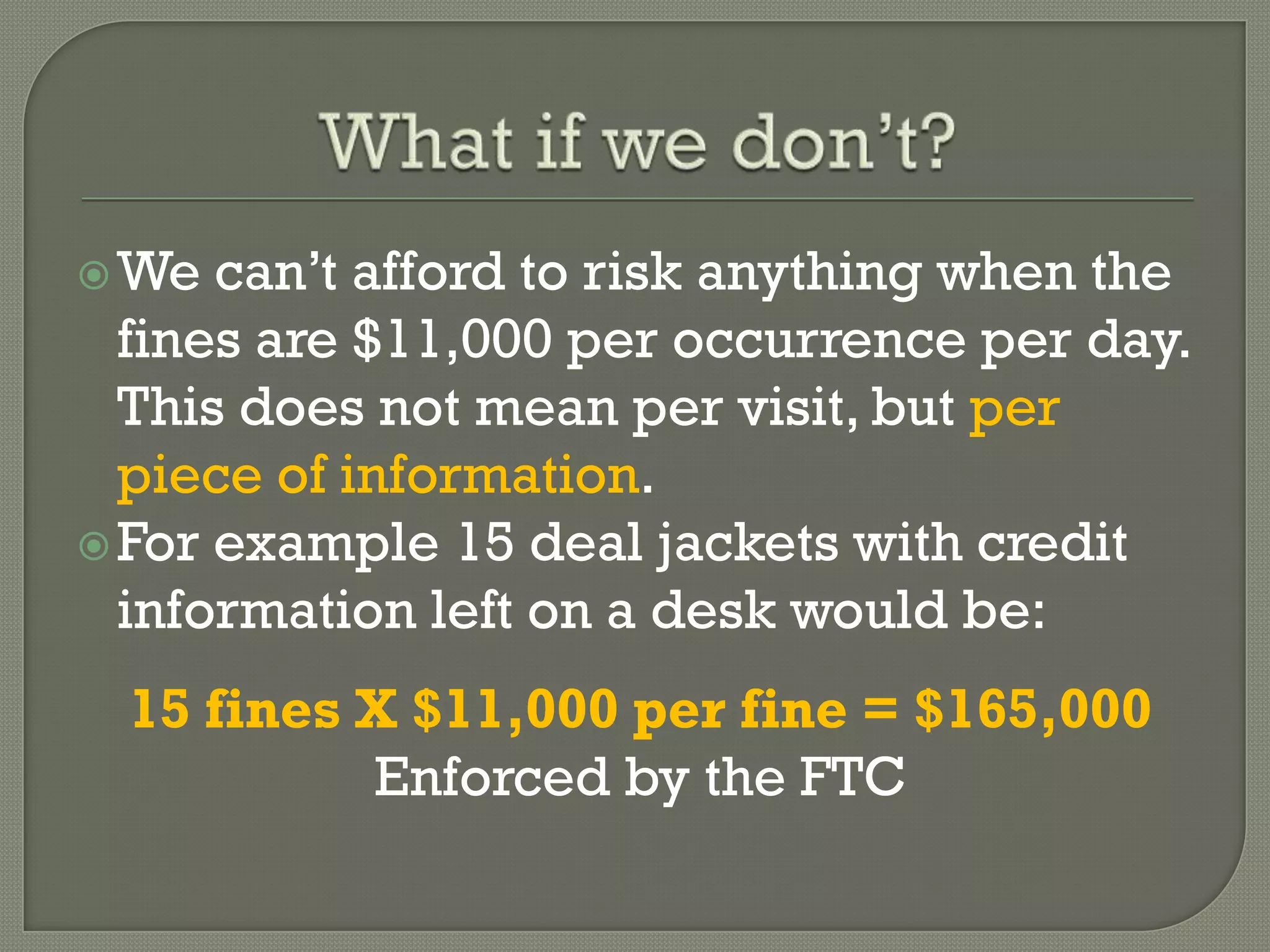

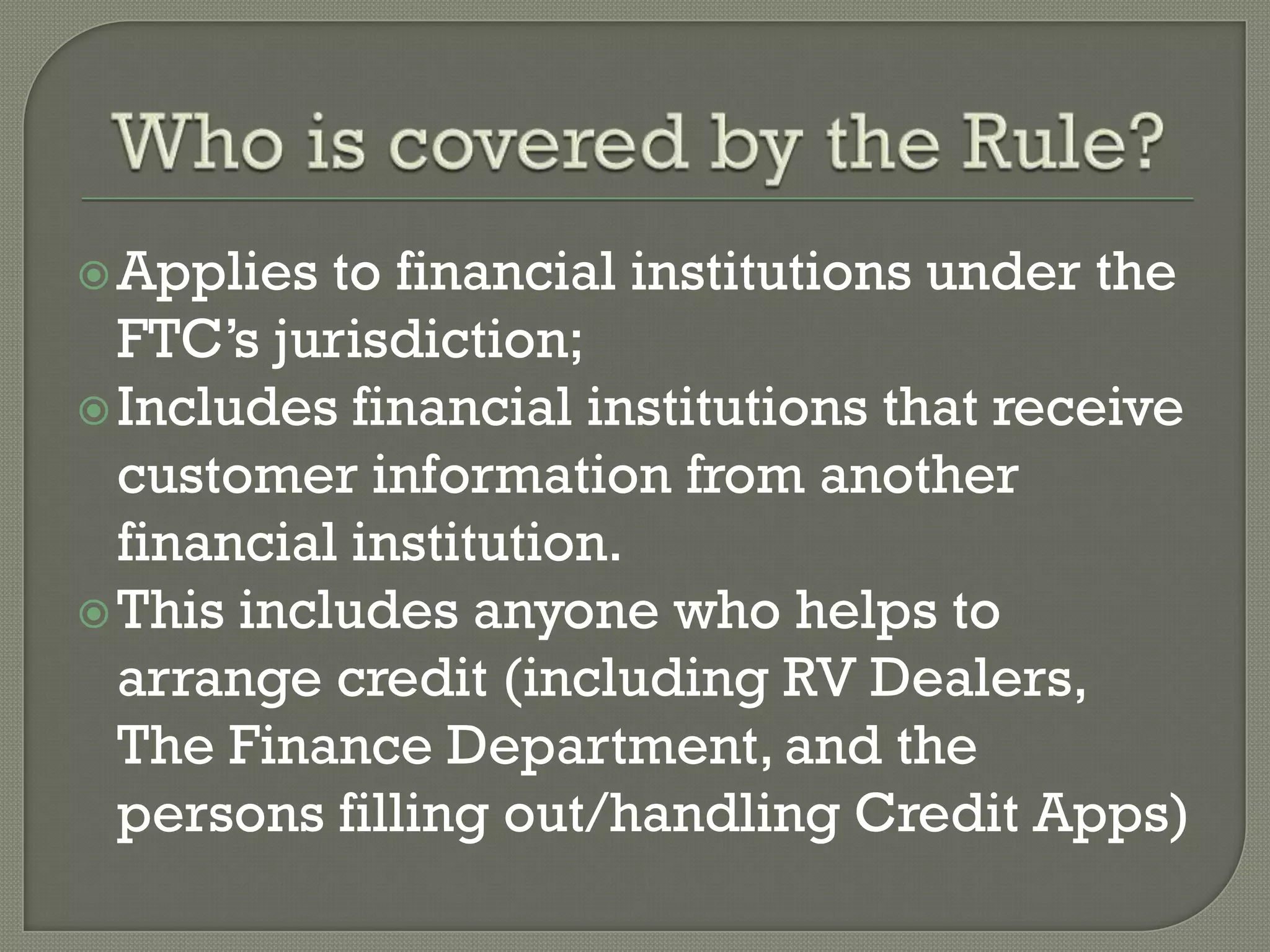

The document outlines regulations from the FTC regarding the implementation of security measures for financial institutions as mandated by the Gramm-Leach-Bliley Act. It emphasizes the need for comprehensive information security programs, risk assessment, and appropriate safeguards to protect customer information. Non-compliance can lead to significant fines, highlighting the importance of proper documentation, employee training, and effective management of service providers.

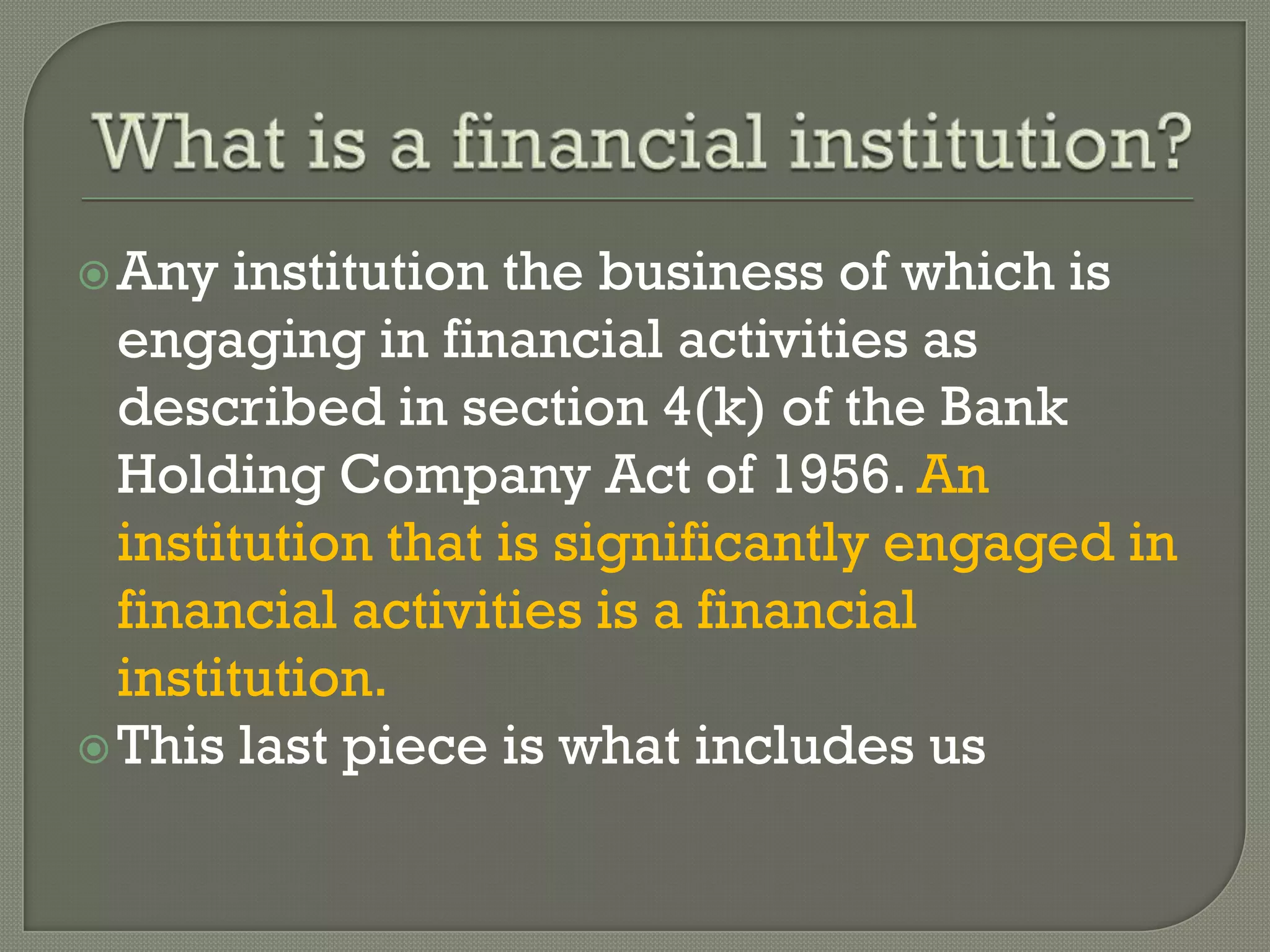

![ Lending, exchanging, transferring, investing for

others, or safeguarding money or securities.

[4(k)(4)(A)]

An activity that the Federal Reserve Board has

determined to be closely related to banking.

[4(k)(4)(F); 12 C.F.R. 225.28]

Extending credit and servicing loans

Collection agency services

Anactivity that a bank holding company may

engage in outside the U.S. [4(k)(4)(G); 12 C.F.R.

211.5].](https://image.slidesharecdn.com/ftcoverviewonglbafinalruleonsafeguardsbh-130204205047-phpapp02/75/FTC-overview-on-glba-final-rule-on-safeguards-2010-Compliance-Presentation-10-2048.jpg)