [1.43] -

Aus/Nzd 0.02 -0.06 -0.04 - 0.14 -

[1.45] [0.35] [1.58] - [1.64] -

Panel B: Net benchmark-adjusted returns (percent)

All funds -0.86*** 0.70 -0.98*** 0.81* -1.05*** -3.90

[0.27] [0.52] [0.30] [0.49] [0.32] [3.39]

U.S. -1.27*** 0.56 -1.43*** 0.21 -1.29*** -3.76***

[0.35] [0.66] [0.41] [0.90] [0.39] [0.92]

Canada -0.17 1.59 -0.28 0.89 -0.45 -

[0.51] [1.52] [0.51] [0.72] [0.62] -

Europe 0.00 1.33 -0.10 1.55* -0.98 -

[0.78] [1.23] [1.12] [0.90] [1.45] -

Aus/Nzd -0.41 -0.31 -0.59 - -0.30 -

[1.47] [0.33] [1.61] - [1.66] -

19 / 25](https://image.slidesharecdn.com/aekslidesnk052712-120527112559-phpapp02/85/The-Performance-of-Pension-Funds-Investments-in-Real-Estate-19-320.jpg)

![Introduction

Allocation to real estate

Research design

Investment costs

Results

Performance

Conclusion

Performance and fund characteristics

We use Fama and MacBeth regressions on the net benchmark-adjusted returns and

correct for autocorrelation and heteroskedasticity using Newey-West with three lags.

Cons. Mandate Costs %Ext %Act %FoF %LP

Panel A: Performance and characteristics for all funds and by region

All funds -0.28 0.32** -1.03*** -1.02** -2.02***

[0.97] [0.15] [0.36] [0.48] [0.69]

U.S. -2.27* 0.40** -0.66 -0.10 -0.38

[1.30] [0.20] [1.01] [0.50] [0.99]

Canada -0.70 0.59*** -1.74*** -0.40 3.17

[1.42] [0.20] [0.66] [0.32] [3.08]

Europe -4.49* 1.05** -6.16 -0.45 0.66

[2.34] [0.41] [5.20] [1.07] [0.87]

Panel B: Performance and characteristics by real estate subcategory

REITs -6.38* 0.70** 0.13 2.42 1.61

[3.21] [0.32] [1.22] [1.47] [1.57]

Direct RE -0.02 0.31*** -1.11*** -1.22** -2.63*** 1.00

[1.05] [0.12] [0.34] [0.56] [0.78] [1.50]

Panel C: Performance and characteristics by investment approach

Internal -0.71 0.43 -2.56

[2.09] [0.28] [2.96]

External -1.07 0.30** -1.13***

[0.70] [0.14] [0.41]

21 / 25](https://image.slidesharecdn.com/aekslidesnk052712-120527112559-phpapp02/85/The-Performance-of-Pension-Funds-Investments-in-Real-Estate-21-320.jpg)