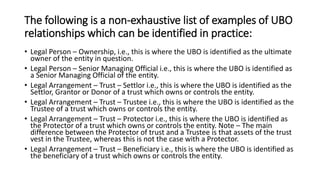

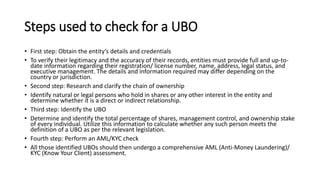

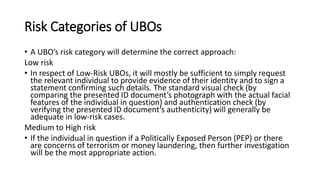

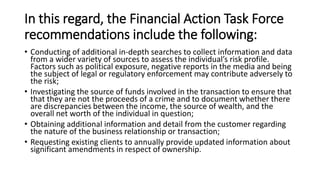

The document discusses the importance of understanding ultimate beneficial owners (UBOs) in the context of anti-money laundering and counter fraud legislation implemented by the UAE government through cabinet resolution no. 58 of 2020. It defines a UBO as an individual who owns or controls 25% or more of an entity and outlines steps for identifying UBOs, including obtaining entity details, researching ownership chains, and conducting AML/KYC checks. The document also categorizes UBOs by risk level, detailing the measures required for low-risk individuals versus those deemed medium to high-risk.