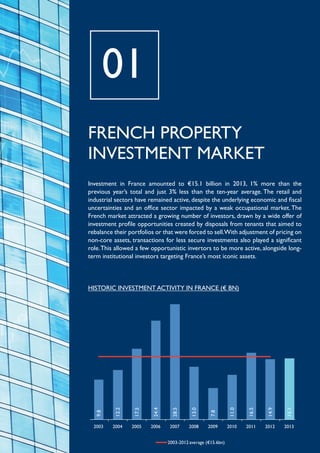

The French property investment market totaled €15.1 billion in 2013, a 1% increase from 2012. While investment volume was stable, the number of transactions declined. Large portfolio deals represented a smaller portion of the market compared to previous years. Office properties accounted for most investment in the Paris region, totaling €11.1 billion or 74% of the French market. Retail properties drove investment in other French regions, totaling €4 billion or 26% of the market. The top investors in France were from France, the United States, and the United Kingdom. The office sector saw more interest in higher risk assets while retail and industrial remained active. Overall, the French market remained stable but uncertainties remained around the economic recovery

![retail

A Cushman & Wakefield Research Publication

Commercial Rent Index as benchmark), to improve relations between

landlords and tenants (priority given to the retailer in the event of a sale),

and to advance laws governing urban retail development (unilateral rights

of the CNAC concerning retail space of more than 30,000 sq. m.). In

addition, the ALUR2 bill, adopted on second reading by the National

Assembly in January 2014, contains several important provisions: the

requirement that retail-project initiators restore lots and treat wasteland,

and the requirement that drive-through grocery-pickup sites have retailoperating permits.

THE NEW ROLE OF storeS

« There’s nothing more moving than to experience the power of architecture.

After entering a store, the customer sees, hears, and breathes the brand’s

universe. The message is all the stronger because it is felt physically and is

emblazoned lastingly on the unconscious mind as a subliminal image. »3

Peter Marino, architect and chief designer for numerous flagship stores of luxury

groups worldwide.

Extended retail opening

hours: a controversial topic

Ordered by the Prime Minister in light of various court

rulings, statements by politicians, and demonstrations by

employees, the Bailly report was unveiled on December 2,

2013. This document reveals the competitive imbalances and

opacity that have reigned since the Maillé law was adopted in

2009. The Bailly report also stresses the importance of

regulatory softening, which would lead to job and wealth

creation.

Taking into account consumers’ generally favorable view of

the opening of stores on Sundays (69% of French people and

82% of residents in the Paris region4) and the largely

underexploited potential of international tourism, the Bailly

report calls for the elimination of tourist zones and

exceptional consumer areas (PUCE) and the implementation

of new zones defined through dialog with all stakeholders

(PACT and PACC5).

The report also proposes raising the limit to 12 (from five)

for exceptional openings authorized by the mayor, a level

more in keeping with the European average. Although the

report does not address the question of the possibility of

late evening hours for retailers, and while a reappraisal of

existing exemptions creates even more uncertainty, the

Prime Minister’s positive reaction at least opens the door to

a better-adapted legal framework.

Les Français et l’ouverture des magasins le dimanche, [The French and store openings on Sundays], IFOP for

Metronews, October 2013.

Boundaries governing tourism (PACT) and retail (PACC) zones.

4

5

The arrival of new concept stores is part of the growth strategies of

major groups. Such stores embody the repositioning of retailers faced

with competition from newcomers, booming e-commerce, and evershorter fashion cycles. With numerous openings and store refurbishments,

this trend became even more visible in 2013 (see the table on page 42 for

the most representative examples). Flagship-store formats, created by

retailers in a wide variety of business sectors and price points, express

the care taken in recent months to improve the shopping experience, to

raise customer loyalty, and to gain market share:

• The opening of a spectacular flagship raises a retailer’s visibility.

Large and sometimes expanded by adjacent space, these stores feature

a large variety of products that are displayed in an especially luxurious

manner or with new technologies (“connected” stores). Flagships

stores are often used to reposition retail brands via openings of new

concepts (e.g., La Halle in a number of former Virgin Megastores, C&A

in Le Madeleine) and the refurbishment of existing sales points (e.g.,

Marionnaud on the Champs-Élysées).

• The spread of single-brand stores allows them to grow closer to

their customers, to offer exclusive services, and sometimes to be

rejuvenated. In the cosmetics sector there were numerous examples

in 2013, with the opening of Caudalie stores in the Marais, and Roger

& Gallet and Chanel on Rue Saint-Honoré.

• Hybrid stores in the form of shops featuring a dedicated restaurant

have appeared in the partnership between Columbus Café and Gémo,

and in the work of Michelin-starred chef Guy Martin, whose restaurant

Le 68 opened in Guerlain’s refurbished flagship on the Champs-Élysées.

Such formats not only promote the brand’s most luxurious products,

but are also a means for building customer loyalty. New projects for

shopping centers also illustrate the rapid development of the

“retailtainment” concept. La Vill’Up, which combines shopping, food,

Bill governing the right to housing and urban renewal.

Interview published in M Le Magazine of Le Monde newspaper on November 29, 2013

2

3

39](https://image.slidesharecdn.com/etudeannuelle2014-anglais-140206111822-phpapp02/85/French-Property-Market-2014-39-320.jpg)

![retail

A Cushman & Wakefield Research Publication

TRENDS IN SUPPLY

General trends

After Surcouf’s closing in 2012, the year 2013 was notable for the closing

or difficulties of other major retailers on the French retail market (e.g.,

Virgin Megastore, Chapitre bookshops, Marithé et François Girbaud).

Certain liquidations brought an abundance of high-quality supply to the

market. This newly available supply, in addition to that created by closings

of other retailers, alleviated the scarcity of opportunities for the most

attractive sites. Despite a satisfactory absorption rate, several of these

sites are still unoccupied and may enliven the French retail market in 2014.

Furthermore, the list of retailers in trouble could get even longer.

A long-term rising trend in

retail vacancy rates?

The retail vacancy rate, estimated by PROCOS at 7.1% for

French city centers in 2012 (6.3% in 2011), has reached 8.6%

in the centers of cities of 50,000 to 100,000 inhabitants

(6.3% in 2011) and even exceeds 10% in several city centers

(e.g., Alençon, Nevers, Roubaix, Niort). Although major cities

enjoy vacancy rates of close to zero on the most prestigious

thoroughfares, overall they feel the effects of a decline in

retail activity. Because of retailers’ relocating to larger zones,

vacancy rates have also risen in several retail parks. While

small malls and the largest shopping centers have held up

relatively well, midsized centers have experienced a rise in

vacancy rates over the past ten years: from 3.7% to 4.2% for

centers with 40–80 retail units, and from 3.8% to 5.5% for

those with 80–120 units, according to PROCOS.

The growing dichotomy between prime and secondary

thoroughfares, as well as among the various center formats,

will probably become more pronounced in the years to

come. Because of the rise of e-commerce, which by 2030

may account for nearly one-quarter of total consumer

spending, some analysts forecast the disappearance of a

considerable portion of retail-property stock (1.7 million

sq. m., according to Booz & Company). While it is difficult to

predict its extent, this change will certainly result in the

transformation of a large amount of retail and service space

(banks, travel agencies, telephone stores).

7

Procos, La vacance commerciale, un phénomène qui s’accroît [Retail vacancy rates: a rising phenomenon], June 2013.

8

Booz & Company, Perspective 2020 : quelle place pour la distribution traditionnelle dans un monde digital ? [Outlook

2020: Does traditional retail still have a place in a digital world?], October 2013.

However, the closing of stores by retail groups and independents

contributed above all to the increase in available space in secondary

markets, raising in certain cases the risk of derelict retail spaces.This trend

is all the more worrisome, because of the steady pace of store openings.

In contrast with household consumption—stagnant since the crisis

began—880,000 sq. m. of retail space was opened in 2013, compared with

920,000 sq. m. in 2012 and 750,000 sq. m. in 2011. The development of

new retail schemes, sustained by the growing tendency of property

owners to expand their sites in order to rejuvenate them or to capitalize

on their reputation, has further diluted retailers’ revenues.The proliferation

of development projects also hinders lettings and has sometimes led to

projects’ being postponed or even canceled.

Trends in supply on high streets

As a result of vacancies by retailers under financial difficulty or restructuring

their store network, exceptional opportunities have arisen on some of

Paris’s most desirable streets (e.g., 52-60 Champs-élysées and sites vacated

on Rue de Rivoli by Etam, Adidas, and Esprit) and in regional capitals (e.g.,

the former Virgin Megastore and Lafayette Maison on the Rue AlsaceLorraine in Toulouse). Nevertheless, prime retail sites on major

thoroughfares remain rare and expensive, a reality that encourages retailers

to focus on improving existing supply in order to innovate and gain market

share. In Paris, the shortage of supply in some neighborhoods, combined

with the rise in international tourism and the growing popularity of certain

trendy areas, has led to retailers’ increasingly turning to alternative districts.

For example, the Rue de Marignan is now home to certain luxury retailers,

while more accessible designers and luxury shops can be found in the

Haut-Marais.

In the longer term, a few large-scale development projects should stir up

the established submarkets in Paris and in large conurbations in the rest of

France. In Paris, the largest projects are the refurbishments of the

Samaritaine and the Poste du Louvre, on the right bank, and the

redevelopment of the Marché Saint-Germain on the left bank. Elsewhere in

France, a few cities will remain in the spotlight, such as Bordeaux

(Promenade Sainte-Catherine) and Marseille. Riding the wave of the

success of the event “Marseille, European Capital of Culture 2013,”

45](https://image.slidesharecdn.com/etudeannuelle2014-anglais-140206111822-phpapp02/85/French-Property-Market-2014-45-320.jpg)