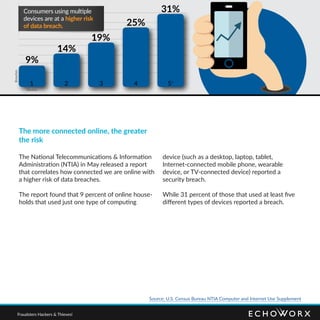

Consumers are increasingly distrustful of online privacy and security, with only 38% believing their internet activities are private, largely due to high-profile data breaches. The prevalence of online fraud and the variety of devices used amplify the risk of data breaches, causing 45% of households to alter their online behavior, such as avoiding financial transactions. Businesses must prioritize customer data protection and adapt to user experience needs to rebuild trust.