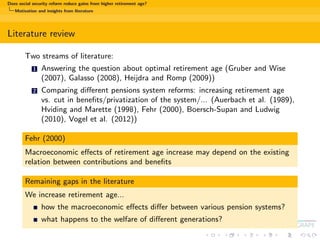

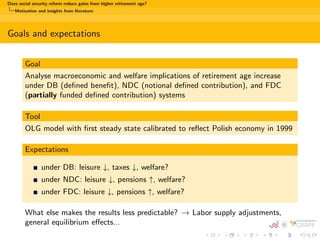

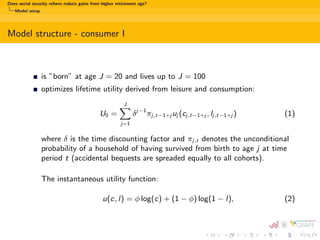

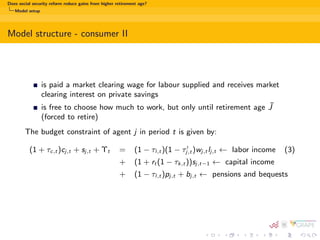

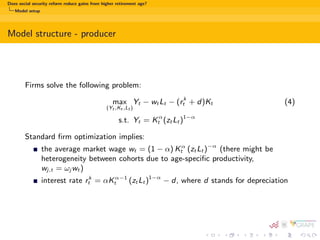

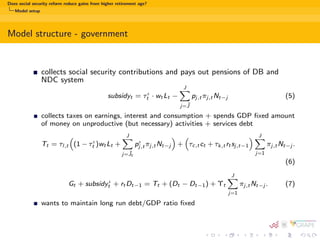

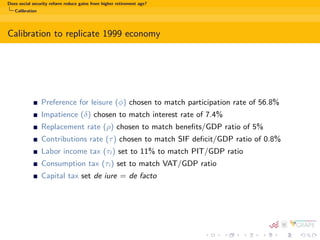

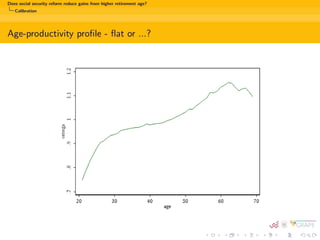

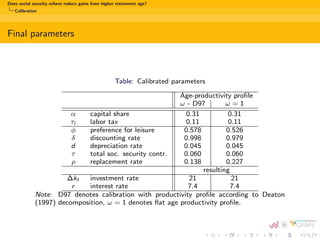

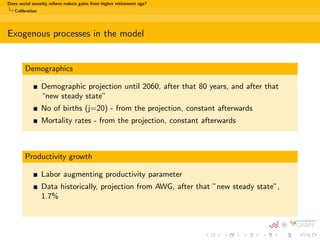

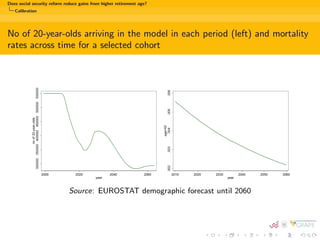

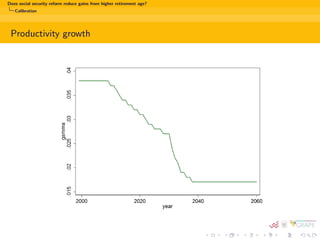

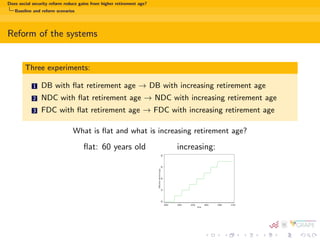

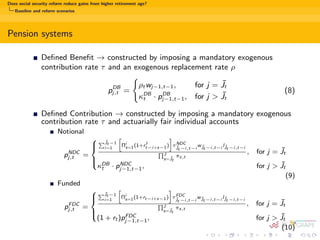

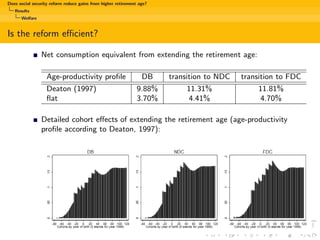

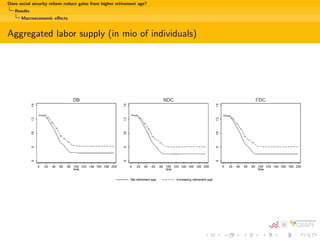

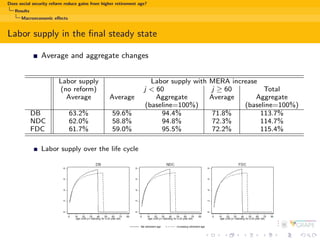

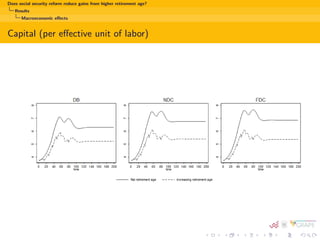

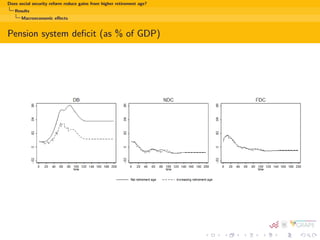

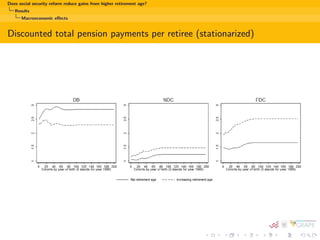

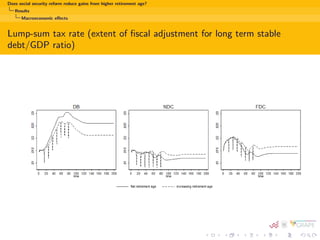

The document analyzes the macroeconomic and welfare implications of increasing retirement age within different pension systems in Poland, specifically comparing defined benefit (DB), notional defined contribution (NDC), and fully funded defined contribution (FDC) schemes. It uses an OLG model to simulate the effects of pension system reforms on labor supply, consumption, and welfare, concluding that extending the retirement age generally improves welfare, particularly when productivity increases with age. The results highlight the importance of structural adjustments in labor supply and overall economic implications of pension reforms.