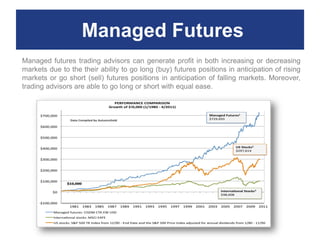

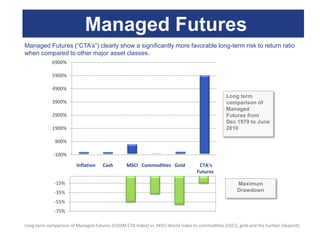

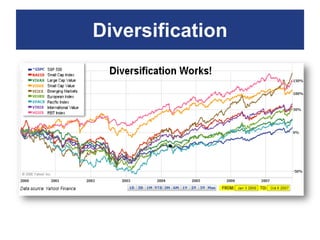

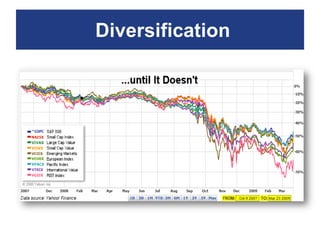

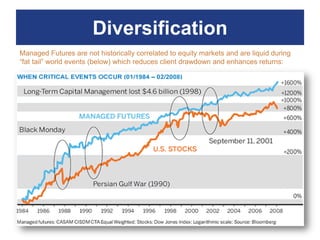

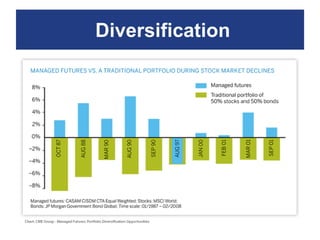

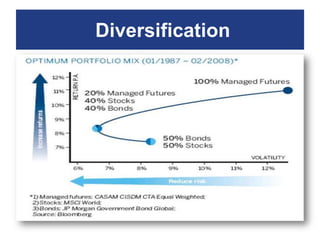

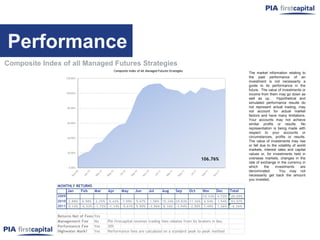

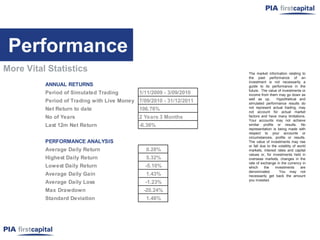

The document describes a managed futures program offered by PIA firstcapital. It is a trading division of Price Information Advantage Limited (PIA), which is authorized in the UK. The program trades futures and forex using leverage, which carries high risk. It has a team of experienced traders who actively manage portfolios in real-time. The program offers managed accounts trading futures on major indexes and bonds. Backtested performance shows the strategy has low correlation to stocks and diversifies portfolios.