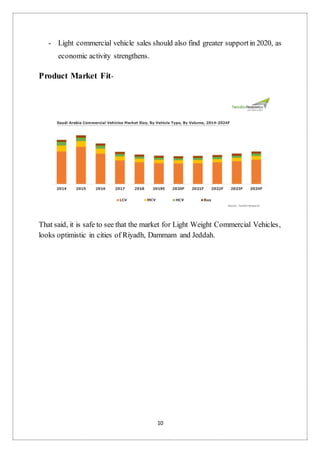

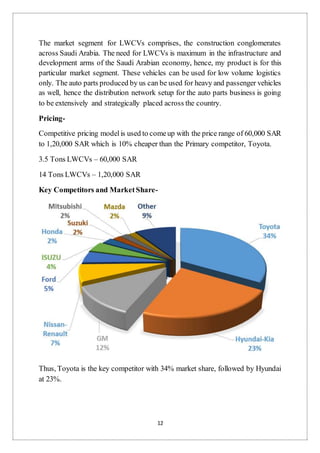

This document provides a business proposal for venturing into the automotive sector of Saudi Arabia by establishing a light commercial vehicle manufacturing business. It includes an introduction to the business environment in Saudi Arabia and an overview of the automotive market, highlighting opportunities in the light commercial vehicle segment. The proposal then presents a detailed business plan to establish Gulf Auto Corp to manufacture and distribute light commercial vehicles in Riyadh, later expanding to other cities. It analyzes the target market and competitors, and establishes pricing below the largest competitors. Finally, it conducts a SWOT analysis and concludes the plan could succeed with a strong distribution network and competitive pricing, despite challenges from established competitors and regulations.