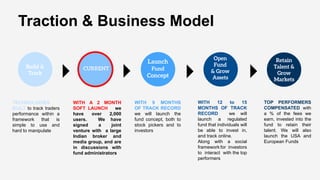

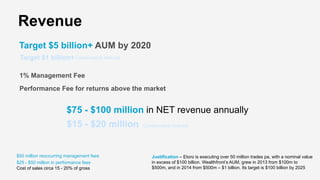

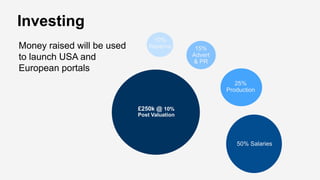

The document discusses how crowdsourced investing works, where individual stock pickers compete to create portfolios and the top performers' stock selections are used to construct investment funds, with the top performers compensated based on fund performance and fees. It outlines plans to launch similar crowdsourced funds targeting the US and European markets based on the success of an existing Indian platform. The business model aims to have billions under management by charging management and performance fees on the crowdsourced funds.