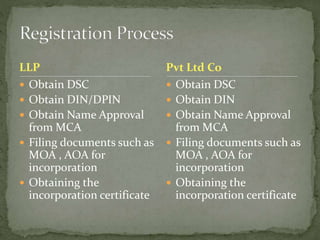

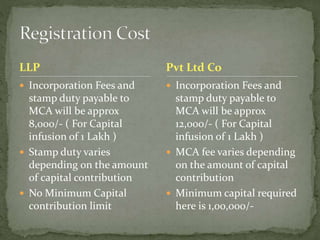

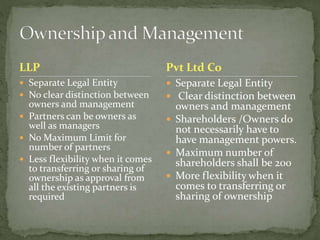

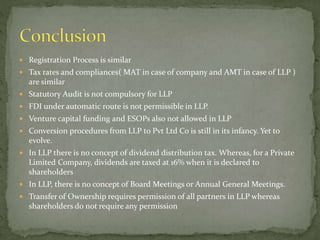

The document compares and contrasts private limited companies and limited liability partnerships (LLPs) in India. It discusses the process for incorporation, fees, capital requirements, ownership structures, flexibility in ownership transfers, taxation, statutory compliance requirements, funding options, and procedures for each entity type. The conclusion is that a private limited company is generally better suited for businesses expecting future funding from foreign direct investment, foreign institutional investors, venture capital or employee stock ownership plans, as these options are more flexible or only allowed for private companies compared to LLPs.