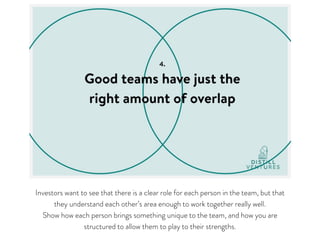

This document provides guidance for successfully pitching investors to obtain funding for launching a new spirits brand. It outlines key areas to have prepared, including intellectual property (IP), supply chain details showing the ability to scale production, pricing and margin calculations, and details on the founding team. It emphasizes showing a realistic understanding of the market while also communicating a vision and passion for the opportunity. The overall message is to be well-prepared with business fundamentals but also leave investors believing in both the opportunity and your ability to succeed.