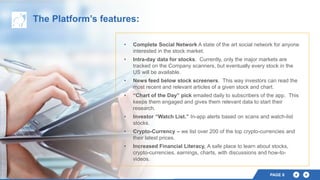

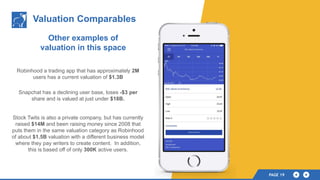

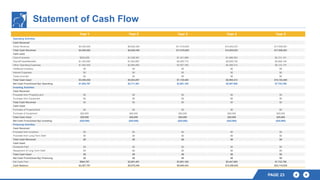

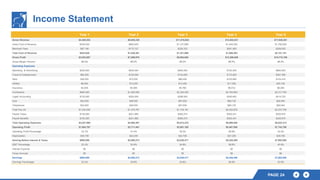

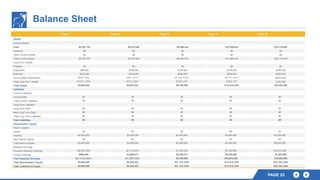

This document summarizes the financial projections and business plan for A La Carte Charts LLC, a proposed social network for investors. It projects rapid revenue growth from $4.3 million in year 1 to $17.9 million in year 5. It also projects strong profit margins, with net profit projected to reach $7.7 million in year 5. The document outlines the company's mission to provide investors with educational resources and an up-to-date social platform. It analyzes the market opportunity among self-directed investors and compares the company's projected valuation to similar platforms.