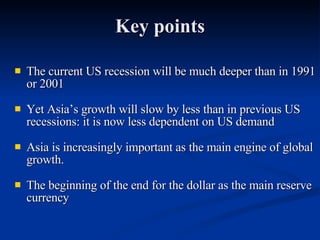

The document summarizes the current state of the global economy and forecasts what may happen in the near future. It notes that the US is entering its deepest recession in decades due to the housing market crash and falling consumer spending. However, Asian economies are less dependent on US demand and continue growing rapidly, making Asia the main driver of global economic growth. While a US recession will impact Asia, the effects are expected to be smaller than in previous downturns due to Asia's growing domestic demand and trade with other regions. Over the long run, the economic shift towards Asia will further weaken the US dollar and American influence on the global economy.