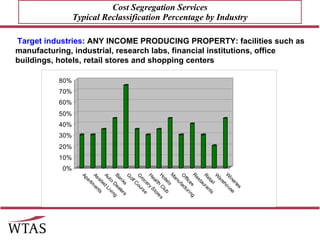

The document discusses cost segregation, which analyzes construction or renovation costs to identify portions that can be depreciated faster for tax purposes. It provides examples of cost segregation studies performed for a manufacturing facility and office building that reallocated costs from 39-year to 5, 7, and 15-year depreciation schedules, yielding substantial first-year tax savings. The document promotes cost segregation services as an easy to explain, value-added service that provides documented tax benefits for clients.

![Jack Young, GPPA, CPA Experience in: Financial Analysis Income Tax Consulting Machinery and Real Estate Appraisal USPAP appraiser of Machinery and Equipment Certified Public Accountant Formerly with: KPMG Price Kong, CPAs Bar None Auction West Auction Jack Young contact information (530) 219-7900 [email_address] www.norcalvaluation.com](https://image.slidesharecdn.com/gilandjackwtascostsegregationpresentation-12533767036542-phpapp02/85/Cost-Segregation-Presentation-3-320.jpg)