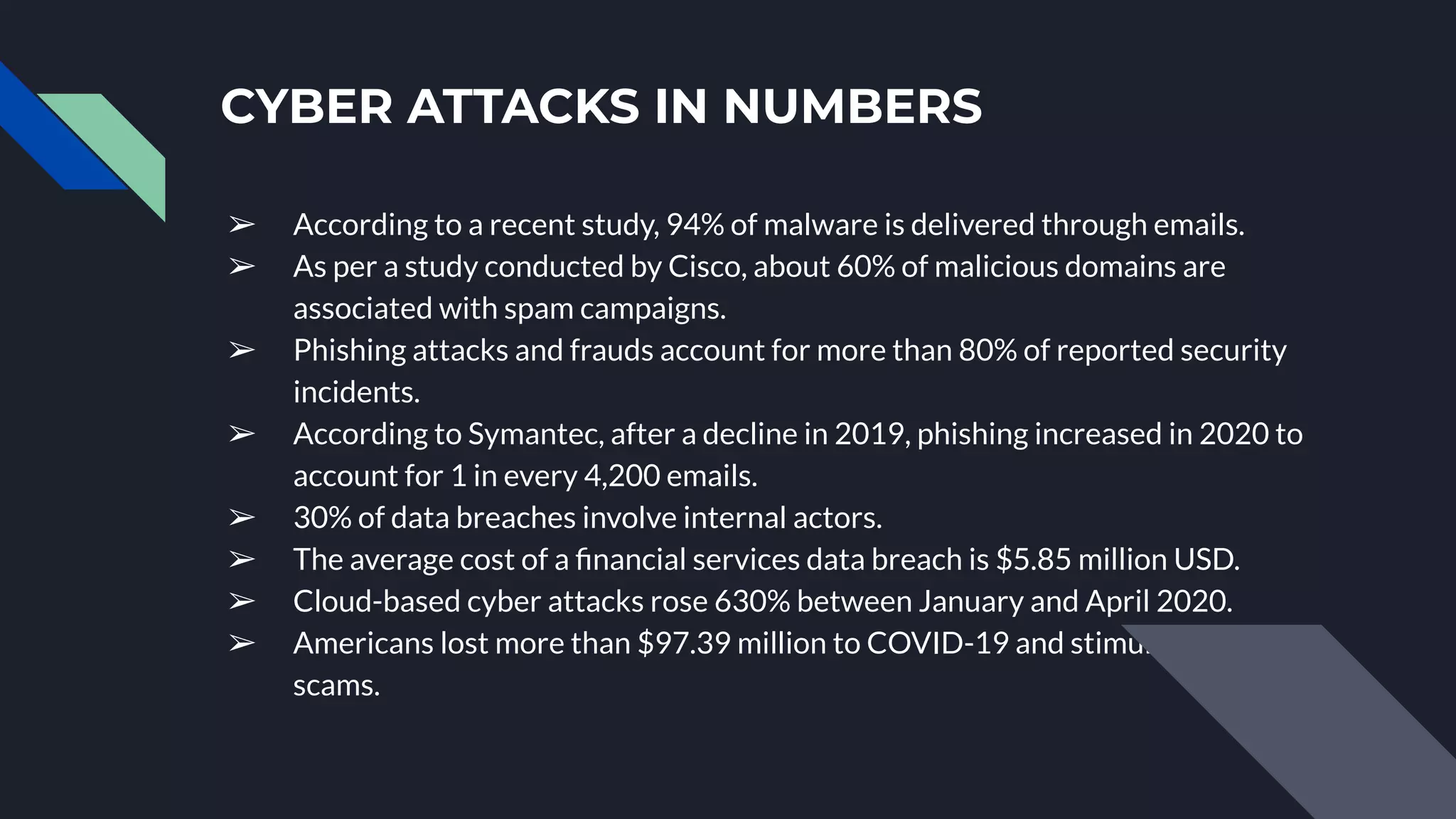

The document discusses the importance of cybersecurity in the fintech industry, highlighting the increase in digital transactions and the corresponding rise in financial frauds. It emphasizes the need for fintech companies to adopt effective cybersecurity practices to protect sensitive data and maintain customer trust, while detailing various types of cyber attacks such as malware and phishing. Lastly, it underscores the significance of cyber resilience and a strong cybersecurity culture within organizations to combat these threats.