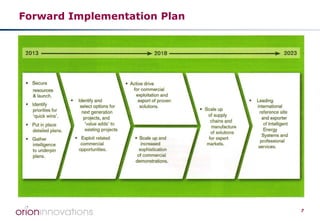

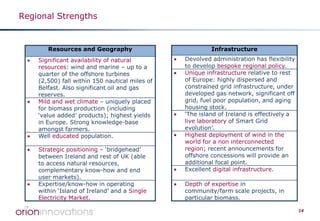

The document discusses the opportunity for Northern Ireland to become a leader in intelligent energy systems through increased use of renewable energy, energy storage, and demand side management. It outlines Matrix's mission to advise the Northern Ireland government on high tech opportunities. The vision is for Northern Ireland's economy to be led by business and academia in science and technology exploitation. The document recommends that Northern Ireland establish an Intelligent Energy System Group and delivery team to drive projects integrating distributed generation, storage, and controls to optimize renewable energy use while reducing grid upgrades. It argues Northern Ireland is well positioned due to its resources, infrastructure, academic strengths, and industrial capabilities.