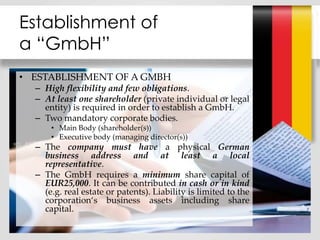

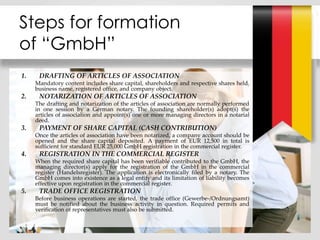

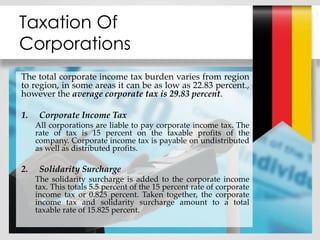

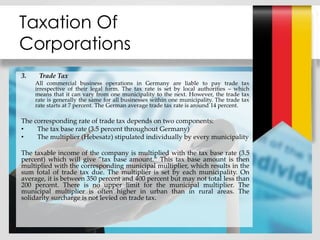

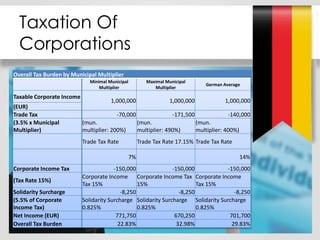

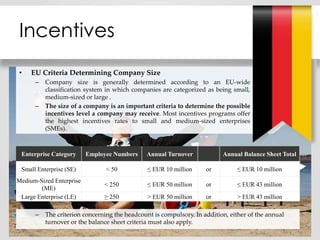

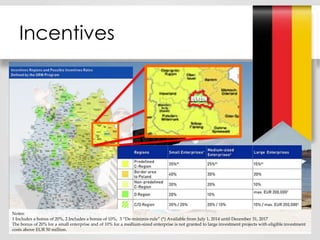

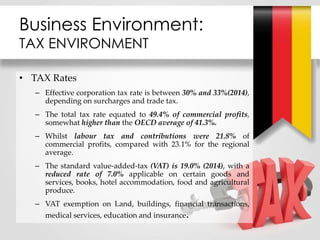

The document provides an overview of company formation in Germany. It discusses the establishment of a GmbH, which requires at least one shareholder, two corporate bodies, a minimum share capital of EUR25,000, and liability is limited to business assets. It outlines the 5 steps for GmbH formation: drafting articles of association, notarization, payment of share capital, registration in the commercial register, and trade office registration. It also summarizes corporate taxation in Germany, including corporate income tax, solidarity surcharge, and trade tax which averages 29.83% overall tax burden. It concludes with incentives available for small and medium enterprises.