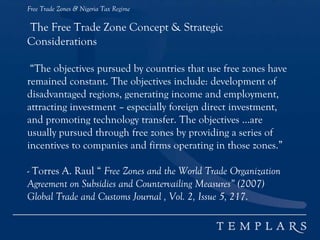

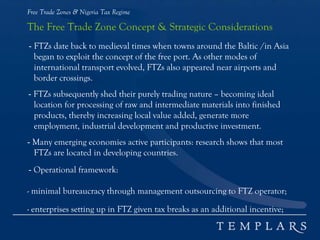

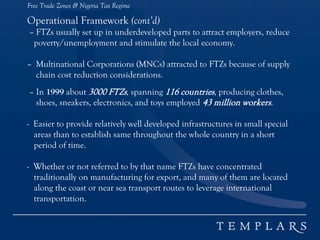

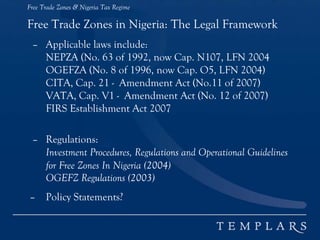

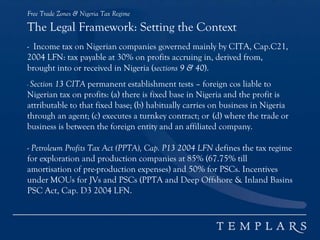

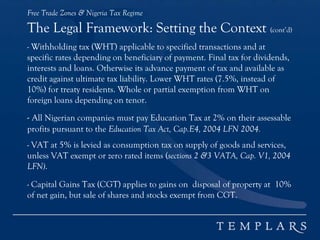

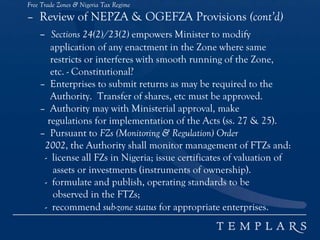

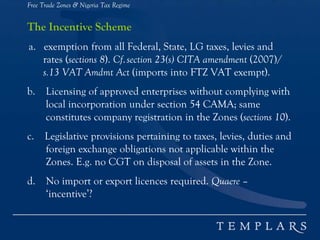

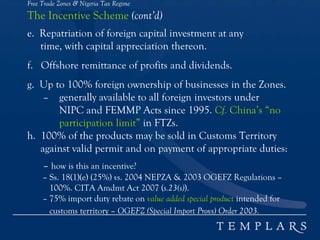

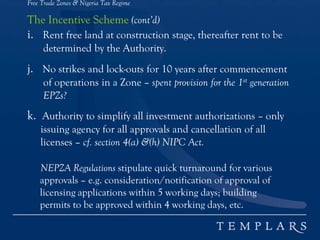

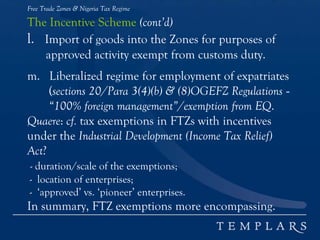

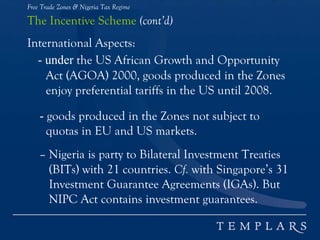

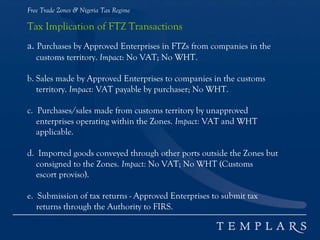

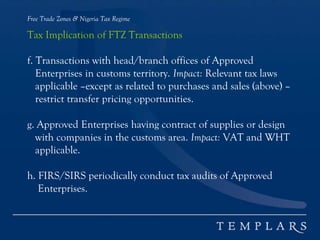

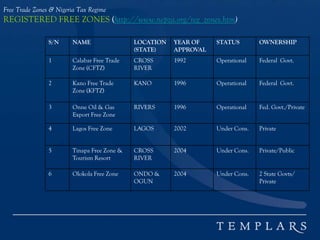

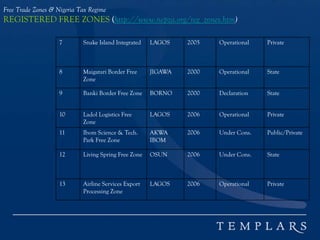

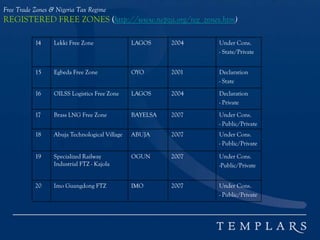

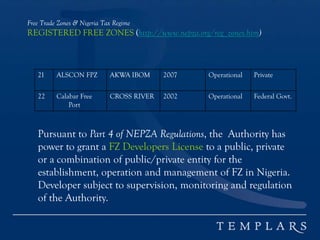

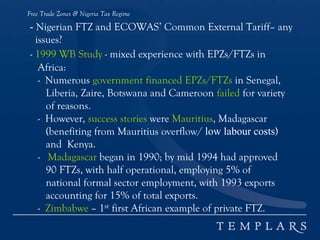

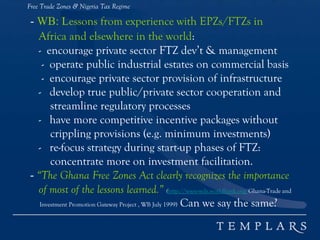

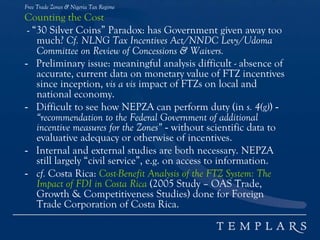

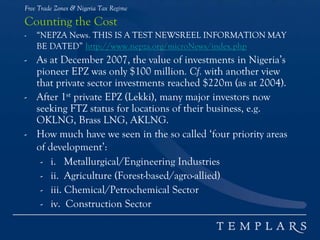

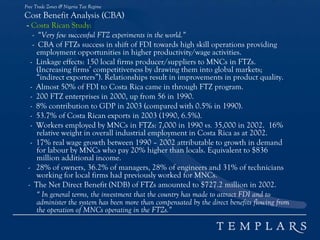

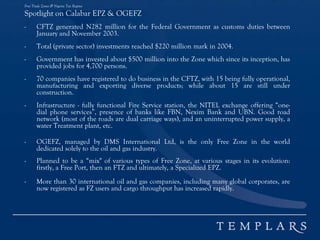

The document discusses free trade zones and Nigeria's tax regime. It provides an overview of Nigeria's legal framework for free trade zones, including the NEPZA and OGEFZA Acts. It outlines the incentives provided to companies operating in free trade zones, including tax exemptions. It also examines some of the tax implications of transactions occurring within free trade zones and between free trade zones and the customs territory. Finally, it lists the two registered free trade zones in Nigeria - the Calabar Free Trade Zone and Kano Free Trade Zone.