The document is a detailed analysis of a capstone project focused on Google's strategic move into the mobile industry with the development of the Android platform. It includes an external and internal analysis of the mobile advertising and operating system industries, competitor analysis, recommendations for strategy implementation, and highlights Google's partnerships and ambitions to enhance mobile internet access while monetizing it through advertisements. Key suggestions include collaborating with handset manufacturers and focusing on local search and mobile TV to accelerate Android's market penetration.

![“How are we expecting [advertisers] to take [the mobile phone] as an advertising device seriously if we

keep telling them about the unbelievable complexity that arises out of the fact that we have 20 carriers

in the US, 2 basic technologies – GSM and CDMA, and 2 downloadable standards – BREW and J2ME with

different versions on different handsets, and then we have mobile TV and VCast but only on some

handsets for $50/month. Why don’t you add a few more complexities and then talk to the advertisers

and say – Why don’t you spend a few thousand dollars on mobile advertising to try out, it’s really fun!

That’s why iPhone version 1.0 has such a high penetration! It’s simple!”

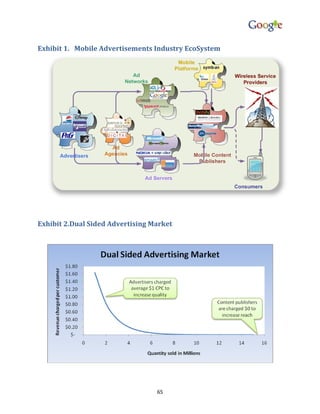

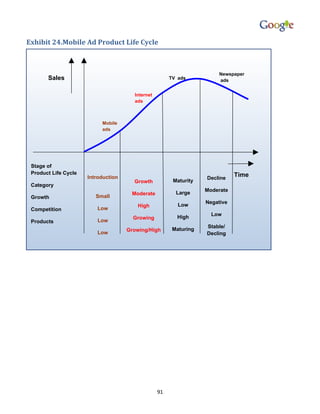

Ad platforms, advertisers, content providers and wireless service providers have to think

creatively and collaboratively to provide a very different way to distribute ads to mobile

phones. Standard banner ads don’t work on the smaller screen size of the mobile

phones. Dropping a successful business model that has worked so well on the internet

has been hard for the players. Innovation is required to make mobile ads successful.

Without that, the consumers will get annoyed and turned off with this model quickly.

Opportunities

No clear market leader established yet

There are smaller players in the industry where a lot of consolidation has been

happening. But nobody has been able to establish a clear market leadership position

yet. Admob serves about 2 Billion ad impressions per month. This is still very small

compared to the internet space. This provides a very lucrative opportunity for the

incumbents in internet ad networks and wireless service providers as they can tap into

their existing networks and fuel the market. Incumbents can also establish their

presence by acquiring market leaders in the space. This will help them learn the new

industry as well.

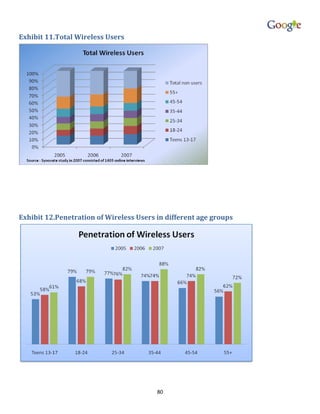

Data penetration projected to increase

There are several drivers behind this projection. The decelerating voice ARPUs has

motivated to push wireless data as the next growth area. The handsets available today

are more feature rich and are able to offer a great multimedia experience33. To go with

this, 4G networks will soon bring broadband capabilities to the phones making them

very powerful and useful devices. With FCC mandating the winner of the C block of 700

Mhz spectrum auction to open up its network, wireless service providers will have to

look at newer ways to monetize their networks.

31](https://image.slidesharecdn.com/googleteamandroidfinal-110115201206-phpapp01/85/Google-team-android_final-41-320.jpg)

![conveys the confidence Google has in its own products, but also enables a more

reliable and user friendly product.

Organizational Structure and Controls

Andy Grove, founder of Intel Corp. observed, “From the outside it looks like Google’s

organizational structure is best described by . . . Brownian motion… in an expanding

bottle. Does [Eric Schmidt] think it will work forever?” In his video response, Eric

Schmidt confirms that the description is accurate, but only for its creative workforce.

Google runs its finance, legal, investment, M&A and sales in a traditional way although

its creative side, engineering and R&D, can be described as Brownian motion. As seen

in their organizational chart in Exhibit 18, at the management level, the creative

workforce falls under the President (Products) and President (Technology). As

mentioned earlier, their Engineering and R&D departments do not follow a hierarchical

structure. Managers are more like tech leads who program at least half time. The

company follows agile programming throughout the company, which enables

programmers to move from one department to the other very easily. In most software

companies, corporate structure limits the movement of employees between projects,

resulting in employees being overworked and burnt out, thus reducing productivity,

innovation and morale. Google eliminates this by encouraging employees to move

between projects at any time without any questions asked. This prompts us to ask how

this system makes sure programmers don’t leave trouble projects behind with buggy

code, in short, what controls are used in monitoring appraising employee behavior. This

is where employee rewards / incentives come in. Reward levels are tied to the

importance of a project, so employees working on more important projects are rewarded

better. The environment can be best described as a bunch of start-ups within a

company. Since employees work on any idea that comes to their mind, they are

rewarded when their products turns out to be tremendously impactful.

So what are the rewards? - Financial rewards can be anything from gift certificates and

massage coupons to huge bonuses and stock option grants. Non financial rewards

include recognizing employees responsible for important product launches in quarterly

all-hands meeting by putting up their pictures and receiving applauds from everyone

35](https://image.slidesharecdn.com/googleteamandroidfinal-110115201206-phpapp01/85/Google-team-android_final-45-320.jpg)