Embed presentation

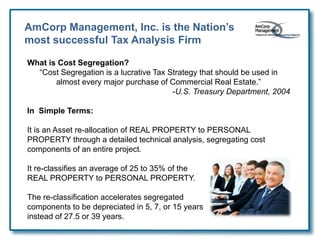

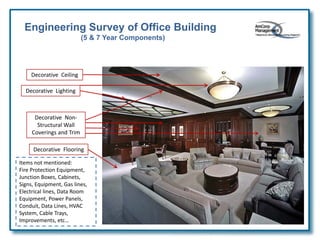

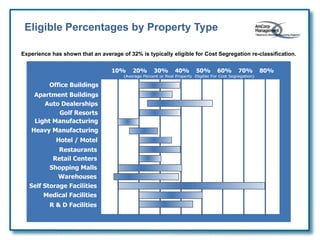

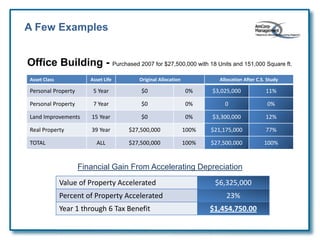

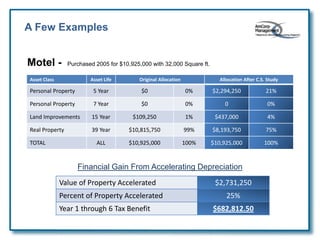

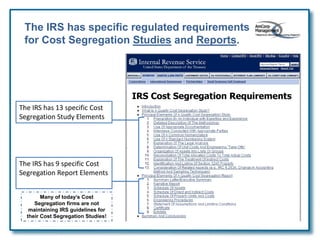

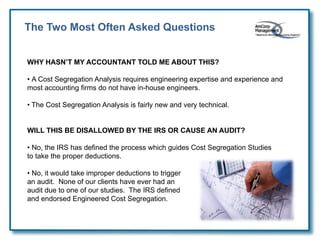

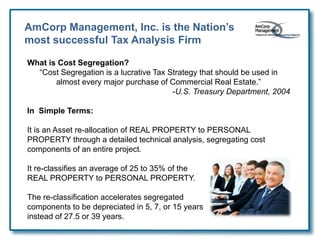

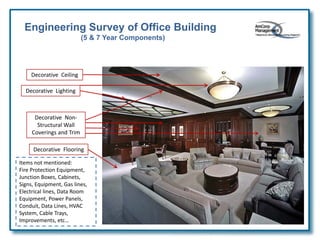

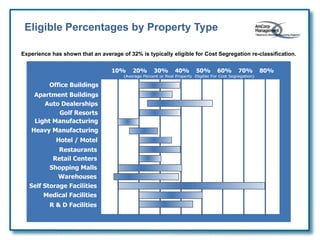

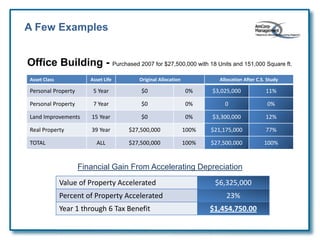

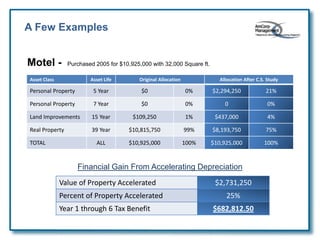

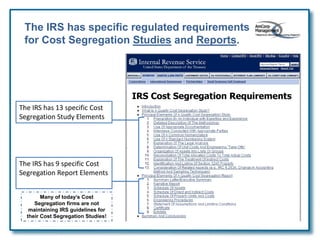

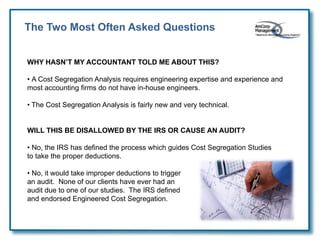

AmCorp Management is a cost segregation firm that identifies real estate components that can be reclassified as personal property for tax purposes, accelerating depreciation deductions. They have engineers and tax professionals who conduct cost segregation studies according to IRS guidelines. These studies typically reclassify 25-35% of real property costs, allowing faster depreciation and increased cash flow. AmCorp provides no-cost feasibility studies and ensures clients face no audit risk from proper cost segregation.