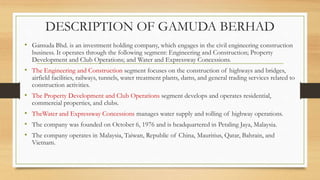

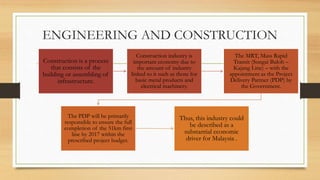

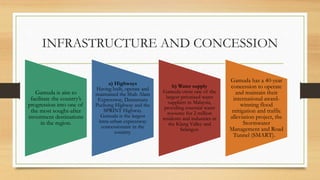

Gamuda Berhad is a Malaysian infrastructure and property developer with operations in Asia and the Middle East. It has three core businesses: engineering and construction, infrastructure concessions, and property development. Some of Gamuda's major ongoing and future projects include the Klang Valley Mass Rapid Transit system, expressways and highways in Malaysia and other countries, and property developments across Asia.