This document provides an overview of alternative investment opportunities for pension schemes and insurance companies in 2010 as the financial markets continue to recover from the credit crisis. It identifies several asset classes that offer illiquidity premiums, such as infrastructure investments, social housing, and insurance linked securities. The document also notes that a lack of funding from traditional sources like banks has led to opportunities in secured leases, ground rents, and equity release mortgages. Constraints on governance budgets are discussed as impacting the ability to invest in some of these alternative assets.

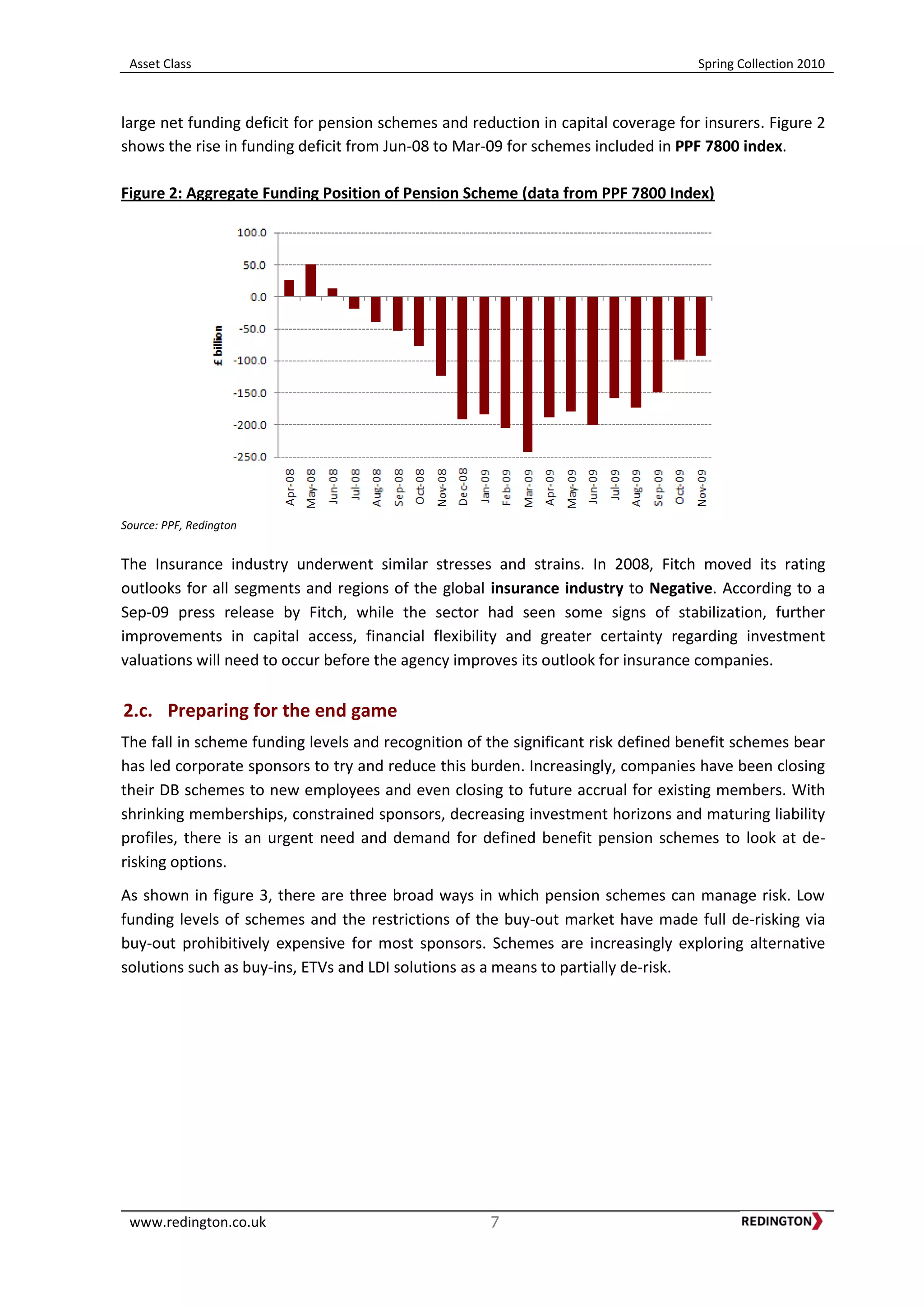

![Asset Class Spring Collection 2010

www.redington.co.uk 19

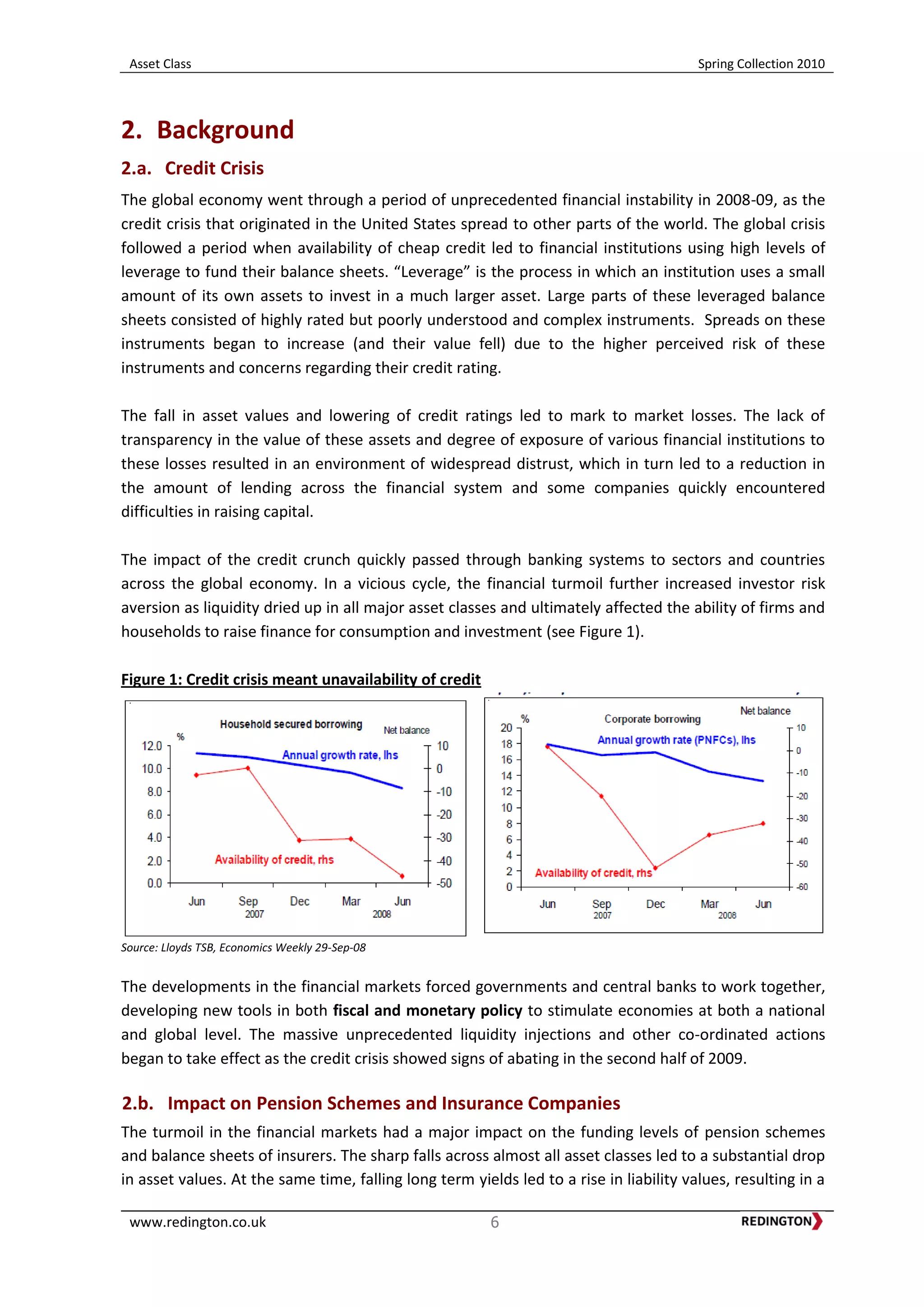

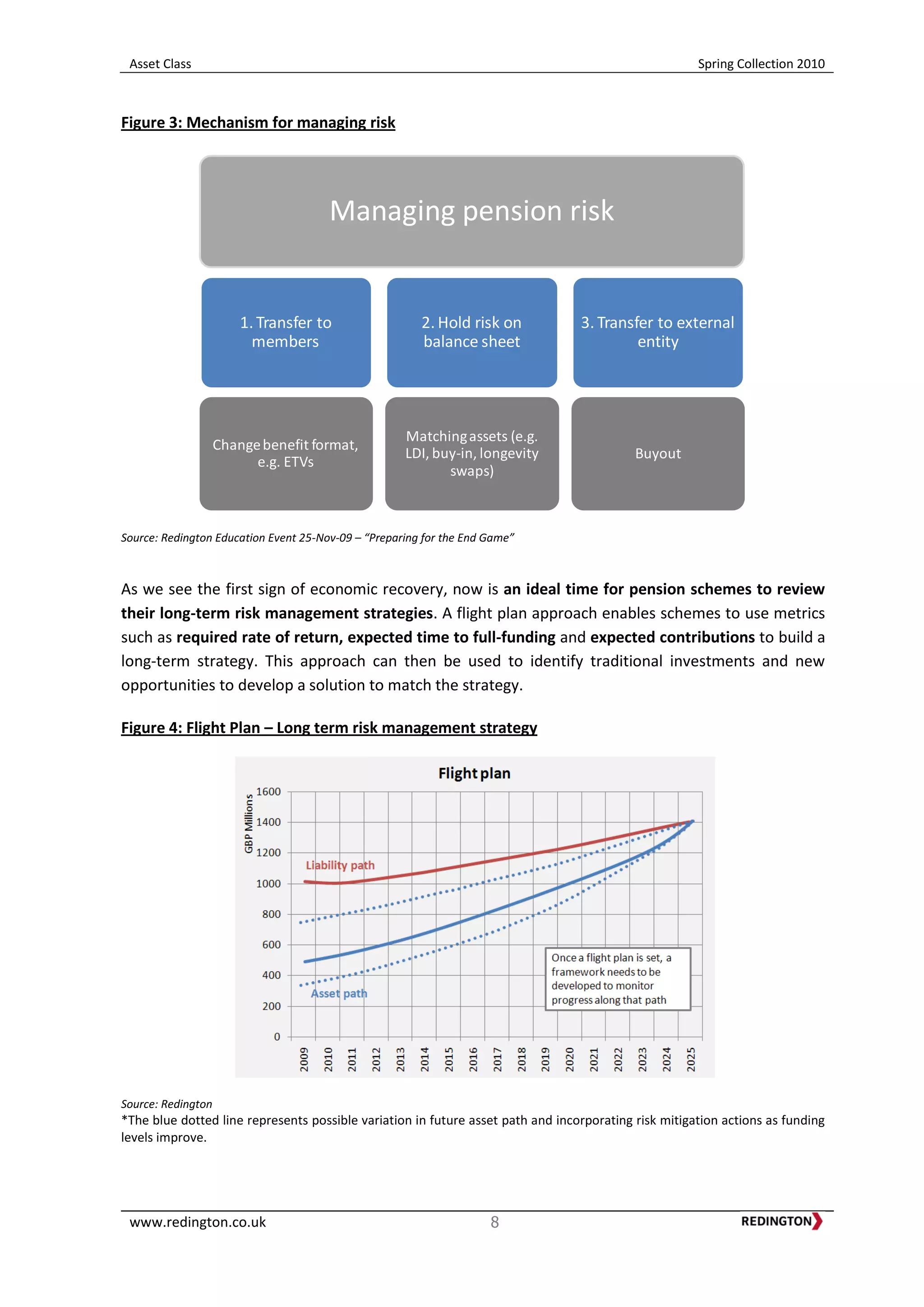

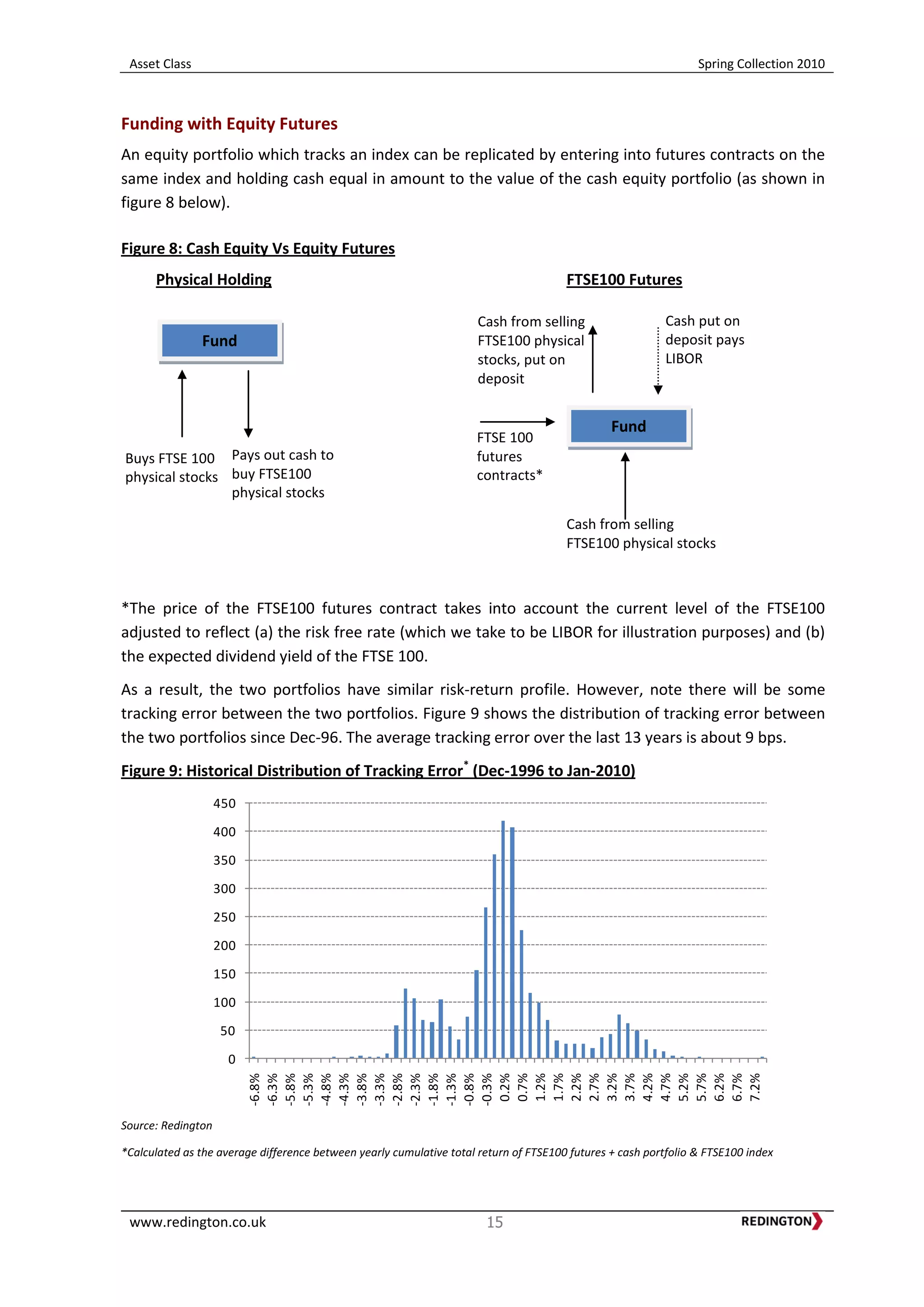

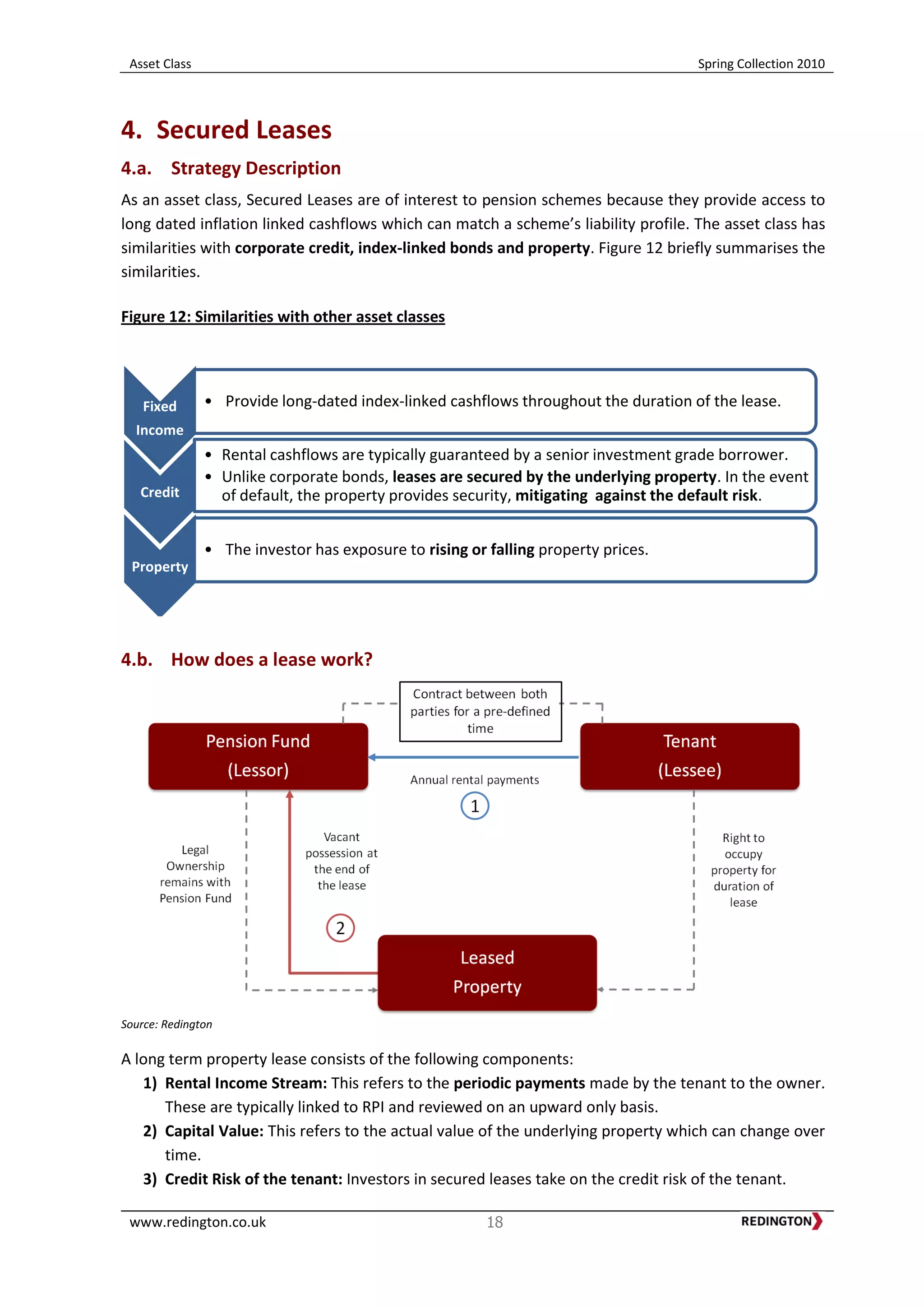

4.c. Key benefits of investing in Secured Leases

LDI Hedging

Secured leases typically provide long dated cashflows indexed to RPI or LPI (LPI is capped and

floored RPI) which extend to over 20 years.

The long-dated nature of the leases provides some nominal and inflation duration which helps

offset the duration mismatch that exists between the assets and liabilities.

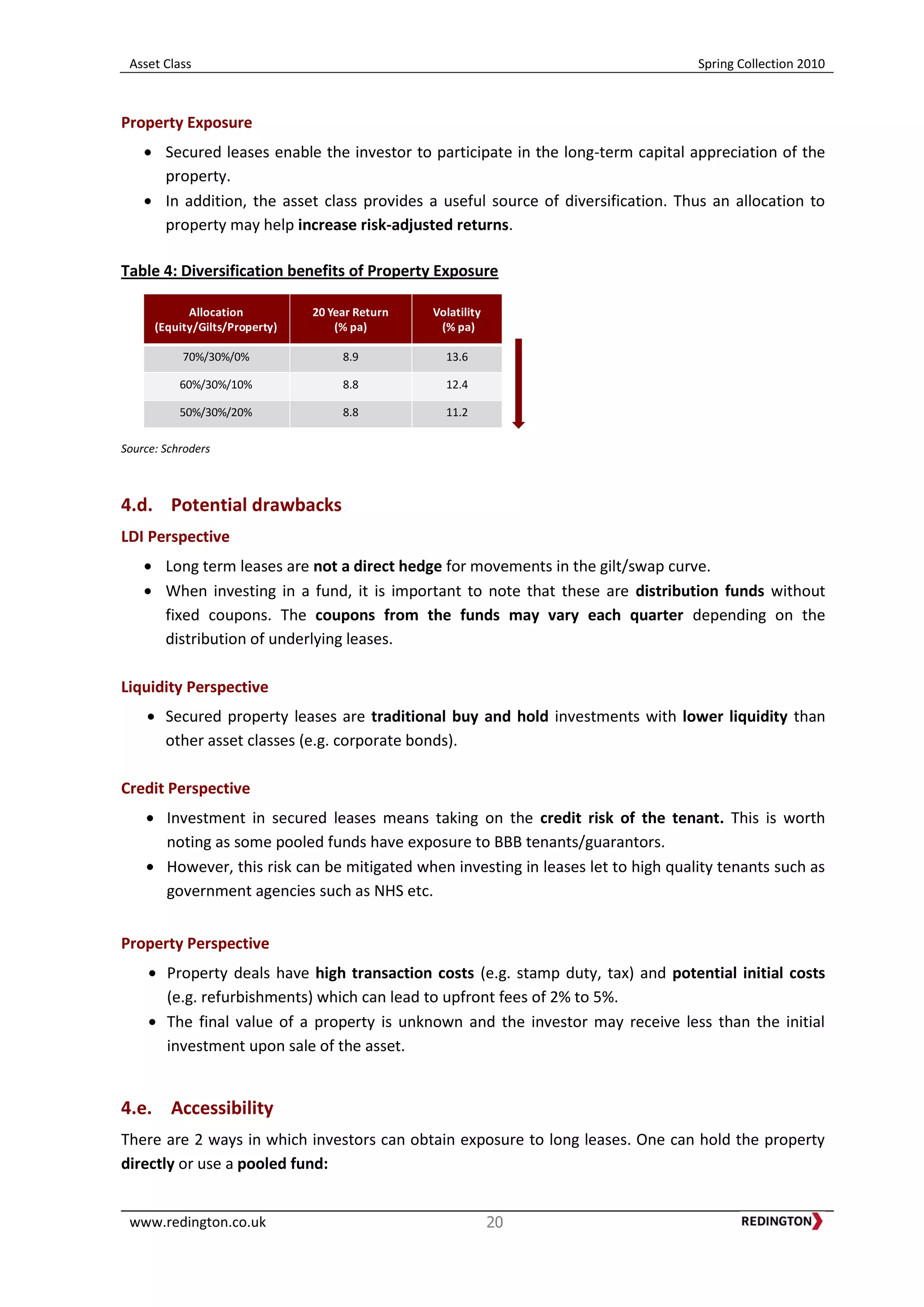

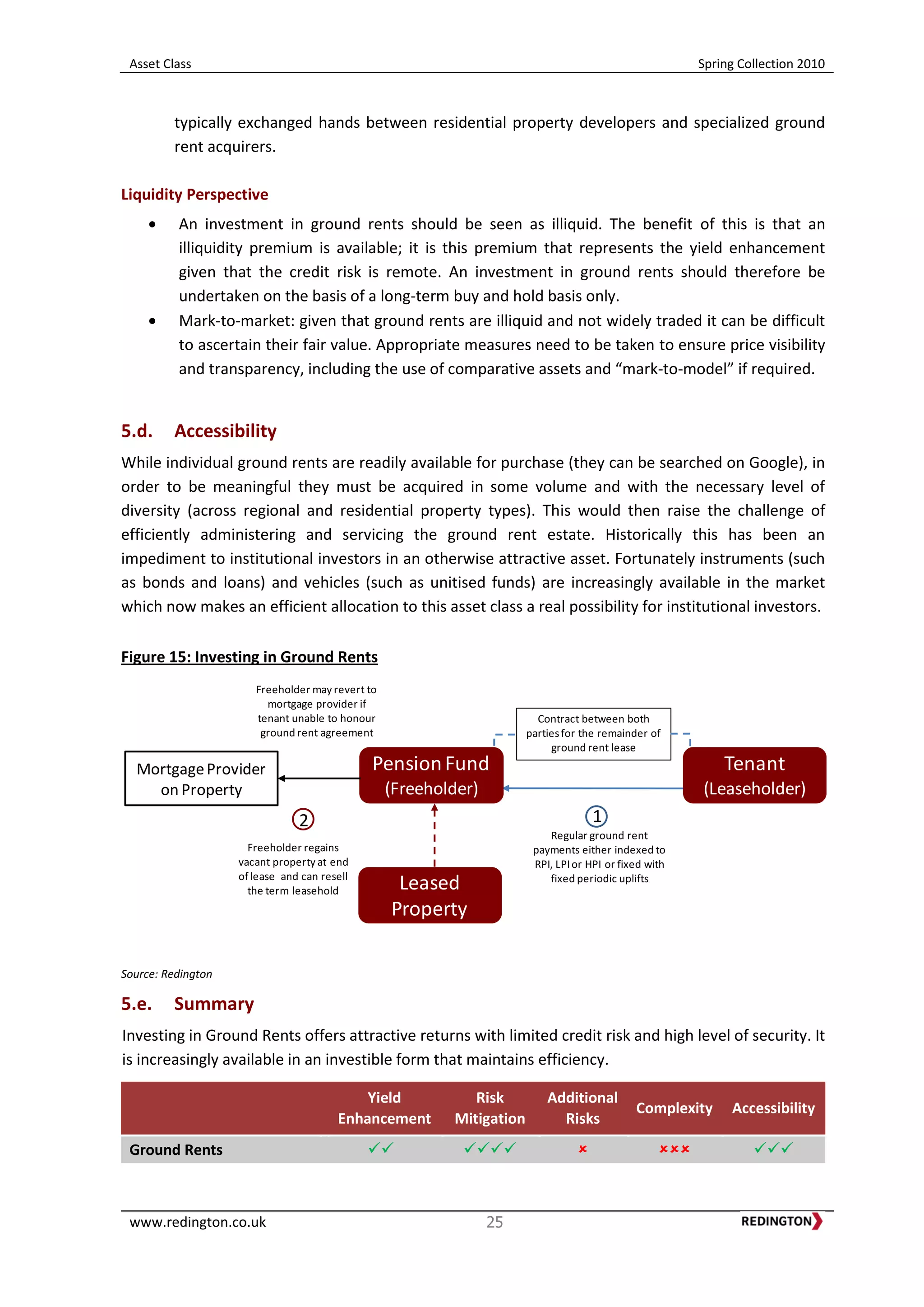

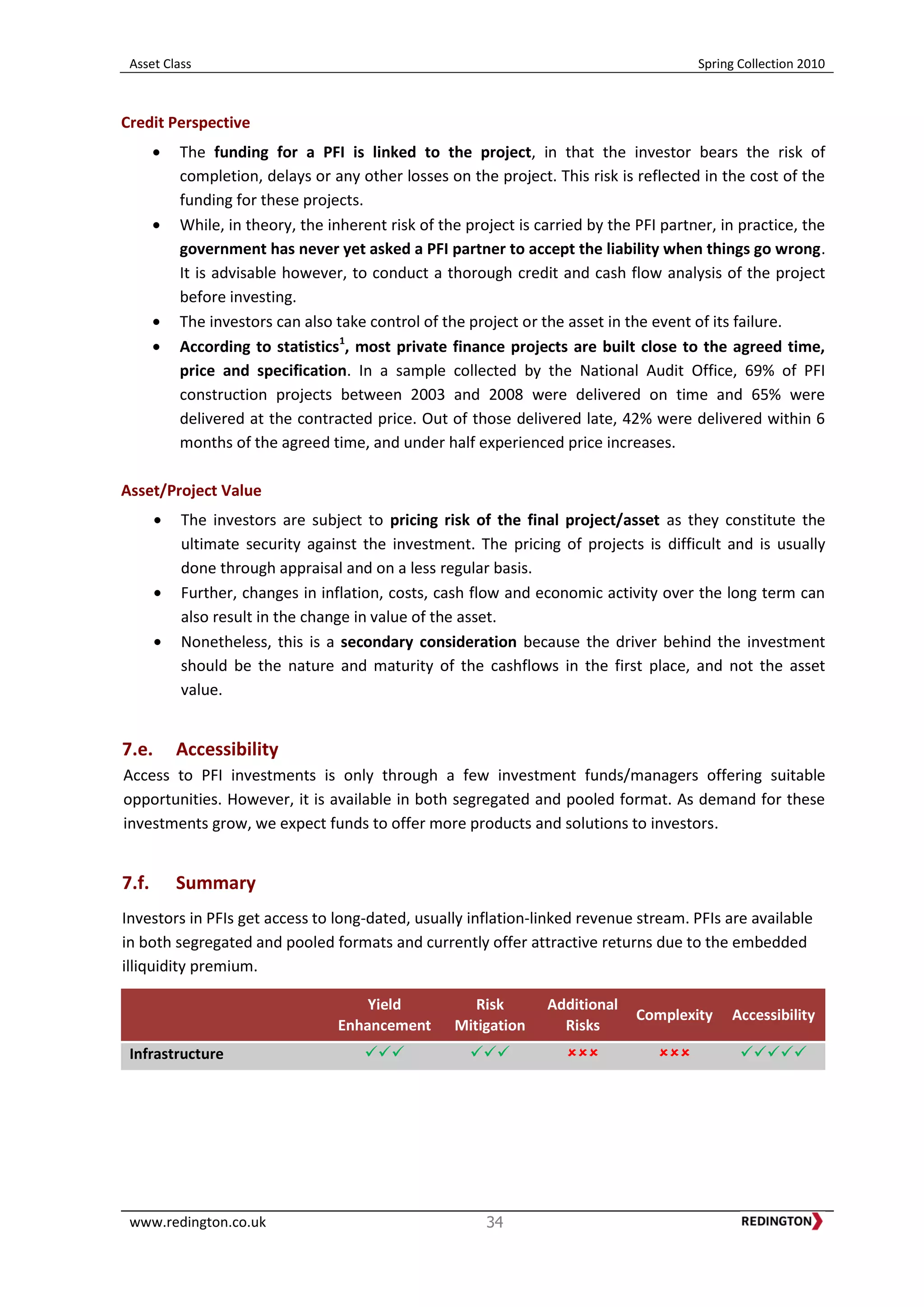

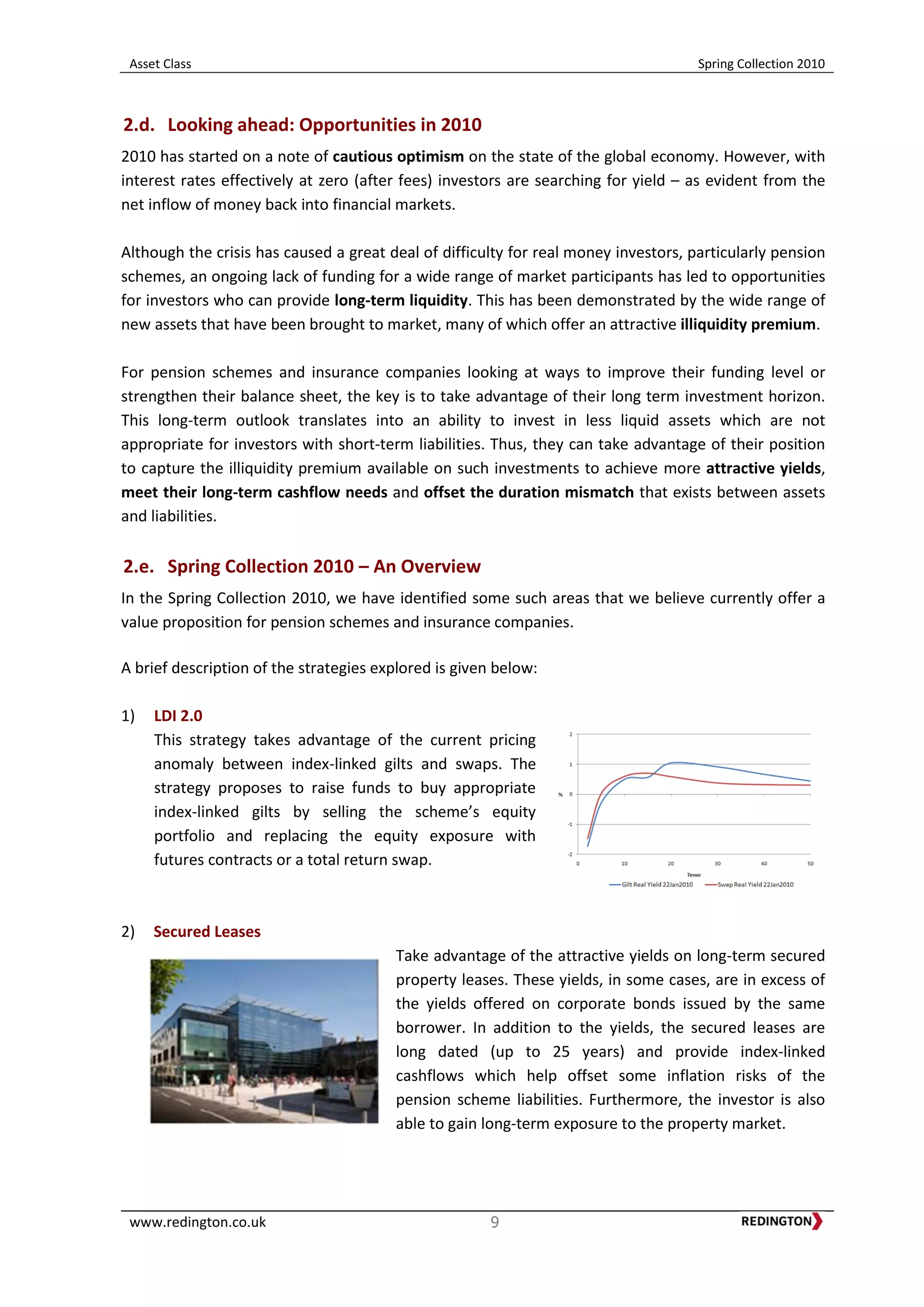

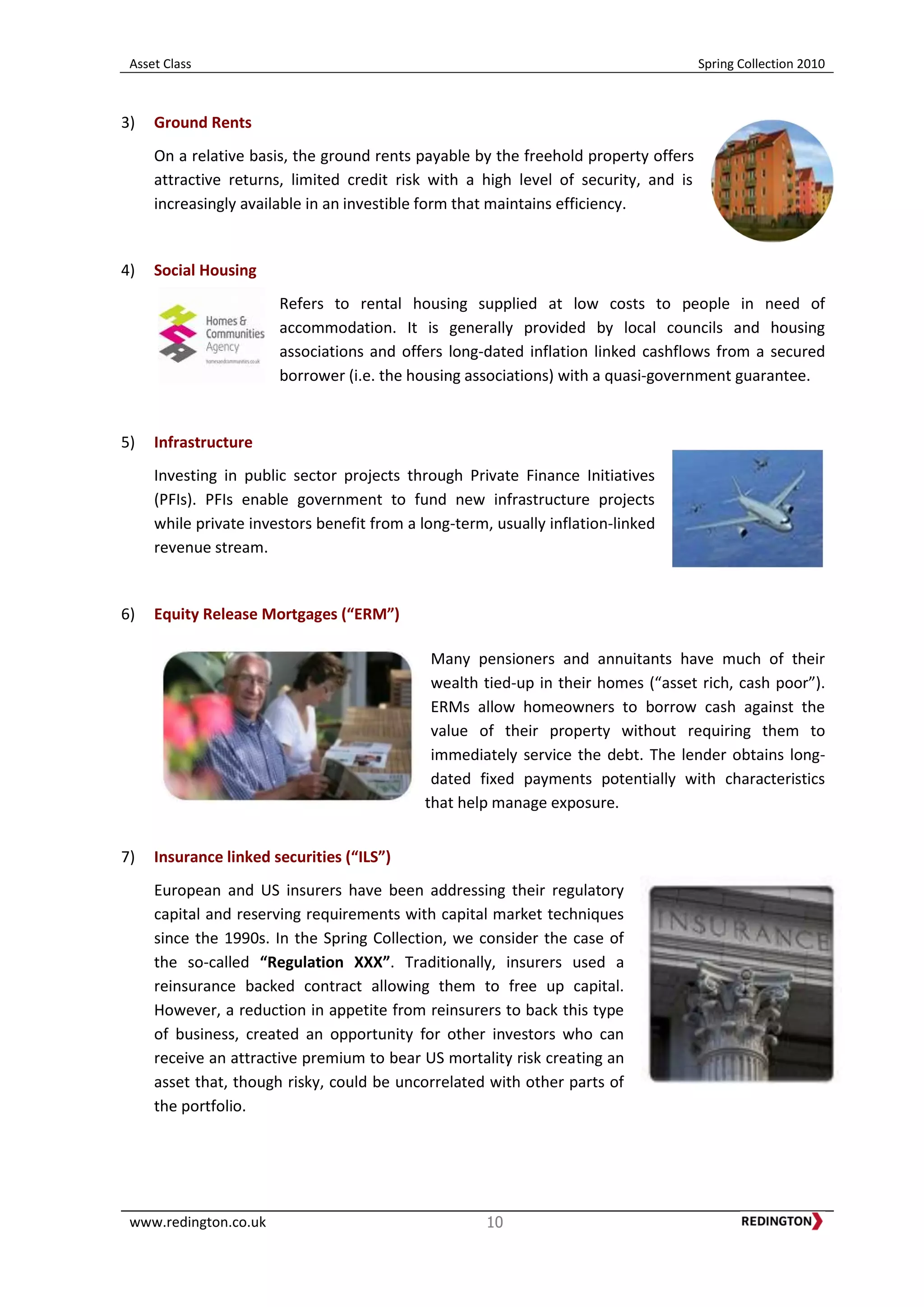

Figure 13: LDI characteristics of the lease component

Source: Redington

Leases vs. Corporate Bonds

At present there are some relative value opportunities available between yields on property

leases compared to those on corporate bonds.

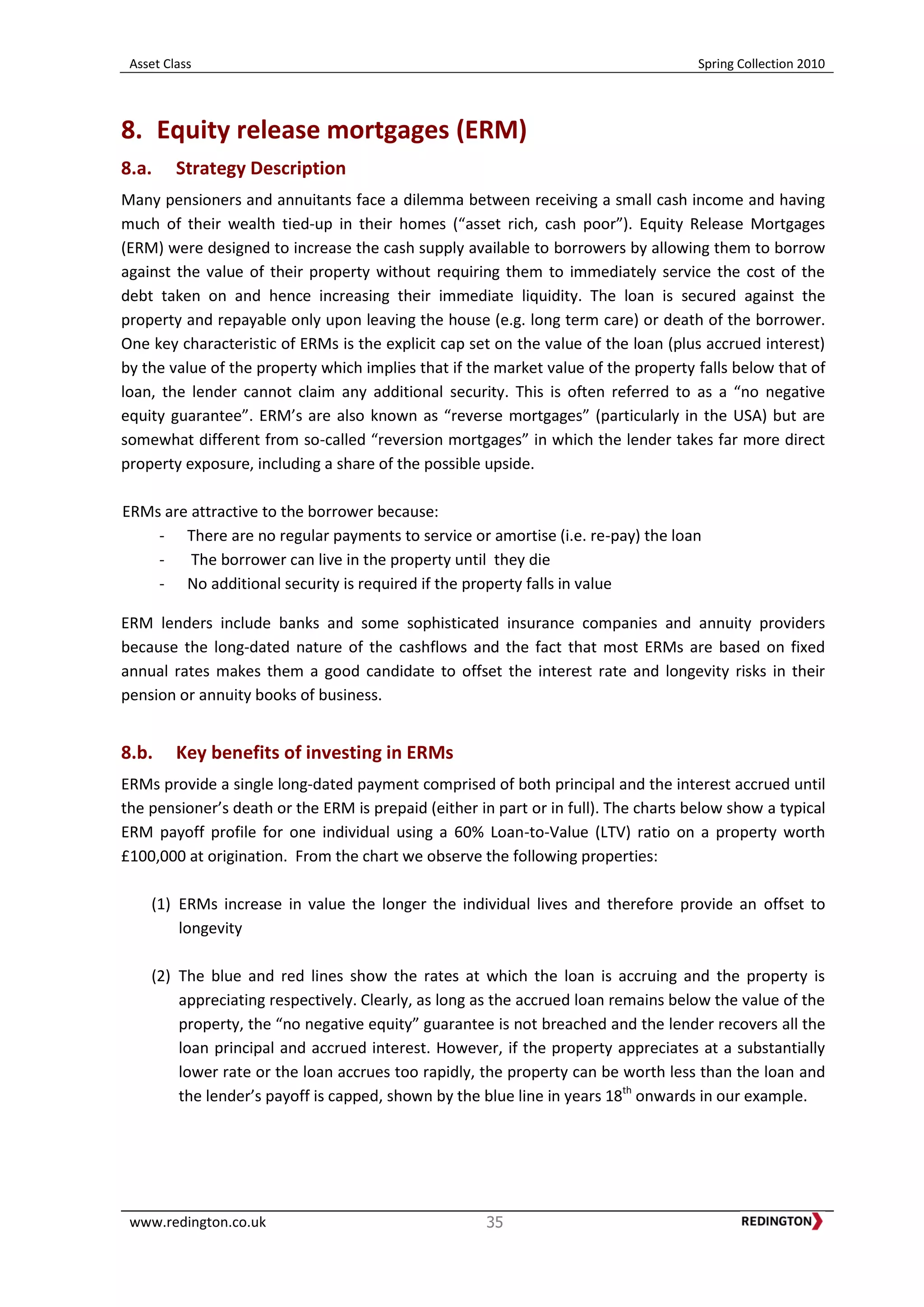

The table below seeks to highlight this point.

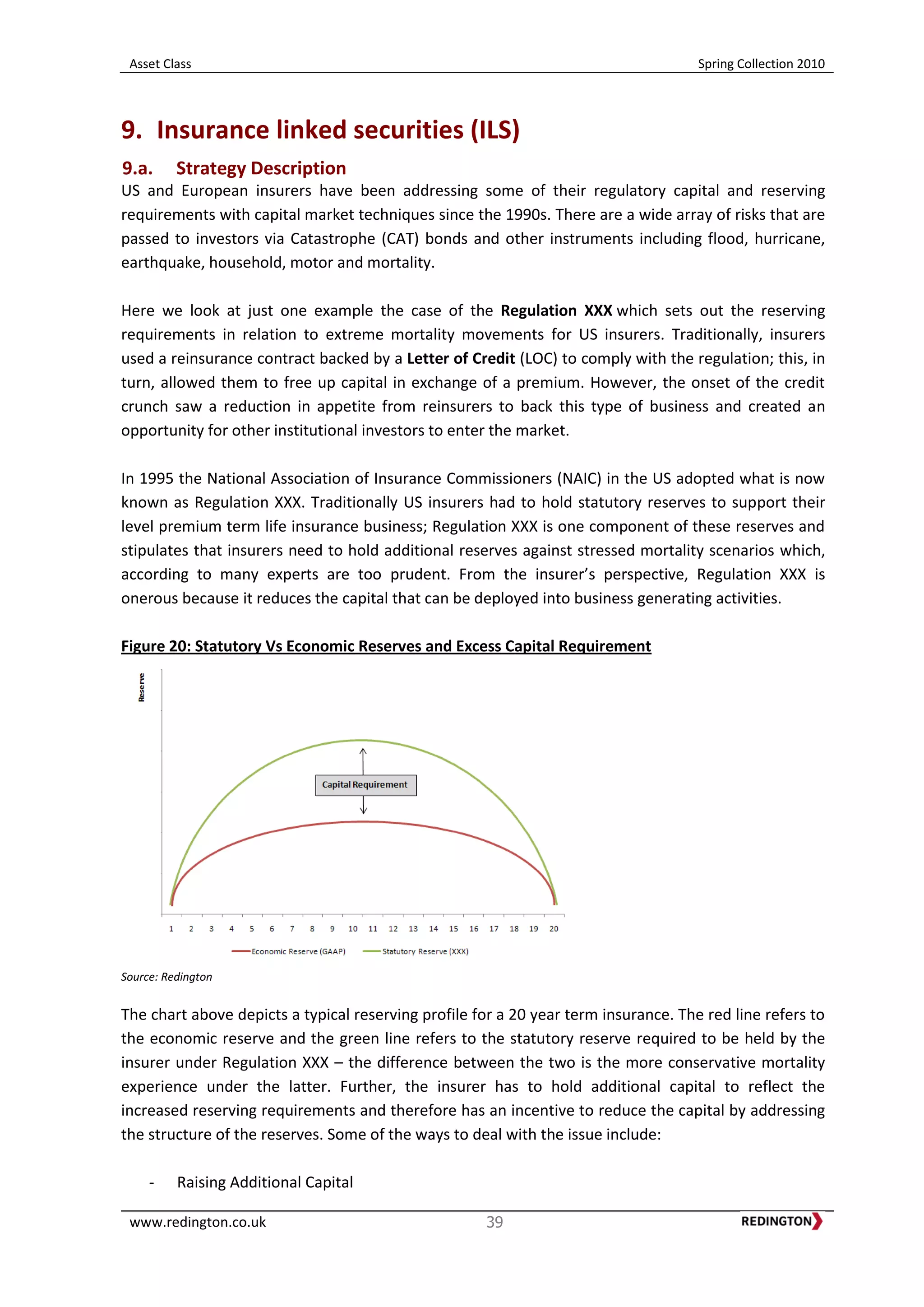

Table 3: Implied spread over LIBOR

Inflation Hedge

Lease payments are

RPI linked and so the

pension fund receives

a constant stream of

[annual] real

cashflows to match

inflation linked

liabilities

Interest Rate

Hedge

Long dated nature

of the lease may

offset the duration

mismatch that

exists between a

pension fund’s

assets and

liabilities

Themajority of pension

fund liabilities are index-

linked

Long dated leases often

contain RPI-linked or fixed

indexation cashflows

By entering into a long-

termlease, the pension

fund receiveslong dated

index-linkedcashflows to

help meet the liabilities

Example: Lease Rental Income Streams received for 25 years

assuming no lessee default with annual RPI Indexation

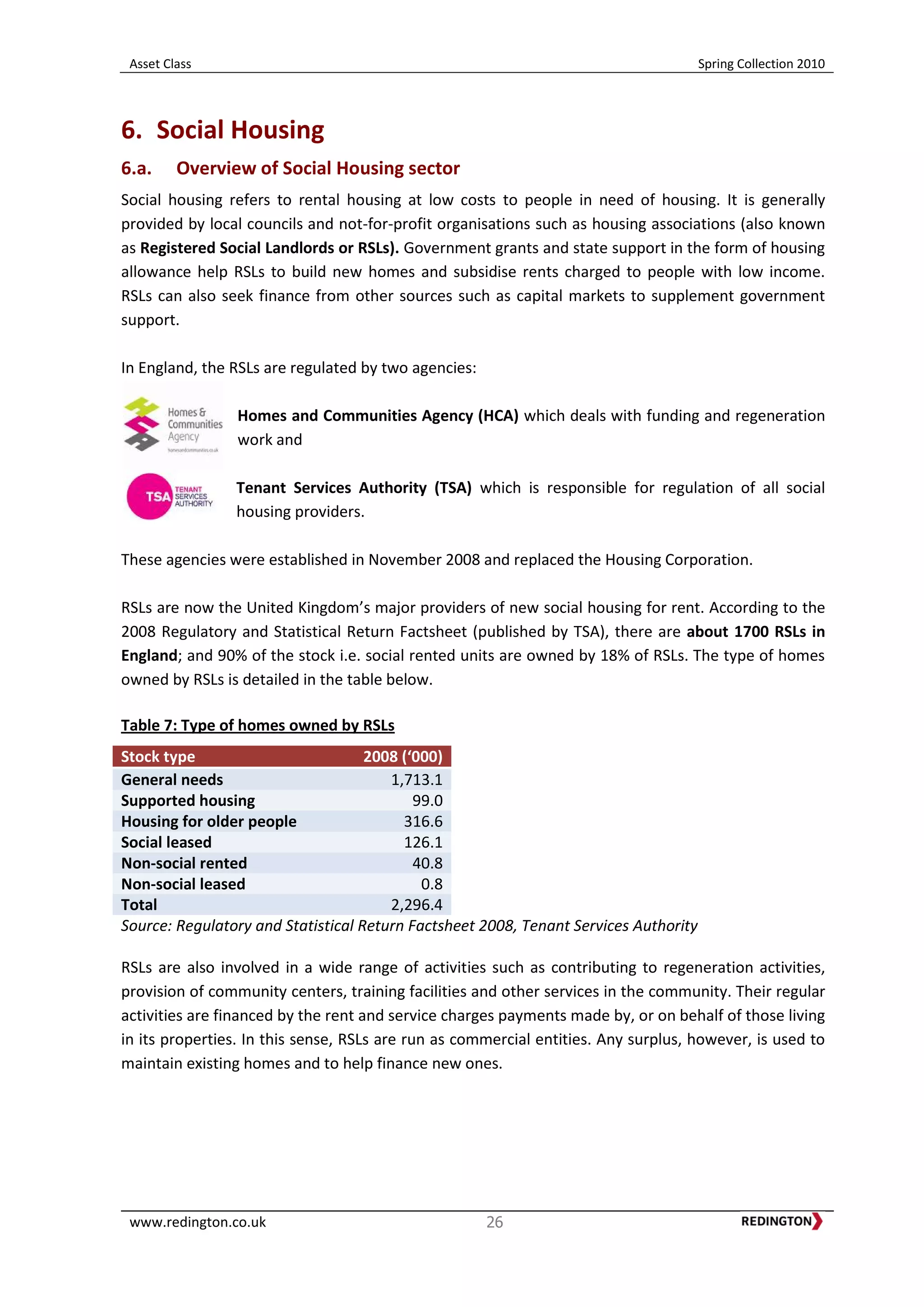

The table shows the implied spread on an

example lease under stress scenarios of various

losses on the underlying property.

Even if the property is worth nothing at the end

of 24 years, the spread over LIBOR on the lease

(1.22%) is comparable to that of the corporate

bond (1.25%).

If the property rises in line with RPI, the investor

receives 4.71% i.e. 3.46% above the yield of the

equivalent corporate bond.

Assumed 24 year lease; no default (Source: Redington, October 2009)](https://image.slidesharecdn.com/redingtonspringcollection2010-150505072320-conversion-gate02/75/Asset-Class-Spring-Collection-2010-19-2048.jpg)