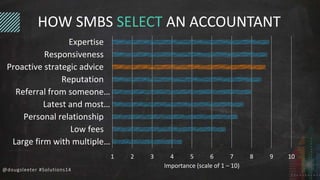

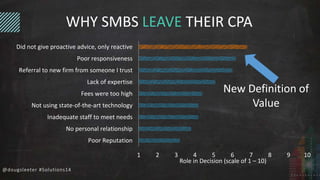

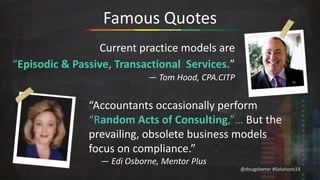

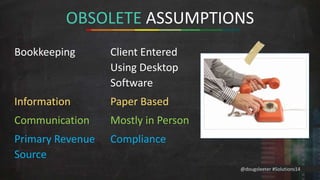

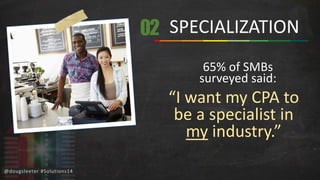

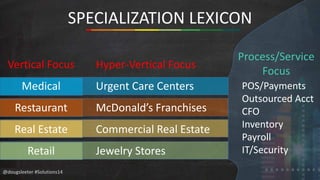

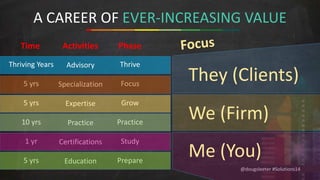

The document discusses the evolving landscape of accounting services, emphasizing the need for small and medium-sized businesses (SMBs) to seek accountants who provide proactive, specialized support through technology. It highlights the importance of client engagement, collaborative services, and reducing reliance on traditional compliance-focused practices. The presentation urges firms to embrace new business models, adapt to technological advances, and prioritize continuous learning to enhance their value and effectiveness.