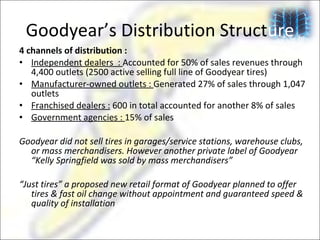

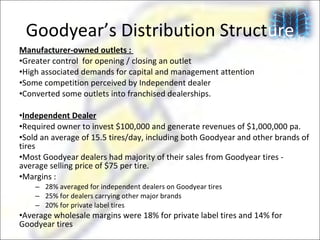

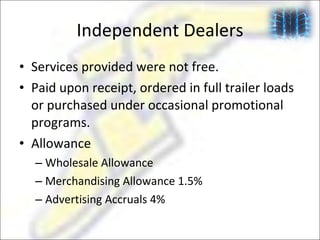

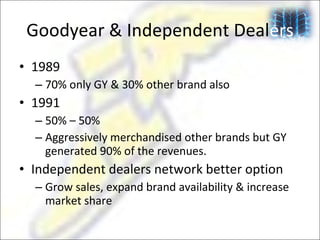

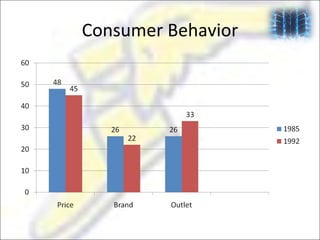

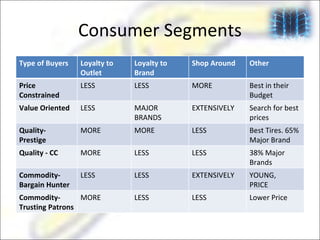

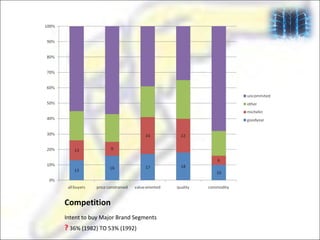

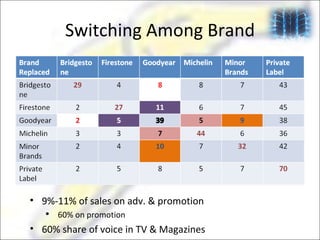

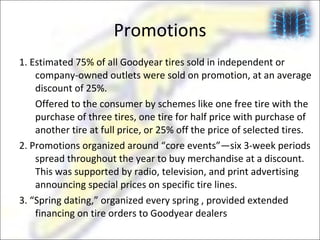

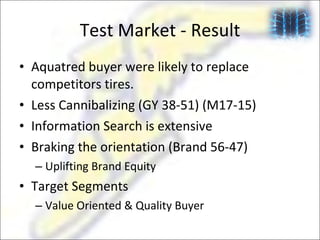

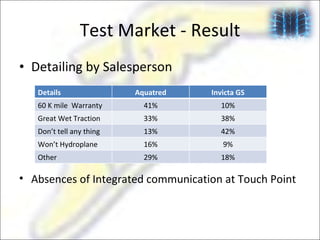

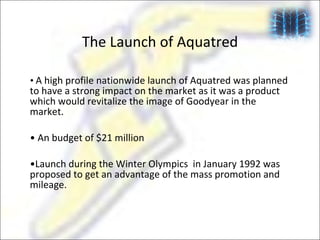

The document discusses Goodyear's plans to launch its new Aquatred tire. It proposes a $21 million budget to launch the tire during the Winter Olympics in January 1992. This would take advantage of the mass promotion and publicity of the Olympics. The launch plan focuses on value-oriented and quality customer segments. It recommends an integrated communication plan highlighting the tire's safety, trustworthiness and all-weather performance. Initial inventory should focus on domestic and imported mixes based on test market results. The plan also recommends using Goodyear's existing distribution channels and dealers while motivating other independent dealers to ensure consistent messaging across all touchpoints.