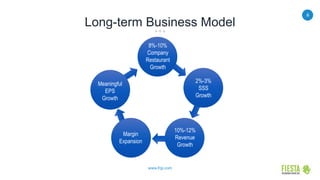

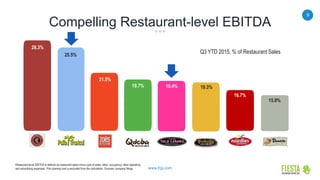

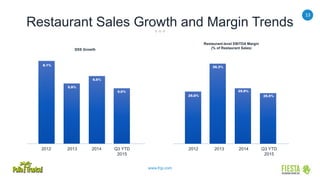

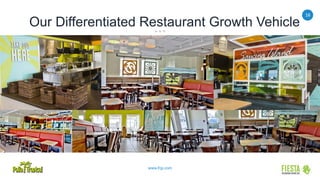

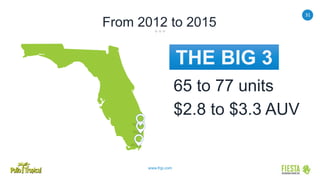

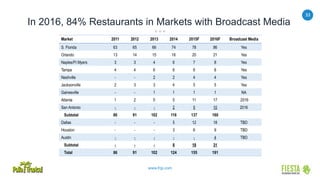

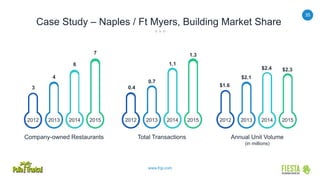

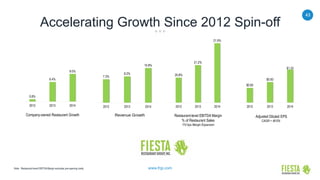

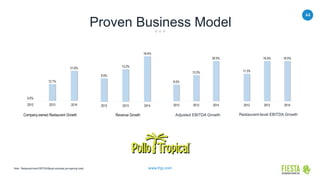

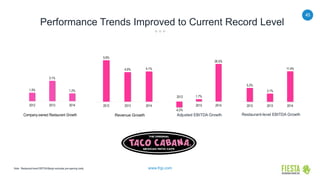

This document provides an investor presentation for a restaurant company operating two brands: a Caribbean-inspired chicken restaurant and a Mexican restaurant. It outlines the company's growth strategy of accelerating development of both brands, highlights their strong financial performance and industry-leading sales volumes. The presentation also reviews strategies to drive continued sales growth through marketing investments, remodels, and expanding the footprint in existing and new markets.