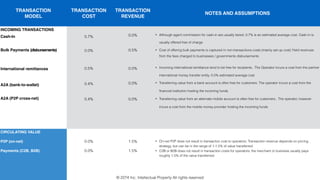

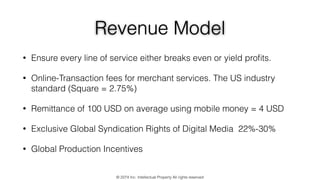

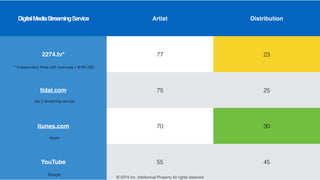

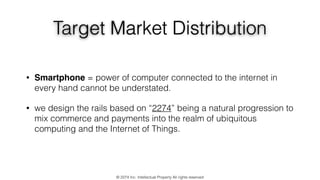

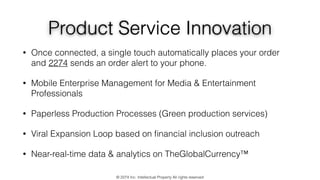

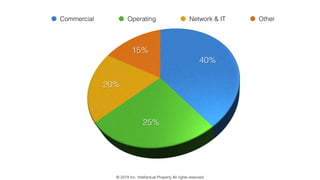

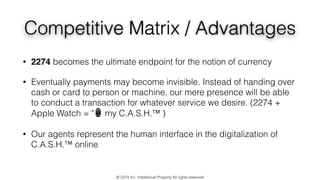

2274 Inc. offers end-to-end custom business solutions focused on enhancing mobile performance and enterprise management, positioning itself as a gold standard in mobile money ecosystems. The company aims to maximize digital transactions and minimize cash transactions through a transaction-driven revenue model, with a proposal for venture capital investment to expand its customer base and global distribution network. Key strategies include leveraging smartphone technology for commerce integration and a focus on sustainable, paperless production processes.