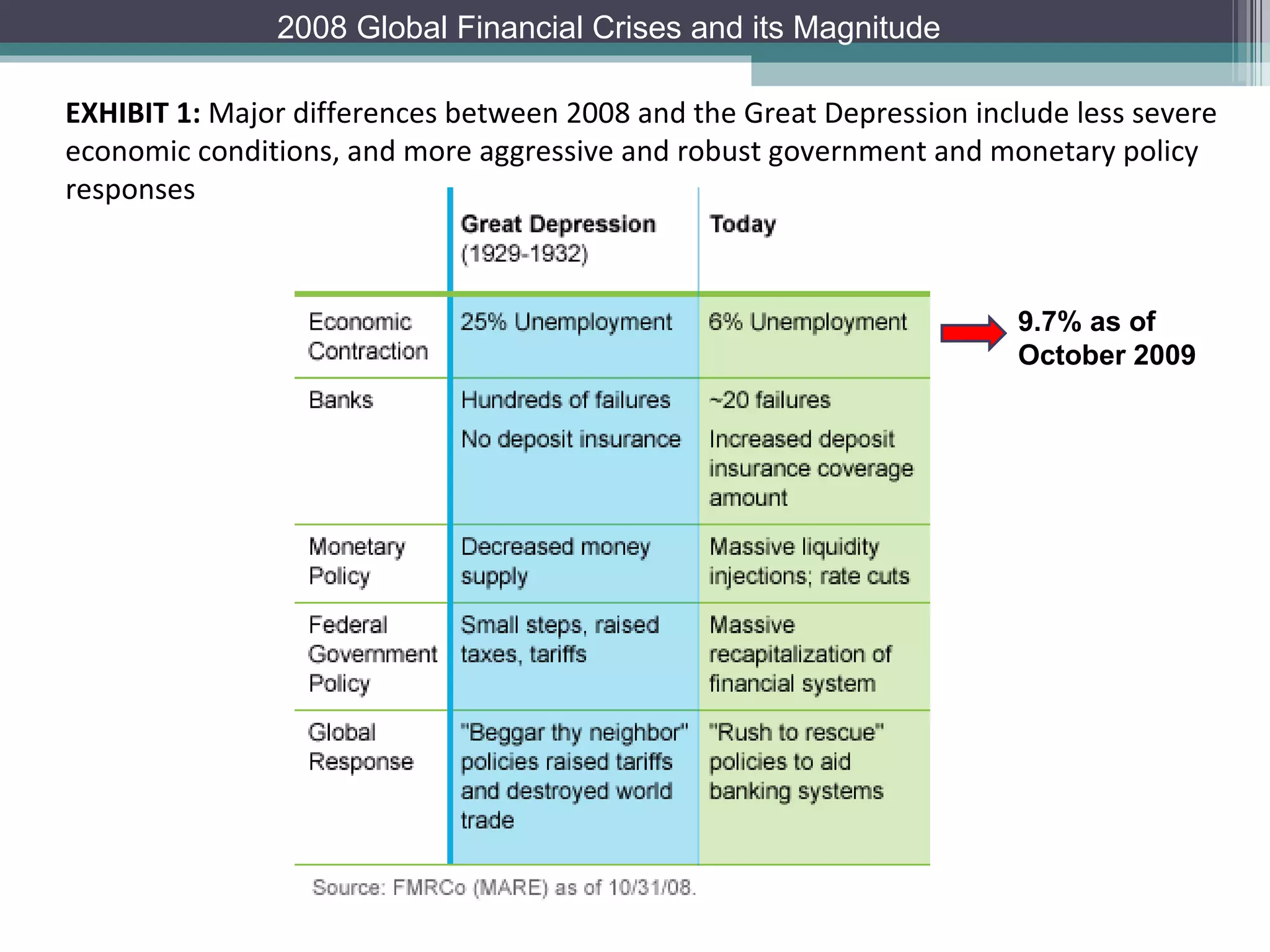

While there are some similarities between today's financial crisis and the Great Depression, such as excessive debt and asset price deflation, there are also key differences:

1) The economic contraction today is far less severe, with estimates of unemployment peaking at around 10% compared to 25% during the Depression.

2) The banking system, while distressed, is not near collapse as hundreds of banks failed during the Depression due to lack of deposit insurance.

3) Monetary policy response has been extraordinary, with the Federal Reserve taking ambitious action unlike the passive role during the 1930s.

4) Government policy response has already been more forceful than in the early years of the Depression, enacting stimulus packages, bank