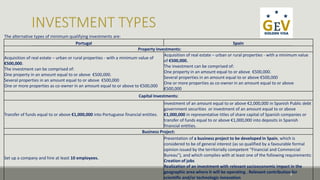

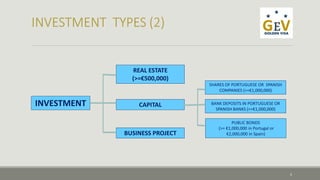

The document summarizes residency programs in Portugal and Spain that grant residence permits to non-EU nationals who invest a minimum of 500,000 euros. It allows investors to live, work or study in Portugal/Spain and travel freely within the Schengen Area. The programs require maintaining the investment for 5 years to receive permanent residency in Portugal or renewing permits every 2 years in Spain. Golden Visa applications are processed by immigration authorities in each country. The document also advertises services from a company called Golden Euroresidence Visas that assists clients with all aspects of the investment and residency application process.