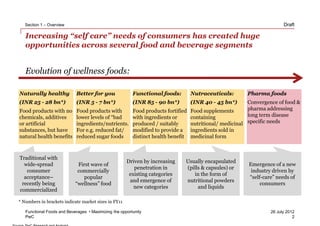

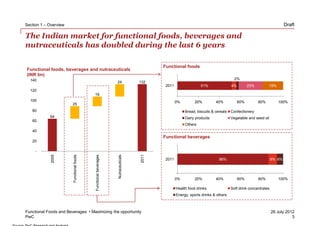

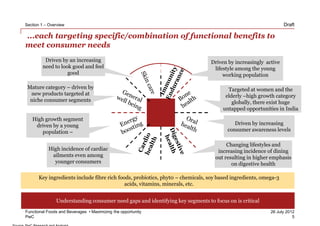

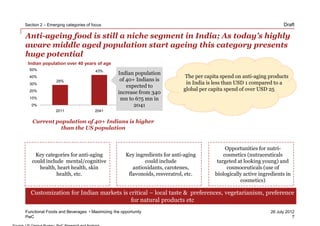

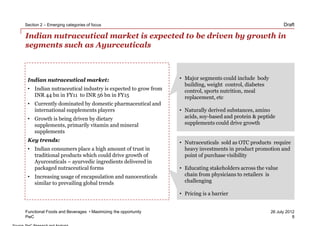

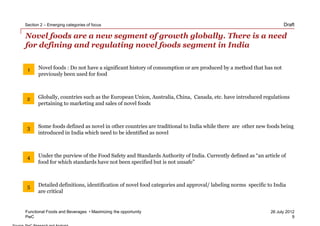

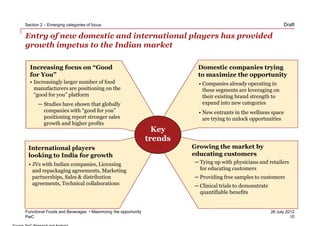

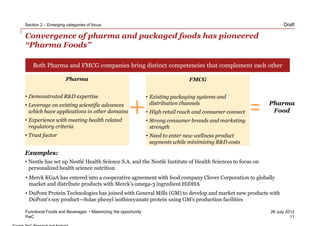

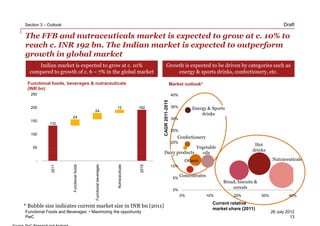

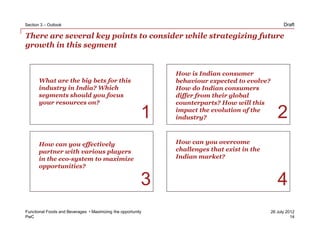

The document provides an overview of the functional foods and beverages market in India. It notes that the market has doubled in size over the past 6 years to INR 132 billion in 2011. Key growth segments include energy drinks, dairy products, and confectionery. The outlook expects continued strong growth of around 10% annually to INR 192 billion by 2015. Emerging categories that could drive future growth are discussed as anti-aging foods, Ayurceuticals (Ayurvedic nutraceuticals), and novel foods. Convergence between the pharmaceutical and food industries is also highlighted through the emergence of "Pharma Foods."