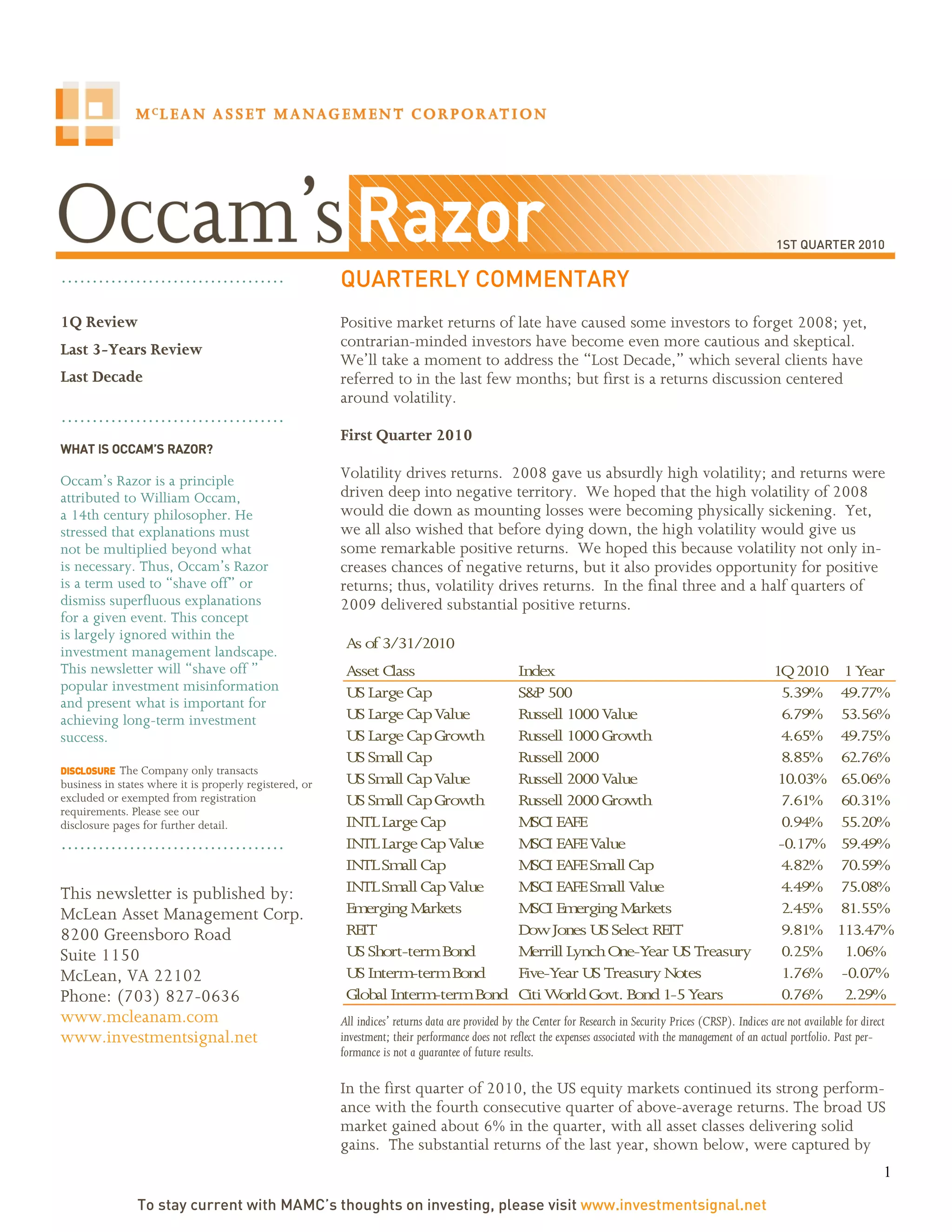

1) Volatility drives returns. The high volatility of 2008 led to large negative returns, but 2009 saw substantial positive returns as volatility decreased.

2) In the first quarter of 2010, most asset classes saw solid gains, with US equity markets continuing strong performance. Over the past year, maintaining a diversified portfolio helped investors benefit from return premiums across different asset classes.

3) Looking back 3 years, only 4 of 15 asset classes had positive returns, with emerging markets and fixed income performing best. However, past performance does not predict future returns, and focusing only on past winners can be misleading.