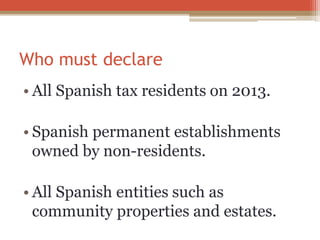

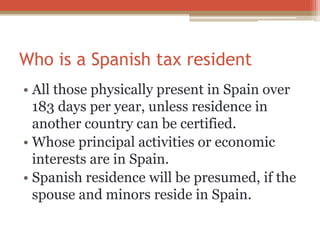

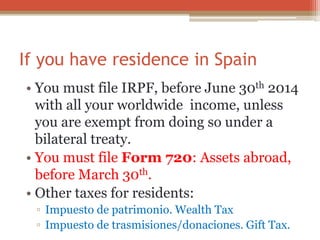

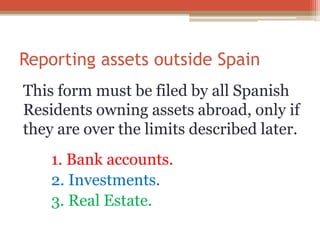

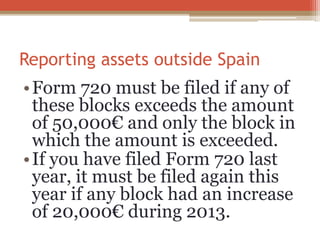

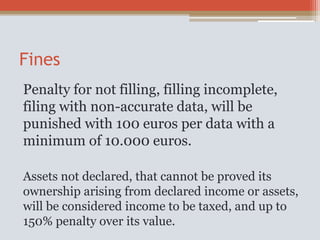

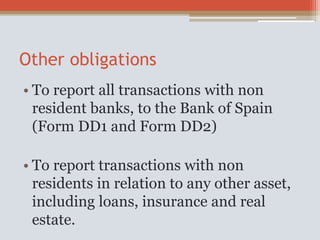

This document provides information about Form 720 filing requirements in Spain. Form 720 must be filed by Spanish tax residents to report assets held abroad if the value of bank accounts, investments, or real estate exceeds 50,000 euros. It outlines what assets must be reported, including bank accounts, stocks, insurance policies, and real estate. Failure to file or filing incomplete or inaccurate information can result in fines of up to 150% of unreported asset values. The deadline to file Form 720 is March 31, 2014.